Enough Sabre Rattling Already!

Folks, this is starting to sound pretty ominous. The Washington War Party is coming unhinged and appears to be leaving no stone unturned when it comes to provoking Putin's Russia and numerous others. The recent collapse of cooperation in Syria----based on the false claim that Assad and his Russian allies are waging genocide in Aleppo---- is only the latest example.

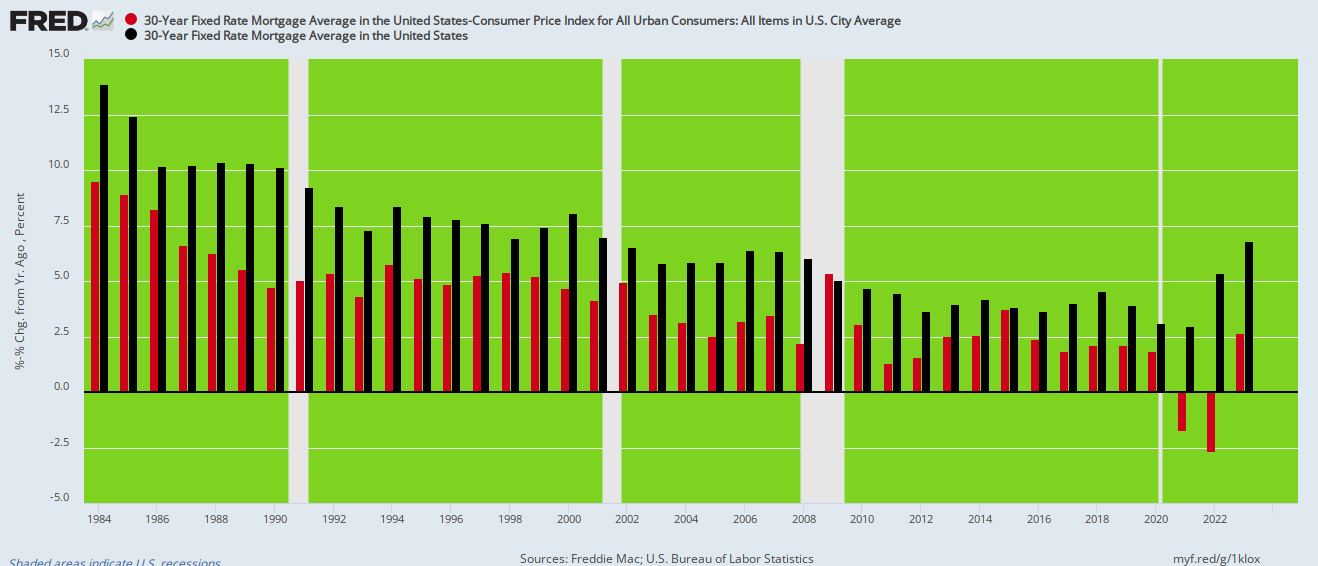

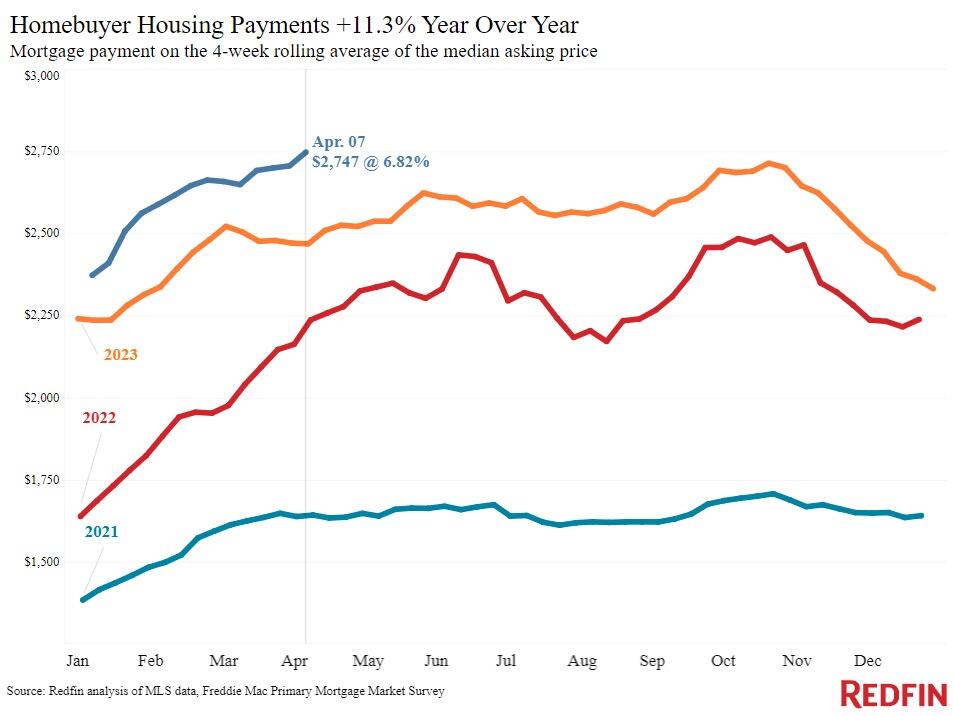

But, no, it's not because the geniuses in the Eccles Building have allowed longer-term interest rates to partially normalize. To the contrary, the real culprit is soaring home prices, which have been fostered by the Fed's relentless suppression of interest rates and saturation of the homeownership market with cheap mortgage debt.

But, no, it's not because the geniuses in the Eccles Building have allowed longer-term interest rates to partially normalize. To the contrary, the real culprit is soaring home prices, which have been fostered by the Fed's relentless suppression of interest rates and saturation of the homeownership market with cheap mortgage debt.