David Stockman On “Wall Street Week”: Get Out of Harms’ Way Now—–The Casino Is Heading For A Crash

America’s Fiscal Armageddon And How To Avoid It, Part 2

America’s Fiscal Armageddon And How To Avoid It, Part 1

What Happened After December 2020 That Was “Effective & Safe” And Mandatory?!

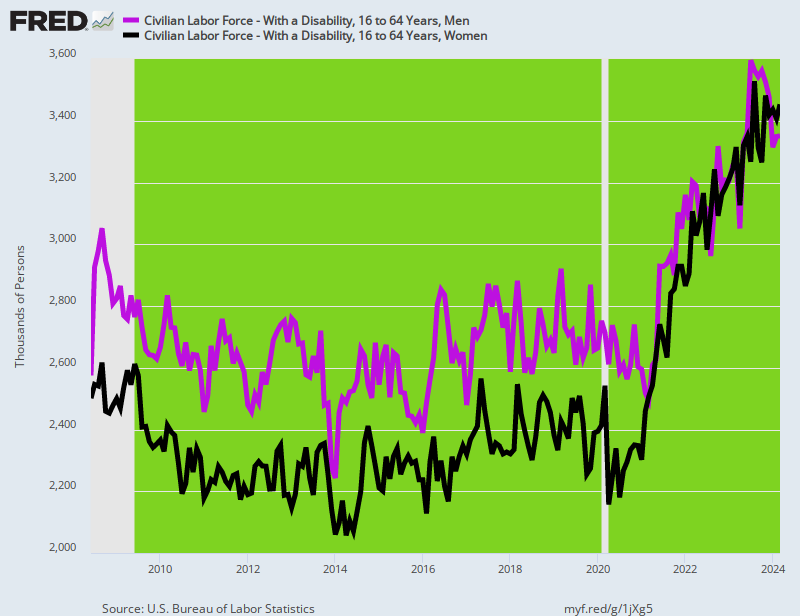

Workers With A Disability, Men (Purple) And Women (Black), Age 16 to 64 Years

America’s Fiscal And Monetary Dead-End

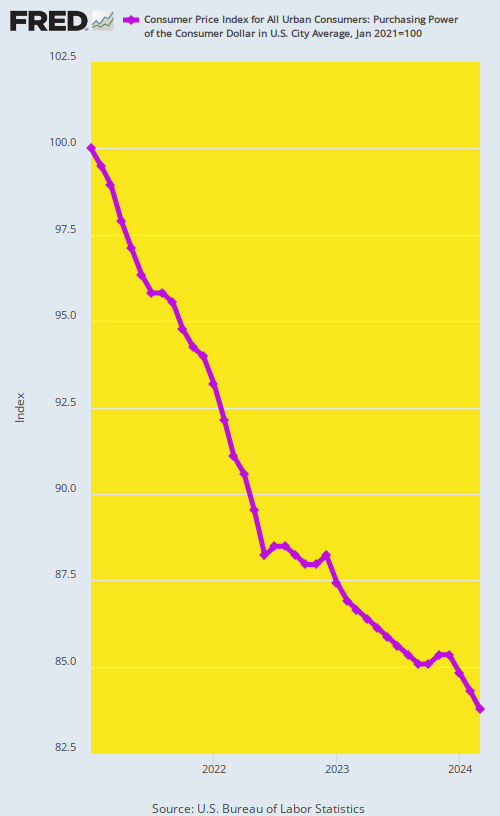

No, “Joe Biden”! Inflation Isn’t Going Down—But The Purchasing Power Of Our Money Is Down 17% Since Jan. 2021

Jay Powell And His Foolish Band Of Keynesian Money-Printers Get Another Wake Up Call

As is well-known, awhile back our clueless Fed Chairman began claiming that the inflation battle had nearly been won owing to the plunge of his favorite new dashboard indicator---the CPI Services SuperCore. Never mind that it excluded 75% of the weight in the CPI item basket! This drastically truncated version of the inflation ruler had been heading straight south during the first nine months of 2023---so it was heralded as a leading, less noise-ridden indicator of the overall inflation trend.

Not according to this morning's report for March 2024, however. The rising SuperCore trend of the last several months not only continued; it actually went supercritical, rising at a 0.7% M/M rate and +5.0% over prior year.

So standby for a new Powell fiddle of the incoming data, perhaps called the "Core SuperCore", which would also exclude transportation services. The latter sub-index was up at a 18% annual rate in March, but its deletion would bring the measure down to, well, just 18.8% of the actual CPI basket.

At some point, therefore, Powell might as well go whole hog, and exclude 100% of the CPI items. Then he'd have a twofer. He could brag that inflation has been reduced to 0.00%, while complaining that his dashboard is now running 200 basis points below target and that the printing presses must be restarted forthwith!

SuperCore CPI Services, 2017-2024

Then again, we'd suggest it's about time to get real about the Fed's giant and utterly failed experiment in monetary central planning. That is to say, it has long been evident that in the context of an intricately integrated $105 trillion global economy and $425 trillion deep worldwide debt and equity market that rational, effective and activist monetary policy in one country is impossible. The leakage through the four walls of the US economic bathtub and the global cross-currents which assail it are beyond mortal comprehension, make a farce of macroeconomic models and, in any event, are far, far out of the reach of the crude policy execution instruments employed by the Fed and other central banks----interest rate tweaking and persistent large-scale monetization of the public debt.

Crony Capitalist Windfalls And The Saga Of Saint Warren Buffett

Of course, the senior Buffett was among the most free market, hard-money, peace-loving constitutionalists to serve in the US House of Representatives during the last century, perhaps ever. The very idea that the Fed-fueled, crony capitalist bubble which peaked in September 2008 merited an open-ended rescue of Wall Street speculators would have been not simply anathema, but damn near evil incarnate to Howard. The latter well knew that speculators are not entitled to indulgences of the state and that the solution to central bank fostered financial bubbles is the tender mercies of the free market and the Chapter 11 courts.

Then again, Howard's sainted son Warren had no such compunction. After piling into a $5 billion investment in late September 2008 in the teetering gambling house known as Goldman Sachs, or what Matt Taibbi better described as the Vampire Squid at the time, Warren had the audacity to call up former Goldman CEO, and then Secretary of the Treasury, Hank Paulson, in the wee hours of the night and suggest that he hand out $5 billion to $25 billion each to Goldman Sachs and a half-dozen other mega-banks, along with more than $200 billion of taxpayer gifts to scores of smaller banks.

Paulson did exactly that shortly thereafter, and, mirabile dictu, Warren Buffett's reckless bet on a house of cards heading for the fate of Bear Stearns, Lehman Bothers and Merrill Lynch was instantly made whole. To wit, Buffett had ostentatiously made his reckless $5 billion bet on Goldman Sachs on September 23rd, when it share price stood at $122, but by October 10th the company was heading for the round file, trading nearly 30% lower at just $88 per share.

Alas, Paulson got his late night not SOS from Saint Warren, and the rest was history. Buffett ultimately made more than $3 billion, thanks to Uncle Sam's rescue brigade.

So Warren Buffett's subsequent unctuous letter to Uncle Sam posted as an op ed in the New York Times was obvious enough. Of course, it was a complete pack of lies. The US economy would have done just fine if Goldman and Morgan Stanley had been carved up into solvent pieces and parts in Chapter 11, and there was never any danger of an old-fashioned bank run by the main street hoi polloi who did know they had deposit insurance.

And his even more tendentious claim that absent the Wall Street bailouts corporate America would have missed payr0lls within weeks due to the collapse of the commercial paper market was utterly risible nonsense. Just plain beyond the pale. Every one of these Fortune 500 commercial paper facilities had legally-binding back-up lines at the banks, and, in turn, any commercial bank that needed to fund a call on these corporate credit lines had open-ended access to the Fed's discount window.

Crony Capitalist Corruption On Steroids or How “Joe Biden” Is Buying Arizona’s Electoral Votes By Sending Taxpayer Loot To Taiwan!

The US plans to award Taiwan Semiconductor Manufacturing Co. $6.6 billion in grants and as much as $5 billion in loans to help the world’s top chipmaker build factories in Arizona, expanding President Joe Biden’s effort to boost domestic production of critical technology.

Under the preliminary agreement announced by the US on Monday, TSMC will construct a third factory in Phoenix, adding to two facilities in the state that are expected to begin production in 2025 and 2028. In total, the package will support more than $65 billion in investments at the three plants by TSMC, the go-to chipmaker for companies such as Apple Inc. and Nvidia Corp.

TSMC’s third fabrication site, or fab, will rely on next-generation 2-nanometer process technology, and is slated to be operational before the end of the decade. US Commerce Secretary Gina Raimondo said the 2nm chips are essential to emerging technologies including artificial intelligence, as well as for the military.

“For the first time ever, we will be making at scale the most advanced semiconductor chips on the planet here in the United States of America, by the way, with American workers,” Raimondo told reporters in a briefing ahead of the announcement. TSMC is planning to first make 2nm chips in Taiwan in 2025.

Biden’s Chips Push

US Commerce Department is divvying up $39 billion in Chips Act grants

TSMC’s award marks another milestone in Biden’s push to boost the US semiconductor industry with the 2022 Chips and Science Act. It’s one of the largest announced under the program, which set aside $39 billion in direct grants — plus loans and guarantees worth $75 billion — to persuade semiconductor companies to build factories in America after decades of shifting production abroad.

TSMC’s American depositary receipts rose as much as 2.8% Monday morning in New York to $145.35.

Intel Corp. has already inked a preliminary agreement for nearly $20 billion in grants and loans, while Samsung Electronics Co. of South Korea is expected to receive a grant of more than $6 billion. The Commerce Department has also handed three awards to companies that manufacture older-generation chips and is expected to announce a multibillion dollar package for Micron Technology Inc. in coming weeks.

Companies have announced more than $200 billion in US investments since Biden took office, with the biggest clusters emerging in Arizona, Texas and New York. The agreement unveiled Monday emerged after months of negotiations with the Commerce Department and TSMC, the world’s largest contract chipmaker by market share.

Read more: TSMC to Win More Than $5 Billion in Grants for US Chip Plant

“The proposed funding from the CHIPS and Science Act would provide TSMC the opportunity to make this unprecedented investment and to offer our foundry service of the most advanced manufacturing technologies in the United States,” TSMC Chairman Mark Liu said in a statement.

TSMC’s work in Phoenix carries added political stakes for Biden, who defeated Donald Trump in Arizona by roughly 10,000 votes in 2020 and is seeking another win in the closely contested state to help secure reelection. Though its Arizona investment was initiated during Trump’s final year in office, TSMC’s projects in the state have become increasingly entwined with Biden’s campaign message on revitalizing the economy.

Arizona has reaped some of the biggest rewards from the Chips Act, with a massive expansion by Intel in addition to dozens of supply-chain initiatives. The TSMC grant includes $50 million in funding to train local workers, and will create 6,000 high-tech manufacturing jobs and more than 20,000 construction jobs, Raimondo said.

Read more: Biden’s $100 Billion Chips Bet Ensnared in Arizona Union Fight

The project also is expected to benefit from a tax credit for investments, according to another senior administration official, who discussed the award on condition of anonymity ahead of the announcement.

The TSMC site has seen several setbacks, including months of conflict with labor unions that resulted in delays at the first factory. The second facility, which is now slated to begin manufacturing 2nm and 3nm chips in 2028, was delayed from 2026 due to market conditions and uncertainty about levels of US government support. At least one TSMC supplier has scrapped its planned Arizona project, citing workforce difficulties.

The company has other international projects underway in Japan and Germany. TSMC held an opening ceremony this year for its Kumamoto fab, which the Japanese government is backing with subsidies.

RFK Nails It Again: J6 Was The Big Lie of the Beltway Ruling Class, Not A Democracy-Threatening “Insurrection”

But like in almost everything else nowadays, this beltway insider's narrative has supplanted reality. Completely. Absurdly.

As usual, however, RFK has seen through the subterfuge. The entire Congressional investigation, related mainstream media "insurrection" narrative and the vicious prosecution of the pro-Trump protestors who stumbled into the Capitol's open doors on January 6, 2021, is just another instance of the weaponization of the machinery of justice.

On Friday, however, Kennedy issued a statement reaffirming his alarm about how the Department of Justice has proceeded against Jan 6 participants. “I am concerned about the possibility that political objectives motivated the vigor of the prosecution of the J6 defendants, their long sentences and their harsh treatment,” wrote Kennedy.That's exactly right. The United States government is the most lethally armed organization in the history of mankind. The very idea of an "insurrection" against it that is worthy of the term, therefore, implies extensive pre-planning, preparatory rehearsals, secret communications networks, detailed D-day organizational protocols and maneuvers, publicly announced manifestos and demands and, of course, the marshalling of an extensive array of arms, ammo and armor.

Kennedy said that, if he is elected, he will appoint a special prosecutor to investigate whether powers were abused for political advantage, and to "right any wrongs" that are found. He also gingerly questioned the notion that Jan. 6 represented an "insurrection," a term embraced by many mainstream media outlets, including the Washington Post:

“I have not examined the evidence in detail, but reasonable people, including Trump opponents, tell me there is little evidence of a true insurrection. They observe that the protestors carried no weapons, had no plans or ability to seize the reins of government, and that Trump himself had urged them to protest ‘peacefully.'"

His questioning of the official Jan 6 narrative isn't new. In March of 2023, he said his then-fellow Democrats had "an obsession" with the event. In October, he pointedly ridiculed the idea that the protesters and rioters were in any position to take over the government: "What’s the worst thing that could happen? Right? I mean, we have an entire military, Pentagon, a few blocks away."

Alas, review all 14,000 hours of camera footage between noon and 8 PM on J6 if you will, but you will find scant evidence---nay, no evidence at all---that any of these rudiments of an "insurrection" were even remotely present at the US Capitol Building that day.

The Labor Market’s Not Strong, The Fed’s Completely Wrong

To paraphrase the Captain in Cool Hand Luke, what we've got here is failure to calculate. That is, the US economy has been radically tortured and twisted by the pandemic era lockdowns and stimmies. So normal economic activity that was disrupted and deferred during the worst lockdown quarters of 2020-2021 has now re-emerged in 2022-2024.

At the same time, the $10 trillion worth of fiscal and monetary stimmies which were force-fed into the US economy during 2020-2021 could not be immediately absorbed by the reduced level of main street activity back then. So they were essentially stock-piled in a huge, unprecedented build-up of household cash balances.

The purple line in the chart below shows total household cash balances (currency, bank deposits and money market funds) relative to GDP. During the decade or so before March 2020 that ratio stood at about +/-59%. But it then soared to 77.4% during Q2 2020 when nominal GDP contracted by 34% owing to the Lockdowns, even as Washington pumped $2.2 trillion of cash into the economy via the CARES act.

In dollar terms, household cash balances (dashed black line) went from a normal $13.4 trillion in Q4 2019 to a peak of $18.3 trillion in Q1 2022, by which time the entire $6.5 trillion of fiscal stimmies had been largely distributed to the main street economy. Yet had the historic ratio of 59% been in place in Q1 2022, the level of household cash balances would have been about $14.8 trillion, meaning, in turn, that households were sitting on about $3.5 trillion of extra-normal cash balances.

This $3.5 trillion cash hoard has functioned as a counterweight to the Fed's monetary braking action since March 2022. What has happened is that the earning power of those cash balances has soared as overnight rates went from 25 basis points to 525 basis points, even as households have been slightly reducing their extraordinary cash balances.

Nevertheless, by Q4 2023 household cash balances stood at $18.0 trillion, which was still far above normal levels. Again, at the 59% historic ratio the household cash balance in Q4 2023 would have been about $16.5 trillion, meaning that the size of the cash hoard was still $1.5 trillion larger than normal.

In effect, households have kept on keeping on when it comes to consumption spending because these huge, extraordinary cash cushions have bolstered confidence, even as the Fed has attempted to cool-down economic activity. This huge cash cushion essentially represents a form of delayed "stimulus", which was sequestered during the disruption of the pandemic era and is now replacing what would have otherwise been an increase in the household savings rate and corresponding reduction in current consumption spending.