Spending and wage growth disappointed in September, particularly as incomes continue to register barely any growth. The fact that this stagnation has continued for several years allows commentary such as this:

U.S. consumer spending in September recorded its smallest gain in eight months as income barely rose, suggesting some cooling in domestic demand after recent hefty increases.

The Commerce Department said on Friday consumer spending edged up 0.1 percent after an unrevised 0.4 percent rise in August. Consumer spending accounts for more than two-thirds of U.S. economic activity.

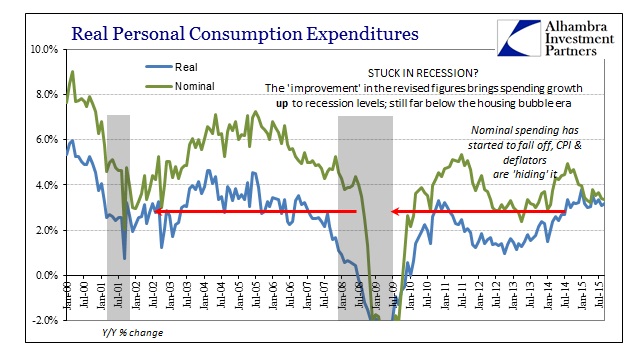

There is no way to reconcile the use of the qualifier “hefty” about spending in the summer with anything other than relative imprecision. In other words, like GDP, it only looks “hefty” if you stick within the deficiency of the current cycle. By any useful, historical standards, both spending and income remain stuck in what may amount to positive numbers but nothing even close to healthy.

Nominal spending has, in 2015, resorted to its lackluster post-2012 slowdown baseline while the decline in the official “inflation” measures all the way to zero mathematically sort out real spending seemingly upward. Neither nominal nor real spending growth comes out anywhere close to a healthy advance, despite continued reference in that direction.

This infirmity starts with the overwrought tendency lately toward huge and altering revisions, particularly where it comes to consumer spending. I believe that is as the unstable and volatile GDP figures (which is not surprising given the statistical relationship there) which more than suggests the difficulty reconciling subjective settings (like trend-cycle) with downside disappointment time and again. It is, as noted earlier, a signal of at least an unstable economy still departed from anything like a recovery track.

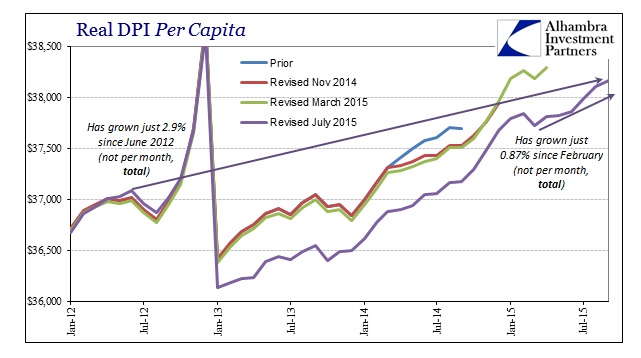

It all starts with incomes, where, despite the purported “best jobs market in decades”, wage growth refuses to relent from economic “slack.” Yellen and the FOMC may see the end to that drain, but it just isn’t anywhere close and the lid on wage and income gains is the major element of economic danger in 2015. Dating back to June 2012, real DPI per capita is up less than 3% total (and just 0.9% since February, which would include those “hefty” gains). That insufficiency is further bothered by the drastic downward revisions that removed a great deal out of 2013 (and thus calls into question what truly happened in later 2014). In contrast to comparable prior periods, none of this adds up to anything other than the same devilish economic inertia.

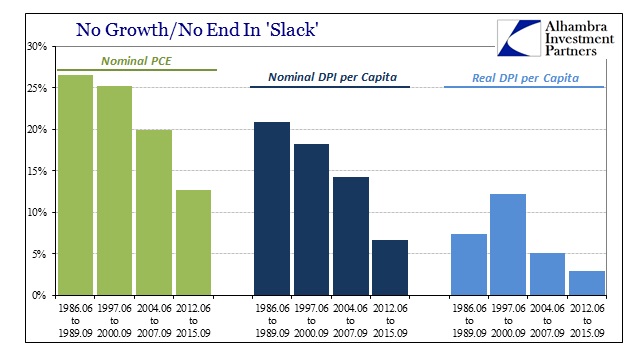

Over the same three plus year period ending at September 2007, real DPI per capita gained nearly twice that amount, 5.1%. Going back to the later cycle of the late 1990’s, the increase was 12.2%, or more than four times the what the FOMC is trying to use as justification for its narrative. In nominal terms, the disparities are even larger owing to the lack of official “inflation” that stubbornly resists all the ZIRP and QE’s: just 6.6% in the current period; 14.3% in the later housing bubble era; 18.3% in the later dot-com bubble era. Unsurprisingly, those figures correspond almost exactly to the ridiculous and conspicuous downgrade in spending activity (nominal terms): 12.7% currently; 19.9% in the middle 2000’s; 25.3% in the late 1990’s.

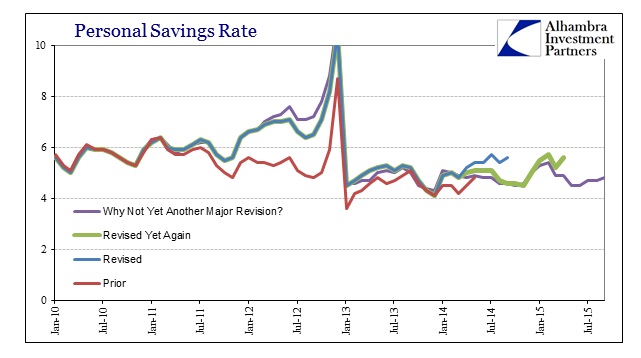

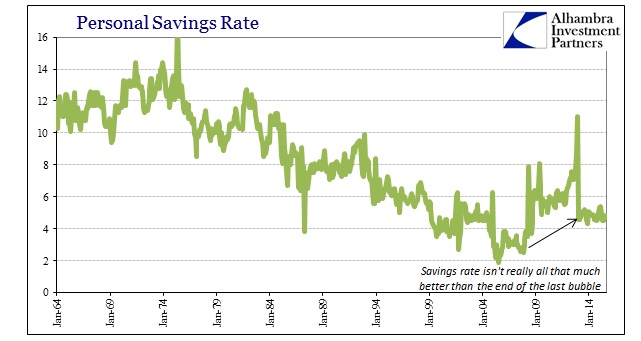

Again, there is no way to reconcile these comparisons with the current economy coming out as accelerating or already booming. These figures confirm it simply scraping along the bottom with positive numbers, and thus the microscope upon monthly variations amounts to the ineffectual splitting of hairs. The true state of income, which is derived instead from the bigger trend, leaves the economy in a hugely precarious position unprepared to accept any negative factors (perhaps that is why snow tends toward depressiveness all of a sudden?). That view accounts also for a personal savings rate not much better than the end of the eurodollar era, where credit flowed so freely as to diminish accumulated saving to nothing, and thus no cushion.

That would be a significantly worrisome trend even under the best of conditions, but these are, as these figures deliver, the opposite. In other words, the savings rate is already quite low by reasonable standards and yet spending growth struggles; if consumers have to spend nearly all their paltry income gains just to maintain decrepit economic levels then that cuts hard against the deep economic sufficiency proclaimed repeatedly as justification for future optimism. Again, that explains a lot about at least instability that shows up in these various numbers.

It leaves the current economic state as, at best, fragile; at worst, straightforwardly breakable. From that we can derive an easy understanding of why retail sales have been consistently among the worst in the entire series in 2015, and why China is no longer set upon restoring its export-driven (“dollar” driven) economic margins. The global slowdown post-2012 is the lack of income in the US. Janet Yellen can proclaim the visible end of “slack” but in reality it isn’t anywhere to be found. And now there are growing signs of slack, unfortunately, rebuilding again as the pitiful numbers of 2015 get more so.