By Abheek Bhattacharya at the Wall Street Journal

To the extent that China’s industrial recovery explains why iron ore and steel prices have jumped this year, China’s latest trade data served as a reminder of how brittle this reason is.

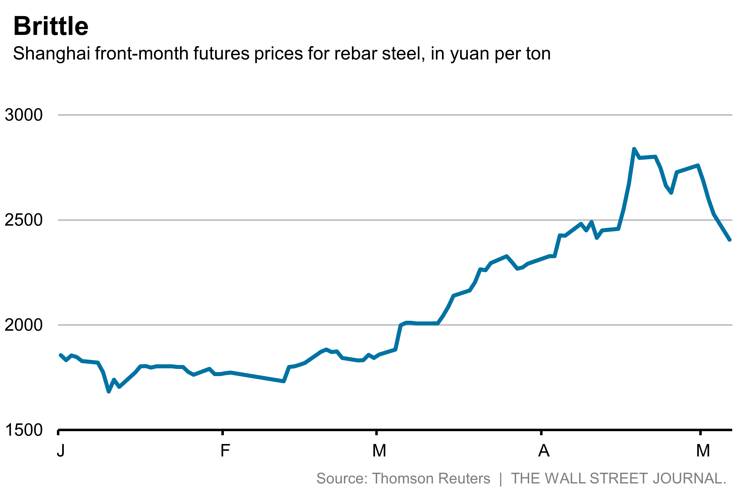

China’s steel net exports rose 8.8% in April from a year before and 9.4% between January and April from a year ago. That raises the question: Why are mills exporting more steel when Shanghai front-month futures prices for rebar steel rocketed 48% between January and April, and signaled a potential rise in demand? Shouldn’t mills be selling more of what they make at home? And steel production is weak, so it isn’t as if producers are churning out more steel available for exports.

The answer may be that there is no sustainable increase in Chinese steel demand. Steel use picked up around March, but this was seasonal, and even then it wasn’t so dramatic. Steel traders, whose job is to anticipate demand from property developers and the like, held lower inventories at the start of this construction season than last year, suggesting they saw limited real demand in the pipeline.

Real demand for steel in China dropped at least 7% in April from the year before, Citigroup’s Tracy Liao estimates, based on changes in exports and inventories. The drop was at least 5% between January and April from the year before.

That reinforces fears that easy money-fueled speculation is the prime mover of steel and iron ore prices today. Chinese futures prices in both commodities fell sharply again Monday. Given that underlying demand isn’t there, don’t be surprised if these prices further crack.

Source: Here Are the Cracks in China’s Steel Story – the Wall Street Journal