By Tyler Durden at ZeroHedge

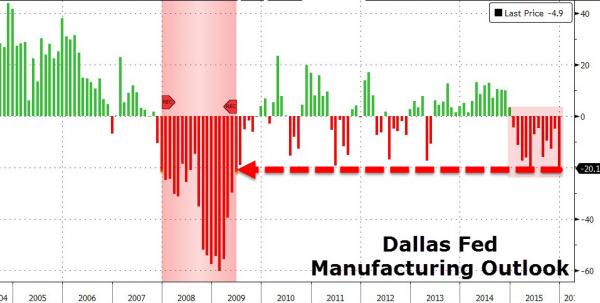

After a Q1 collapse, the Dallas Fed Manufacturing Outlook managed a bounce for a few months (though never got back above zero). It appears, Dallas Fed’s aptly-named ‘Dick’ Fischer was entirely wrong when he progonosticated that “on net, low oil prices are good for Texas.” December’s Dallas Fed print crashed to -20.1 (from -4.9) massively missing expectations of -7.0 and back at the lows not seen since June 2009.

Dallas Fed is in contraction for the 12th month in a row…

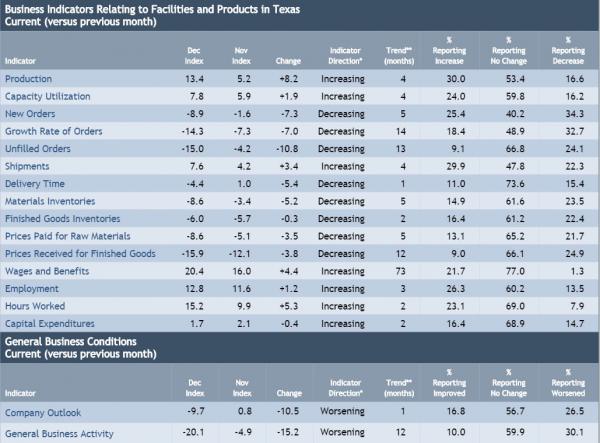

New Orders crashed, Prices Paid and Received plunged, Order growth rates tumbled…

And perhaps most worrisome, “hope” turned negative.

Respondents added:

“The price of oil is really impacting our customer base and, in turn, purchases of our product. It is getting ugly.”

There are lots of contradictions in the marketplace. As an offshore oil service provider, we have had very strong orders for the last five months, which is bizarre. We continue to read about doom and gloom, but the numbers haven’t borne that out. Living in Houston, I continue to see multiple out-of-state license plates on the freeways. People are continuing to pour into Houston; I just don’t know what they’re doing.

Oil and gas work has significantly slowed. There is pressure from customers to lower prices further.

The full Dallas Fed responses below:

Fabricated Metal Product Manufacturing

- Much of our work comes from petrochemical and midstream owners and contractors. Although our backlog and December work have improved, capital expenditures going out are being reduced by our customers. We have increased some capital expenditures plans in the last quarter, anticipating passage of Section 179 extensions, but Congress’ waiting until year-end has been problematic since we cannot do anything significant without actual passage.

- New Environmental Protection Agency regulations on wood-burning furnaces set to take effect Jan. 1, 2016, have decreased orders and will continue to do so throughout the winter months.

- We first saw an increase of orders due to the end of the year, per usual. We are now seeing a continued surge of orders moving into the new year.

- The crude oil and natural gas market price downturn continues to negatively impact our industry and our company. Labor costs remain stable, but the producers of our primary raw material, hot rolled coil steel, have announced price increases effective first quarter of 2016, which the finished goods market will not absorb due to highly competitive pricing, thus further compressing our margins.

- The price of oil is really impacting our customer base and, in turn, purchases of our product. It is getting ugly.

- The Architecture Billings Index mixed-practice index slipped below 50 about nine months ago, which historically would foreshadow a slowdown in booking new work, which we are experiencing. We expect this will likely mean we will experience a slowdown in shipments in our fiscal second quarter (February–April). We are forecasting 2016 low-rise nonresidential construction starts measured in square feet to grow at 4 to 5 percent, which is our expected growth rate for our business.

Machinery Manufacturing

- There are lots of contradictions in the marketplace. As an offshore oil service provider, we have had very strong orders for the last five months, which is bizarre. We continue to read about doom and gloom, but the numbers haven’t borne that out. Living in Houston, I continue to see multiple out-of-state license plates on the freeways. People are continuing to pour into Houston; I just don’t know what they’re doing.

- The oil industry continues to suffer. We will end the year with less debt and more backlog because we have diversified out of the oil patch and out of Houston.

- Weak oil and natural gas prices are having a material adverse effect on our business.

- Several of our customers have slowed down for different reasons that do not appear to be related to a general slowdown in the economy.

Computer and Electronic Product Manufacturing

- Expectations for 2016 and midterm (the next three to five years) are for a low-growth environment.

Transportation Equipment Manufacturing

- Oil and gas work has significantly slowed. There is pressure from customers to lower prices further. We haven’t had any feedback provided from customers with regard to future expectations.

Food Manufacturing

- The strong dollar and overall weak Latin American economies are impacting our export business. Domestic demand is strong, base raw material costs are steady to down, and energy costs are reasonable. 2016 looks good.

Paper Manufacturing

- We have had a very slow December. Our outlook for first quarter 2016 is cautiously guarded.

- Several of our large automotive customers shut down their plants for part of December, so our production is naturally down compared to other months. Also, during recent months, we have increased our entry-level wages and increased the pay of existing employees as part of our efforts to reduce employee turnover.

- The business cycle will pick up in the new year.

Printing and Related Support Activities

- It is hard to see what six months away looks like at this point; we need an infusion of new customers to make it look any better. The fourth quarter has been much softer than anticipated. We lost a chunk of work. We had to raise starting pay for trainees just to get qualified folks in the door. Price-reduction pressure from key customers continues, squeezing margins further.

- We often get busy this time of year, and this December has been like that—not really seasonal, just a busy time of year for us. We are very concerned about lower activity levels and what that will do for business in the upcoming six months.

Miscellaneous Manufacturing

- The new tax changes in December will improve our capital expenditures, and new-product introductions in the next six months will increase sales and productivity.

Source: Dallas Fed Survey Crashes to June 2009 Lows, Warns “It Is Getting Ugly” – ZeroHedge