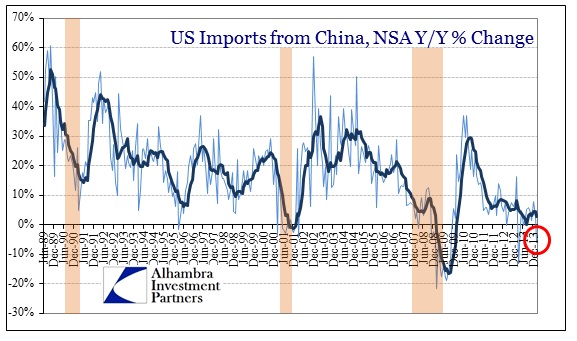

The news from China this morning was unexpected only to those who still cling to the idea that the PBOC control is omnipresent. Exports were down 6.6% Y/Y in March (after dropping 18.1% Y/Y in February), while imports simply collapsed 11.3% Y/Y. Since China has been operating as the global trade pivot, the results on both sides of the trade balance for China show unkempt systemic strain.

That has been the case since the Great Recession produced (revealed, actually) a structural decline in demand for goods, but at least in the domestic sense it was partially mitigated by an internal credit surge making ghost cities and malls. That kept the resource nations somewhat busy, if not completely, while the entirety was expected to rebound on a surging US and resurgent Europe. In such circumstances, the middle ground in China would be bridged and then they could take concerns over credit and ghost cities in due course under far more tame and manageable conditions.

The ongoing disaster in trade demonstrates the miscarriage of that strategy (on both ends), namely not anticipating orthodox failure across every jurisdiction to deliver promised resurrection. There has been no American surge to reignite the export “miracle”, while Europe tries to convince itself and the world that not shrinking counts as a recovery. Now the Chinese are in a nearly impossible and precarious position.

I have argued before that behavior in the yuan, the recent “devaluation”, was not initiated at the behest of the PBOC to punish “speculators.” Rather, it seems far more likely that it was a dollar problem, one tracing through both global trade and finance.

The primary piece of evidence in that direction is the behavior of copper. Copper forms a dollar collateral basis and its price movements tie together unique dollar factors centering on the Chinese relations with externality.

The closely correlated movements in the prices of copper and yuan both point, very strongly, to that single dollar source. Furthermore, copper prices have not much reacted on the most recent trade data which you would expect if the price of copper was being driven by fundamental economic discounting (copper piling up) rather than financial and dollar factors.

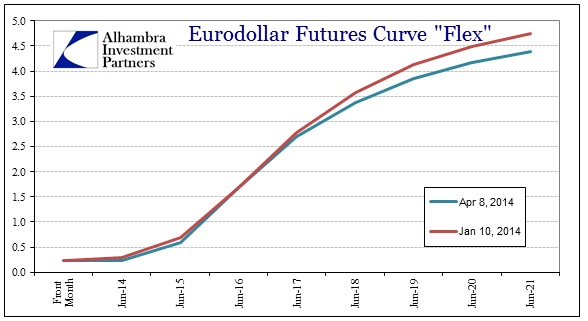

As I noted Wednesday, overall dollar conditions have been conspicuously benign. The eurodollar market is more than well-behaved, it seems downright comatose.

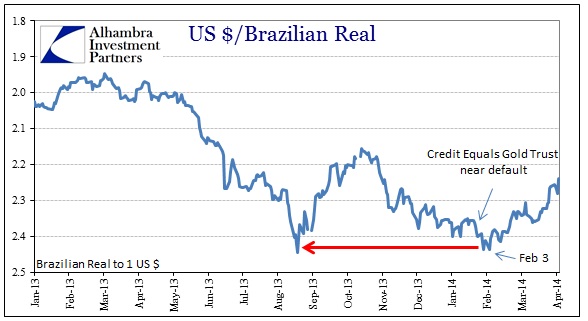

Aside from the continued flattening, the “money” part of the curve has barely budged. Into that vacuum a countertrend and retracement has developed in other emerging markets, particularly Brazil. The Brazilian real, which was headed back toward the cycle low of last summer, has been bid back from near-death.

Given the timing of these moves, it may be that Chinese dollar disruption benefited the real as it took the primary attention of dollar markets. In addition, the real began this retracement around February 3 – the day Yellen officially took over for Bernanke. This trend, then, times exactly to the confused stasis I alluded to in US credit markets. So it may be here that the changeover is injecting more hope that dollar conditions will not deteriorate further (outside of China’s idiosyncratic issues).

The stasis in US credit markets suggests that they are less sure, instead preferring not to make major moves in one direction or the other. In terms of emerging markets, the dollar-driven hope sets up as a classic staged devaluation process (natural ebb and flow). With global trade further contracting across all parts of the global supply chain, the economic and structural problems in China and Brazil are magnified, not receded.

While China is fomenting worries on the front pages, Brazil faces its own dire threats. “Inflation” remains at the upper end of the Banco do Brasil’s target (6.3% inflation; 6.5% upper limit). Brazil’s GDP is predicted to grow only at about 2% this year, the lowest persistent rate of expansion since the 1990’s. Into those conditions flow surges in interest rates, as the central bank reversed its courtship of a falling real when inflation “unexpectedly” got out of hand. The benchmark SELIC rate was a record low 7.25% in 2012, but is now back at 11%. In other words, conditions have grown darker in Brazil in the past few months.

Standard Poor’s (for what it’s worth) saw fit to downgrade Brazil last month on such settings. Given the Chinese trade data there is not likely to be reprieve in the near future. That contrasts against the hope seen in the real’s recent move, pointing again to dollar stasis rather than fundamental discounting and rebuilding.

In a recent Financial Times summary of the Brazilian tempest, the paper quoted:

“Lacklustre growth has become the norm rather than the exception,” said the Institute of International Finance, in a report last month on Brazil.

If only that applied to just Brazil. The soft bigotry of low expectations, the Orwellian recast of economic wording intended to realign expectations with what can only be described as full-blown failure. What used to pass as recessionary is now “lackluster”; worse, it has become fully acceptable as a natural condition. There is nothing natural about it, as economies freed from the yolk of central planners actually can deliver broad-based growth at impressive rates – something far greater than just non-zero. However, as long as asset inflation rages, it will remain somebody else’s problem.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com