When home sales rose M/M (slightly) in April for the first time in 2014, the NAR theorized it as the turnaround signal. Their reasoning for it was strange in the context of basic, intuitive economics (meaning non-textbook). Rising prices on too few available homes for sale was supposed to signal more construction, as this shortage narrative was perhaps the only way to explain the dramatic slide in sales without admitting exasperation with finance.

“We’ll continue to see a balancing act between housing inventory and price growth, which remains stronger than normal simply because there have not been enough sellers in many areas. More inventory and increased new-home construction will help to foster healthy market conditions,” Yun added.

Given the dramatic rise in inventory of for-sale homes in that very same month, it was a curious appeal. You can understand the price mechanics, as more construction should lead to that increasing supply and thereby reducing the so-called price squeeze, but all of that ignores the basic fact that if home prices are not affordable at this level then reducing the price appreciation rate will not fix that problem. It will only make it worse at a slower rate.

Companies with actual money interest in building houses are not lining up to do so. Again, that is contrary to what would be the typical, intuitively economic response to a supply bottleneck. Instead, home construction continues to slip, and do so in a rather straight line.

Given the construction data for May, which is wholly ensconced in springtime, there can be no doubt as to what homebuilders are actually doing. They are cutting back on construction levels, prices or not.

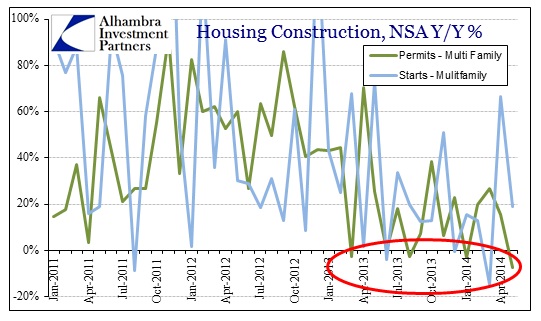

The variability in the data for total construction is being driven by the normal and heavy fluctuations in the multi-family segment, so stripping that out shows single family home construction permits declining for the fourth consecutive month (and somehow avoiding any weather-based patterning).

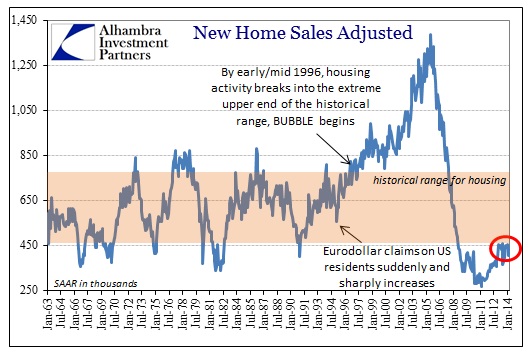

Whatever mini-bubble in housing that began with the promise of QE3 has dissipated, and now we are again searching for a bottom. That is not just an economic drag, it is a financial drag in more than one sense.

And where apartment construction perhaps might pick up the economic slack in trades industries, the growth rate there has “matured” to the point that it won’t offer too much by way of a boost.

It is clear that construction industry-wide has tapered significantly from the pace set in 2012. Taper is undoubtedly the right word to use, particularly with its close relation in monetary policy terms. QE3 is still ongoing, which, in the words of Janet Yellen, is supposed to “support mortgage markets.” The mechanism is by way of a reduction in interest rates, purportedly anyway, making such homes more affordable.

Instead, mortgage finance has continued to plod in disarray ever since her predecessor realized the affordability issue of mini-bubble price acceleration might come back to haunt him. The average 30-year mortgage rate has moved lower once more, as the yield curve continues to bear-flatten, back to about where it was in the middle of September when taper was believed to be originally scheduled. Despite that “support” of lower rates, total MBS issuance has remained stuck at the collapsed rate.

While the majority of that decline was the end of the refi mini-boom, purchase activity continues to lag behind 2013. Total purchase applications are still about 10% below where they were a year ago and remain at levels last seen in 2011. There just isn’t a lot of financial support for housing construction and I have no doubt that builders are keenly aware of it (and becoming moreso).

We may not talk about it much anymore, but there remains a shadow inventory that has never been allowed to clear. The Fed may have attempted to circumvent supply and demand, especially the oversupply created and fed last decade (really last two) by financial leverage expansion, but emphasis on price reflation only created a new facet to the old imbalance. The downside of such reflation is, obviously, that affordability constraint. But it doesn’t speak well of the health of the overall “market” if such a small increase in the interest rate after taper should produce such disproportionate financial destruction.

It may be a generation before the housing imbalance actually recedes enough for a healthy recovery. That opinion is “supported” by the lack of economic recovery that is in sharp contrast to the basis underlying so much of housing optimism. Imbalances clear much faster in robust economic conditions, which was the idea behind QE – it was supposed to be a virtuous circle, as aid in housing aids the recovery, which aids housing, and so on. Instead it breaks down into a tortuous and circuitous “logic” – the recovery needs a durable housing rebound, but a durable housing rebound isn’t possible without a recovery. It seems such pump-priming is just another expression of what is really just simple misallocation.

Misallocation on top of previously unresolved misallocation? As it relates to housing, if there has been a recovery nobody has told the pool of potential first time buyers.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com