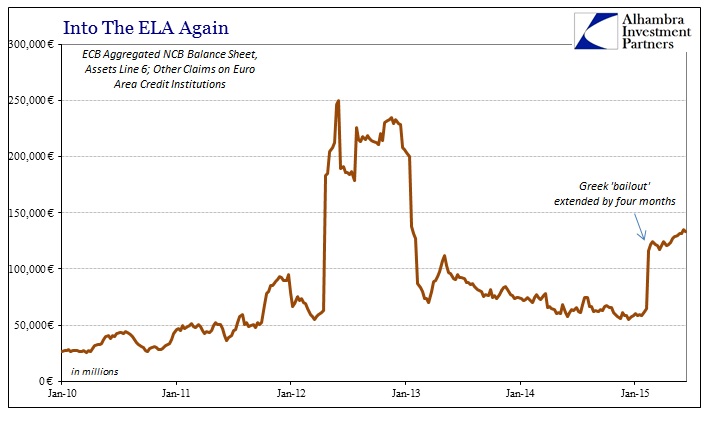

The Greek drama seems to have reached somewhat of a boundary, with deadlines and credit assistance drawing toward maximums. If this seems more than a little déjà vu that’s because it is an almost exact replay of 2012; all that is missing at this point is another default (debt swap or however it shall be classified). Greek banks have been beset by billions in withdrawals, in turn sending them to the Bank of Greece, loosely backstopped by the ECB, for “liquidity.”

In broader terms, it has always been liquidity that answers these difficulties. Central banks have little else to offer, but that doesn’t necessarily violate what they are trying to accomplish. In fact, it is an article of monetary faith, neutrality and all that, where liquidity is the answer to these problems. The operative orthodox theory for all of this is that the economy, of true and robust character, is hidden amidst a mountain of irregularity. In the case of Europe, the ECB has decided that banks are the issue as they fail to restore the immense credit function that central bankers believe consistent with typical economic momentum.

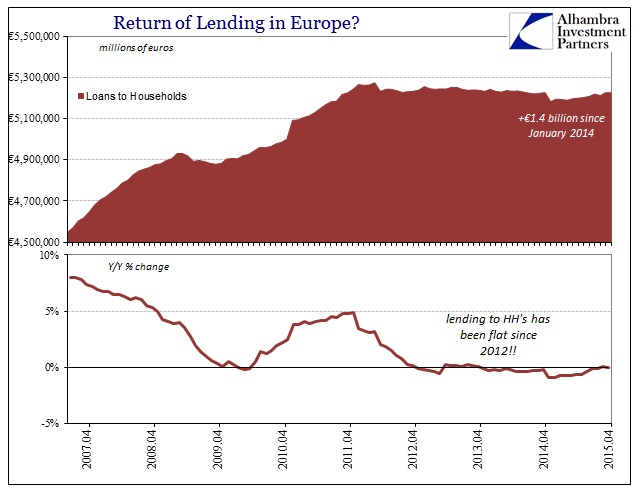

To gain a robust economy, then, requires, as they believe, robust banking and therefore robust liquidity. Working backwards from the 2008 panic, the ECB has been almost exclusively fixated on the liquidity portion in order to jump-start lending. In terms of Greece’s specific problems, that was accompanied by fiscal refiguring born out of intense monetarism, where the national government was “relieved” of massive burdens through what was called a debt swap but was really a default.

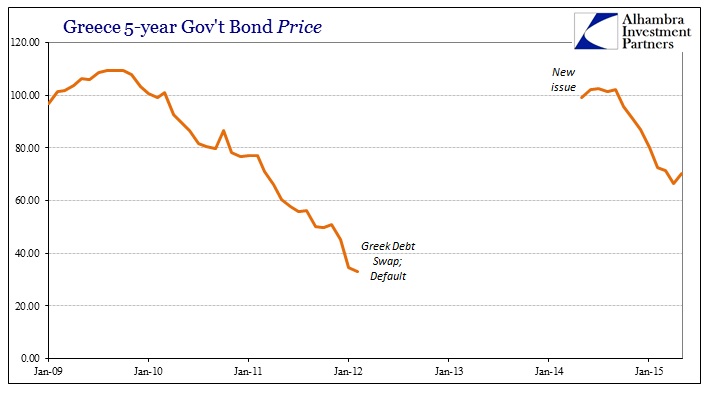

The highlight of the process, and the formal step with which success was briefly claimed, was last year’s floatation of new Greek government debt. It was just fourteen months ago that Greece was selling its issue at a promised yield of 5.25% to 5.50%, around €3 billion euros total of five-year paper. The underwriters took in more than €20 billion in bids, and the deal eventually priced at a yield of just 4.95%!

Again, that was by intention as Mario Draghi promised in July 2012 that he would use the ECB in whatever capacity to save the euro, taken to mean that he would no longer allow such high yields to clog monetary channels. Greece selling its bond only two years after the largest sovereign default was the high point in the effort. With all that euphoria over once-disowned and disavowed paper surely meant that monetary policy had reached at least Step 2, liquidity into lending, inching tantalizingly close to Step 3 – real recovery through debt.

The illusion lasted perhaps longer than it should have, as that 5-year bond remained priced at a premium into October 2014 (there’s that month again), despite the ECB’s struggles elsewhere to convince the economy to follow its simple monetary packages. Reality has caught up, as “markets” (a term that in this case deserves the scare quotes) realize that liquidity solved exactly nothing except convincing at least €20 billion worth of “investors” that monetary policy actually holds some specific healing capacity.

At the time the Greek bond was first taking subscriptions, I wrote quite incredulously:

That is more than astounding given the risks attached. Greek bond yields have been steadily dropping ever since Draghi’s promise, but it strains reason to see new Greek bonds trade to the same yield as that of Hungary, Dominican Republic or even Sri Lanka. All three of those countries hold higher ratings than Greece (though the “big” news is that Moodys might upgrade Greece to less junk status), but far more importantly none of them have defaulted in the past three years. The Greek government managed to do it twice.

The way things are going, including bond prices and “emergency” liquidity yet again, Greece may yet find a third default in its future. That would mean the ECB, for all its supposed and assumed economic vigor and attention, only managed to accomplish creating €20 billion in Greater Fools that we know of; small miracle, then, that the Greek government did not dare to float far greater debt, especially as current thinking has the chance at that third default around 75%.

NOTE: the Emergency Liquidity Assistance program (ELA) is aggregated with other monetary programs, classified within a single line item on the ECB’s aggregated view of all its constituent National Central Banks’ (NCB’s) balance sheet; “Other Claims on Euro Area Credit Institutions Denomimated in Euros” as an asset.

By every measure of what those bond “investors” were expecting, the Greek government and the economy there failed miserably – which is not actually a change from the period leading up to the default. In fact, despite all the immense interference financially from central planners, Greece has exhibited an extraordinary sense of stability of the exact wrong kind. As the Bank of Greece put it just two days ago,

In late 2014, there were serious indications that the Greek economy had overcome the recession and was returning to positive growth. At the time, the Bank of Greece, as well as all the international organisations, were projecting positive GDP growth in 2015 and a further pick-up in 2016.

These projections have since been revised downwards, as the latest GDP data point to a sharp slowdown in annual growth and to quarterly contractions of GDP in two consecutive quarters. The deterioration of economic sentiment indicators and financing conditions in the private sector suggest that the slowdown of the economy is likely to accelerate in the second quarter of 2015, putting the economy at risk for a renewed bout of recession.

In other words, despite all that was done, nothing (nothing) was moved even slightly in the right direction except a bunch of prices predicated on the same assumptions disproven time and again. Liquidity is effective in only a narrow capacity to send economic estimates and asset prices ever-skyward – prices that now only create more problems.

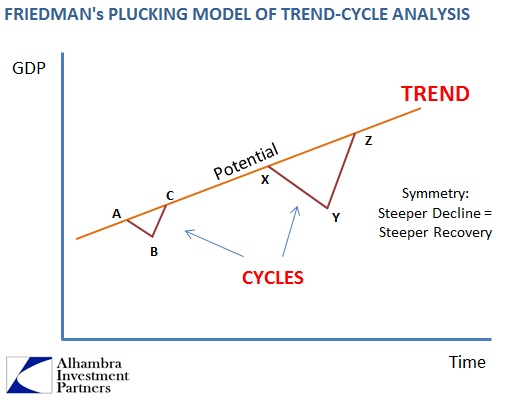

It would be fittingly tragic if this was all limited to just Greece, but it is rather universal beyond even Europe. This is a failure of orthodox thinking from its most basic premises, including how an economy actually works. If you view the economic world through the concepts incorporated into Milton Friedman’s plucking model and encounter a great financial “shock” that produces a severe recession, including a huge curtailment in credit supply and lending, then it might seem a plausible solution to address only that shock and expect the economy, through restored lending, to return to its prior and healthy trajectory.

If that doesn’t occur, certainly after the passage of five and now six years, that might suggest rethinking the entire premise. But orthodox monetary economics does not allow such evolution. Instead captured by monetary neutrality and Keynesian hysteresis (which is nothing more than an updated, fancy “pump priming”) the “solution” is never to change course but always bigger. The ECB, as other central banks, do greater and greater “liquidity” convinced only of debt (and future debt at that) as the one true answer.

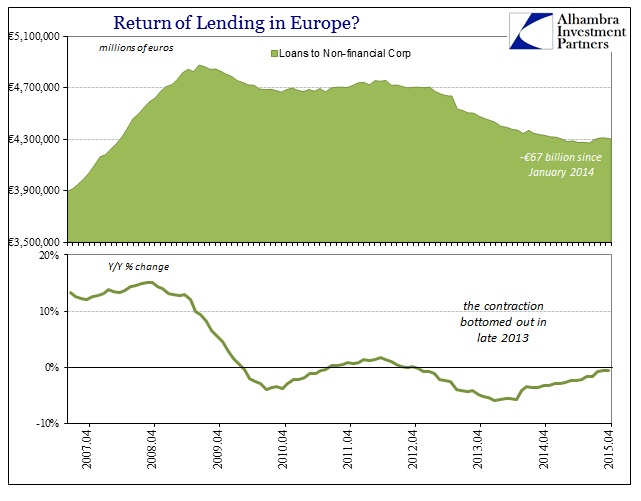

The ECB cannot even gain Step 2 aside from some minor turns here and there. Overall, as noted last week, lending in Europe is decidedly unbothered no matter what the ECB does or does not do. Despite tremendous influence in the banking system, consistently and perpetually, real economy lending is about as stable as could possibly be; if there is monetary influence in these lending patterns it is remarkably well-hidden. You would think trillions in euros in “stimulus” would at least offer some minor perturbation, but none still exists exactly where it should be and is expected to be.

The Greek case offers quite a relevant view into the world of 21st century monetary alchemy, because that is what it really amounts to. Consistent with the Yellen Doctrine, the ECB conspired to a bubble (even a mini version this time) in order to create the economy that would eventually justify the bubble on an ex post facto basis – liquidity, to prices, to lending, to recovery and normal economy. That places financial factors upside down or backwards, as asset prices are no longer discounting mechanisms but simple (and ineffectve) tools not to recognize what might happen in the near future but rather to actually make it happen (rational expectations). What is left, however, is the worst of all cases; no recovery, no lending and now just more financial imbalance piled onto the same negative pressures and imbalances that never really went away. The recessionary “shock” in the first place was itself the “solutions” that central banks continue to offer; thus, what they really offer is the condition to make it all still worse.

Accountability will likely continue to be narrowed to hysteresis terms yet again, meaning that the “experts” will claim that they didn’t do enough to get Sisyphus’s rock over the economic hill. The problem isn’t really Sisyphus or the rock, it is the fact that the hill, the mountain of debt, remains the primary problem and can never be solved by more of the same. What is amazing is how short the attention of “investors” may be, and how they allow themselves to think monetary complexity passes for proficiency or even expertise despite all and continued observation otherwise. The ECB has innumerable programs, theories and mathematical equations, all of which amount to everything I have shown above; nothing.