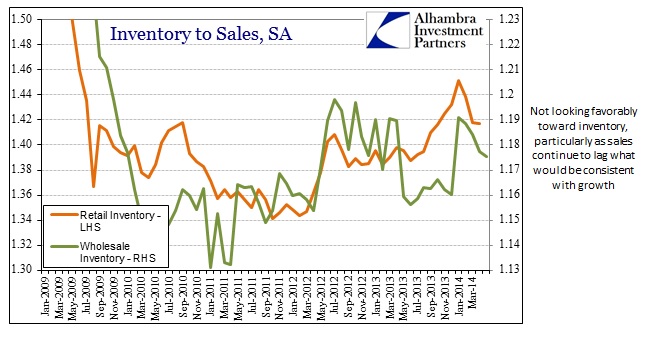

The wholesale inventory estimates seem to have raised more than a bit of optimism. I think that is highly misplaced for both GDP and the economy. On the GDP calculation side, there needs to be another huge gain in inventory to be “highly supportive” due to the second derivative nature of the estimate. As for the economy, even on a seasonally-adjusted basis, wholesalers are taking a dimmer view of holding inventory.

The mainstream narrative, which has been copied almost word for word across the media, is here:

U.S. wholesale inventories rose in May, reinforcing the view that economic growth should surge in the second quarter following a weak first three months of the year.

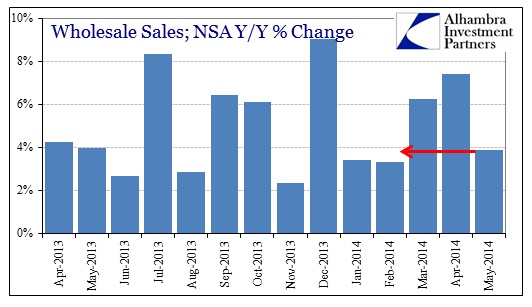

This flips around what is actually taking place, as sales are lagging not surging. Whether you take it in the form of seasonally-adjusted or raw nominal data, there is nothing to suggest the pace of sales is appreciably better than the first quarter. If anything, the sales pattern continues to lag what would actually be consistent with sustainable growth. In fact, wholesale sales in May were only slightly better on a year-over-year basis than January and February.

That matches what we have seen in many other indications, where the slump in January and February was temporarily rescinded in March and even April, but seems to have faltered once again come May (Wal-Mart being the latest to admit as much).

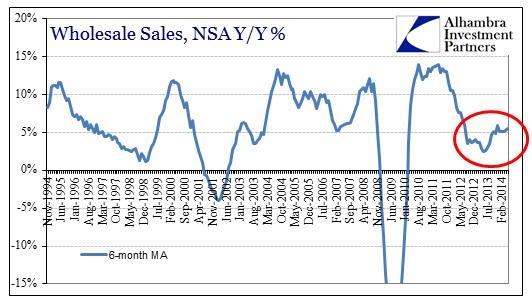

In a wider context, the pace of sales continues to be stuck at a decelerated rate, which is consistent with the highly unstable pace of economic movement recently. There is nothing here to suggest a rapid acceleration toward the mythical recovery, only that the second quarter is not likely to be as bad as the first (as far as inventory goes) for what are largely technical factors. Those are two separate and distinct narratives with far different implications.

That still doesn’t mean that inventory may contribute all that much toward a positive number. After all, inventory accumulation in the first quarter was still rather large – it just wasn’t nearly as much as the insane accrual of the last six months of last year.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com