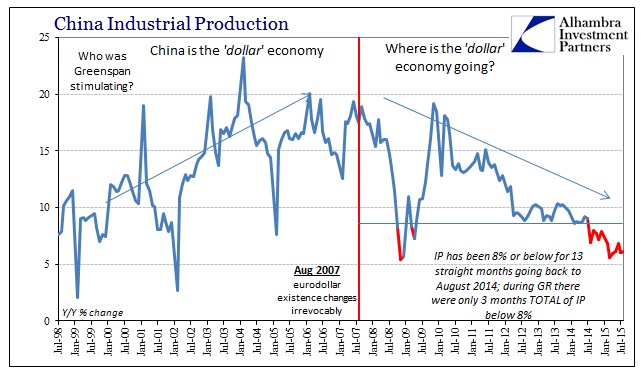

If for the Asian “dollar”, then China’s inability to place an economic bottom is a problem for every market and economy. The more hopeful mainstream rhetoric from the summer is now gone, just as the “dollar” would have it. China’s variations have far too closely matched these “dollar” waves which, in the midst of another, is not a hopeful sign about any actual trough anytime soon. That China may already be at Great Recession lows without yet the evident means for a turnaround is an indication of potential – this downturn far exceeds in duration the (global) Great Recession already and may now also be hinting, unthinkably, beyond its depths.

A closely-watched gauge of China’s economic activity fell to a six-year low in September, casting more gloom over the outlook for world stock markets and adding unwelcome material for discussion when President Xi Jinping meets President Barack Obama this week.

Research firm Markit and its local partner Caixin said Wednesday the flash estimate of its Purchasing Managers’ Index fell to 47.0 in September from 47.3 in August. That’s the lowest reading since March 2009, at the low point of the global recession that followed the collapse of Lehman Brothers. Analysts had expected a small bounce to 47.5.

Global “demand”, based on the eurodollar perpetually financializing, just isn’t there. As noted yesterday, it isn’t raw coincidence that China’s manufacturing struggle is mirrored in the same, though less dramatic (so far), “softness” here.

In contrast, Asian equity markets tumbled after a Chinese purchasing managers index intensified fears a slowdown in the world’s second-largest economy will spread more widely…

Growth in the U.S. manufacturing sector showed no month-over-month change in September, staying at its weakest in almost two years, according to an industry report.

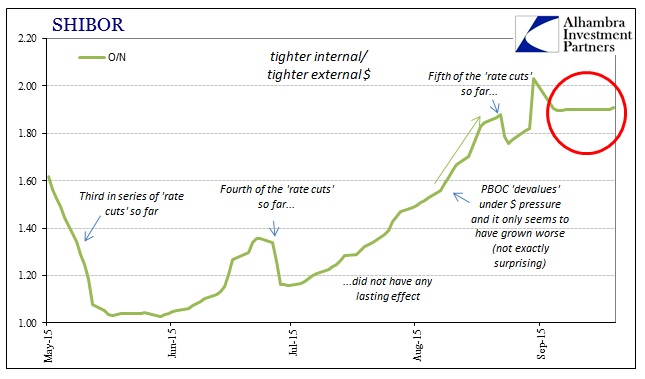

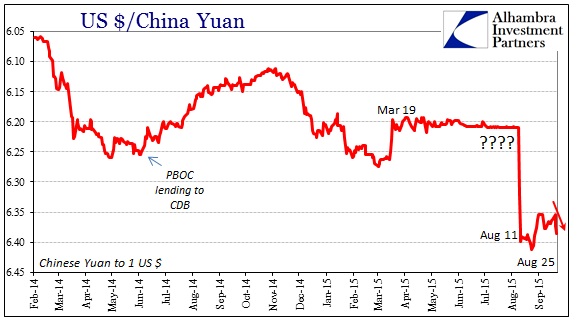

While stocks have shrugged off the implications and jitters about China to this point today, global money markets are far from enthused. That starts with the PBOC’s clear attempt to purge volatility in SHIBOR. Last night was the first time in several weeks that O/N SHIBOR cleared more than 1 pip in either direction, as the rate fixed at 1.908%. It doesn’t sound like much, but given that the yuan also traded weaker (for those still referring to “devaluation”) for the lowest cross to the dollar since late August, it suggests much more strain internally (which is, I believe, the point of the PBOC’s action; to hide as much as possible, only that what is actually possible is always far less than a central bank believes).

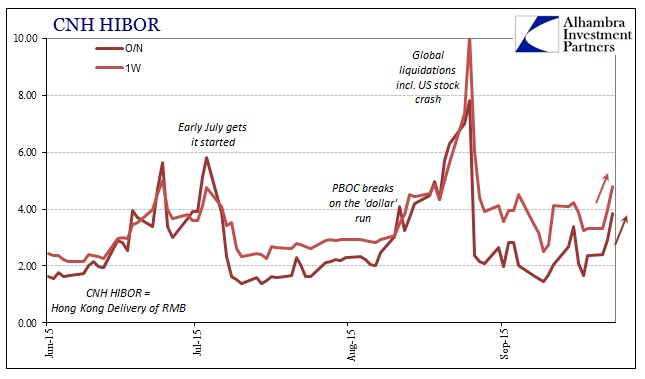

But where internal yuan liquidity may be more at the mercy of the PBOC’s directives, the offshore market is not. CNH HIBOR (the rates for Hong Kong delivery of renminbi) has turned upward yet again, threatening to mimic its surge in mid-August. The O/N rate jumped to 3.86% today from 2.917%, while the 1-week rate fixed at just shy of 5% and the highest since August 26. That would suggest the PBOC is, predictably, losing its struggle.

What I am really describing in all of these rates and charts is Asian bank balance sheets; the modern, wholesale framework that passes for global “money.” While ostensibly this all seems to be about yuan, that is really just one indication of strain on Asian bank “supply” that will manifest outward. That much we see of “dollar” markets almost everywhere, which is why stocks might not want to get too comfortable about China being China (yet again).

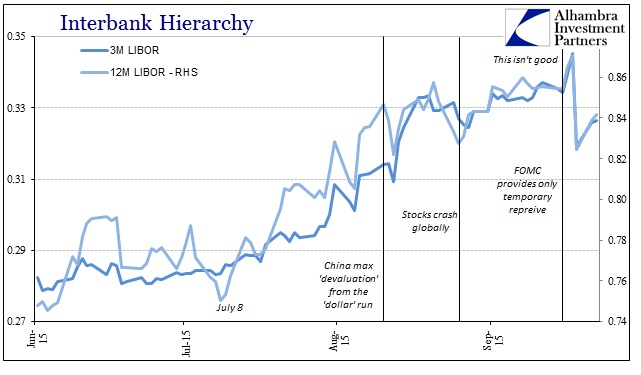

LIBOR rates (London delivery of eurodollars) dropped on Friday clearly in relief that the Fed did not make it worse at their Thursday meeting. However, LIBOR has picked back up again this week and remains at about the same level as prevailed in mid- to late-August (so elevated and upward once more).

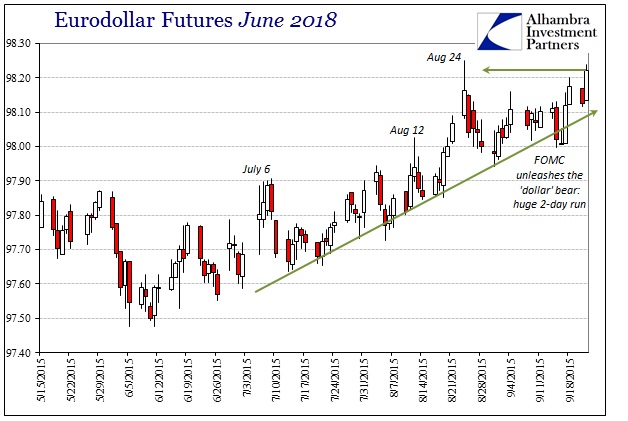

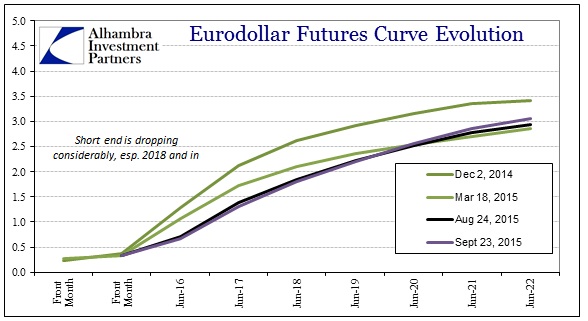

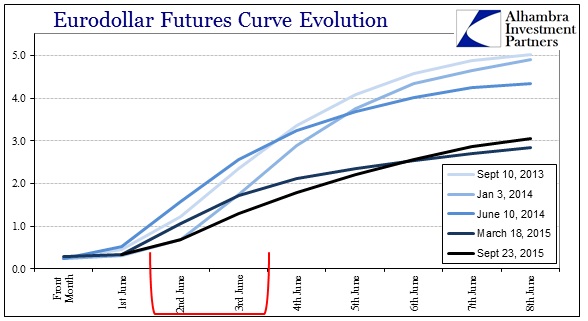

The eurodollar curve itself was nowhere near as enthused as LIBOR, with the curve continuing to shift downward into a shriveled, bearish hump. The “money part” of the curve continues to be bid such that rate expectations now are at “cycle” lows; the recovery, once again, is dead via this view of “dollar” funding. However, to believe that unrelated to the yuan or Asian “dollar” is a huge mistake.

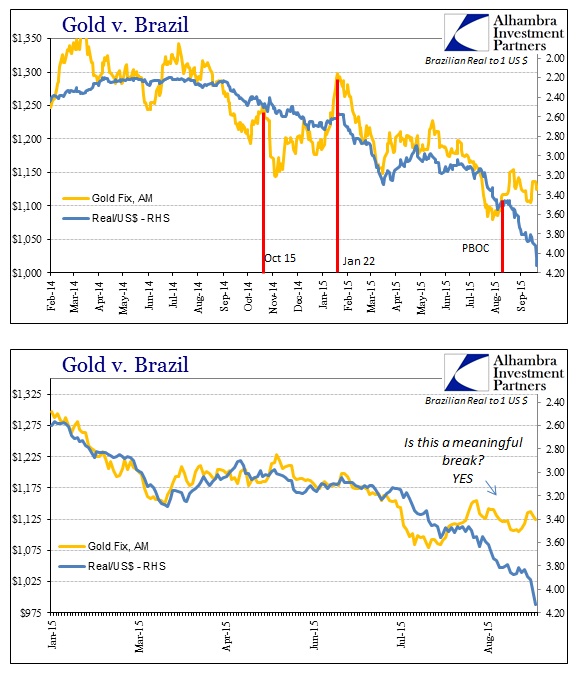

The slight steepening on the back end compared with the March 18 termination of the first “dollar” wave I think suggests the main theme for the “dollar” – it gets worse before it gets better. That first part seems proved where the “dollar” remains more openly violent, such as with the Brazilian real. The wholesale effects on that currency are both related to the economic problems caused by the financial retreat and the inability of that to suggest where this all ends in less catastrophic circumstances.

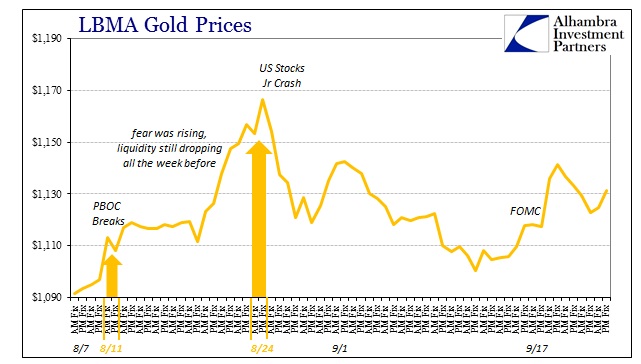

That brings out what is certainly an ongoing shift in sentiment; or as I put it yesterday, going from “transitory with no downside possible” to “what is going on here?” That shift might be best demonstrated in the related “dollar” implications suggested by gold prices. Under the cover of “transitory”, “dollar” disruption had been visited squarely upon gold as a consistently negative price factor (often hugely; see 2013). Since the PBOC broke in August, gold has held up reasonably well during continued wholesale fluttering. At the worst points, gold even surged (relatively) suggesting the safety bid finally overcoming even the worst of the wholesale downside mechanics.

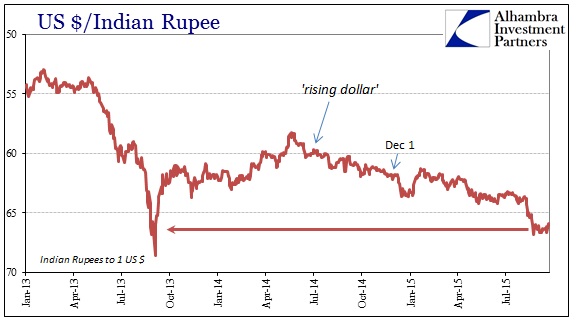

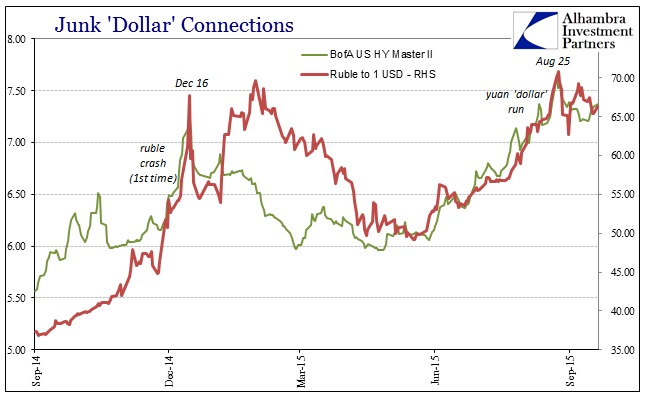

It isn’t just Brazil and the real, however, as other currency proxies for “dollar” funding also remain perilously depressed – in no small part because “markets” had assumed that their respective central banks in these places actually had some ability to fix the problem, only to find out now, as everywhere else, that was all an illusion waiting to be revealed whenever the “dollar” grew serious about it once more. India and Russia count in that view, as did the PBOC at one point.

China’s problems are “our” problems, to the point that the disaster unfolding there wasn’t even created there. There may be an argument over whether the eurodollar decay has created the Asian “dollar” nightmare, or whether it is the Asian “dollar” stirring the eurodollar but that is largely moot since either ends up in the same place (and I think they are just different manifestations of the same governing dynamic to begin with). In other words, wholesale banking in every format is a huge puzzle right now, one in which central banks have no answers. The problem is that global “markets” are just now starting to ask those questions.

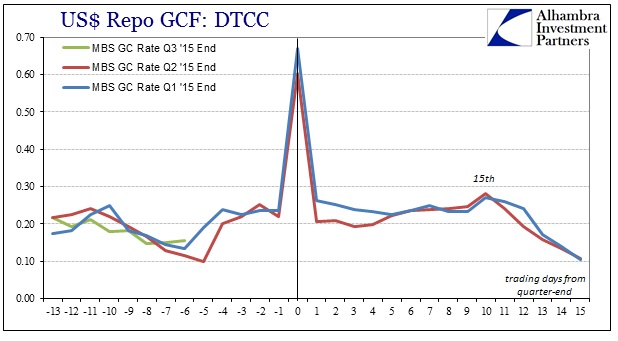

One final note, heading toward the Q3 bottleneck, the repo market in US$’s remains mostly on track:

And China’s wholesale, “dollar” economy; as bad as the Great Recession already, but lasting far, far longer: