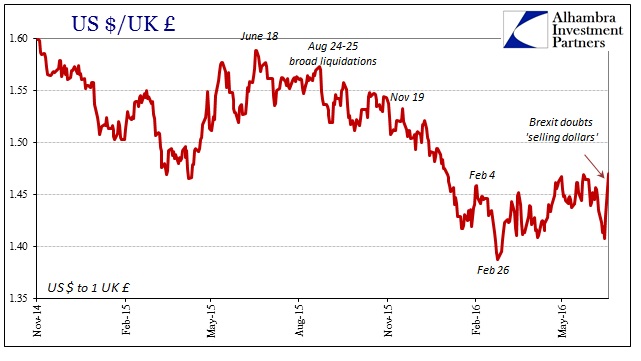

With the sudden interjection of uncertainty halting the surge in Brexit odds since the unfortunate attack on British MP Jo Cox last week, the financial world has benefitted from the pound’s resurrection. Sterling has had a very good couple of days in this reversal, especially today. As it rises it adds the same as we saw on the day of the atrocious US payroll report – determined “dollar selling.” CNY has been dutifully higher during its run, also halting its seemingly inevitable further disruptive influence.

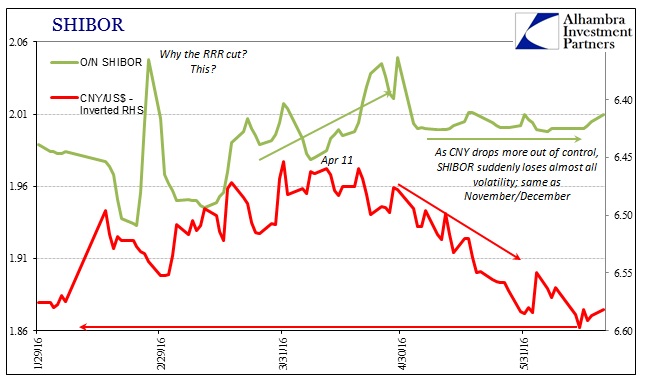

Again, in what is so far a repeat of “dollar selling” at the start of the month with payrolls, this calm isn’t corroborated anywhere else suggesting at best temporary influence. Stocks are up but that is again merely the opposite of CNY down = bad. Inside China itself, we find instead SHIBOR breaking above 2% as CNY fails to clear out more funding space (“devaluing”) in RMB. Violation of 2% in the overnight onshore interbank rate usually brings further CNY “devaluation” as the PBOC forces itself to reckon onshore first. Thus, it’s not clear how long these Brexit, GBP factors might muddy these dynamics.

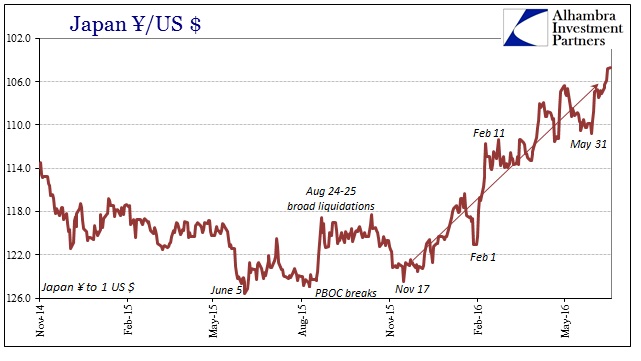

Instead, the Japanese yen continues its advance in the direction that CNY should likely follow before too long. This isn’t a direct correlation in small timescales, but as JPY goes up it signals the related pressure on CNY further in “dollars.” From this divergence with GBP, then, we can reasonably assume that Brexit “effect” for however short it might work (in overly simple terms, banks selling “dollars” against the pound appear to be filling any funding “dollar” gap for China due to Japanese/Hong Kong banks getting out, but leaving RMB to struggle because of the Asian direction).

And so whether in just correlation or in actual, direct liquidity, as CNY goes so does global risk. The correlation has been almost perfectly accurate in daily conditions:

Thus, we see the directly inverse relationship between CNY and global risk assets in even the minute details of intraday trading. When CNY was down sharply the rest of the week, particularly yesterday’s [June 14] new established low, asset markets struggled. If they happen to find a brief window of “dollar selling” related almost assuredly to the absurdity of monetary policy projection, then liquidity turns around and asset prices rise.

The FOMC meeting did provide just such an outlet if only for one day, succumbing rather quickly to more CNY devaluation and global asset prices struggling again. Now under “favor” of sterling, the whole thing reverses so that the entire global asset approach appears much more optimistic even though fundamentally nothing changed (except to confirm at best more of the same, at worst getting worse).

The UK referendum thus clouds the issue until Thursday. What happens thereafter is anybody’s guess, but in my view before too long Brexit fades and the Asian “dollar” takes over again. That seems to be the direction foretold by JPY, and even the Bank of Japan has learned to consider first the yen verdict.