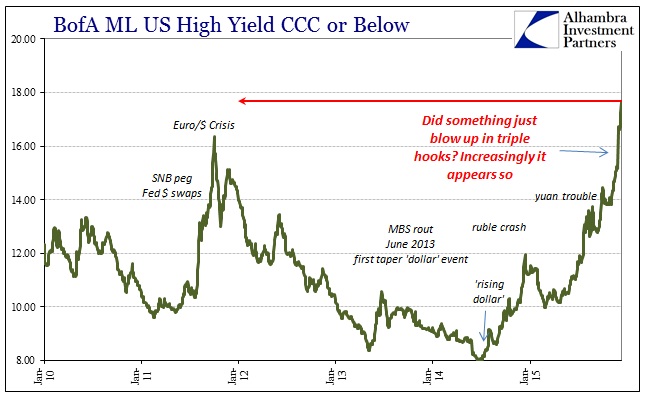

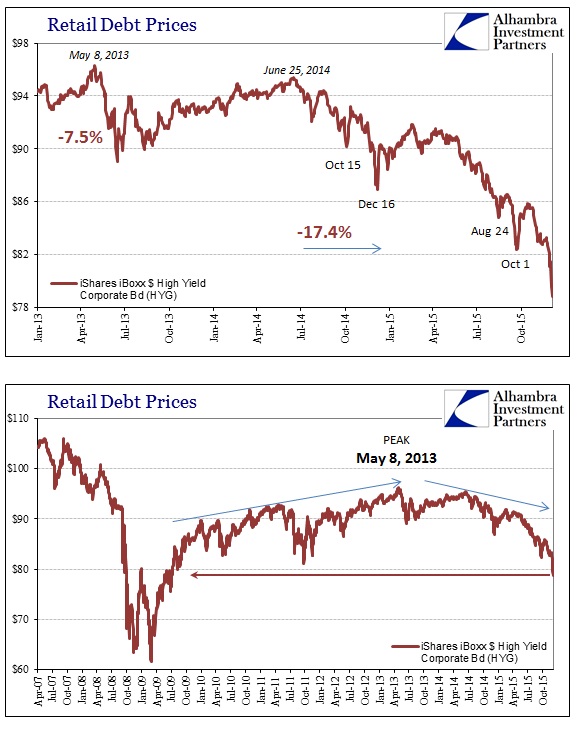

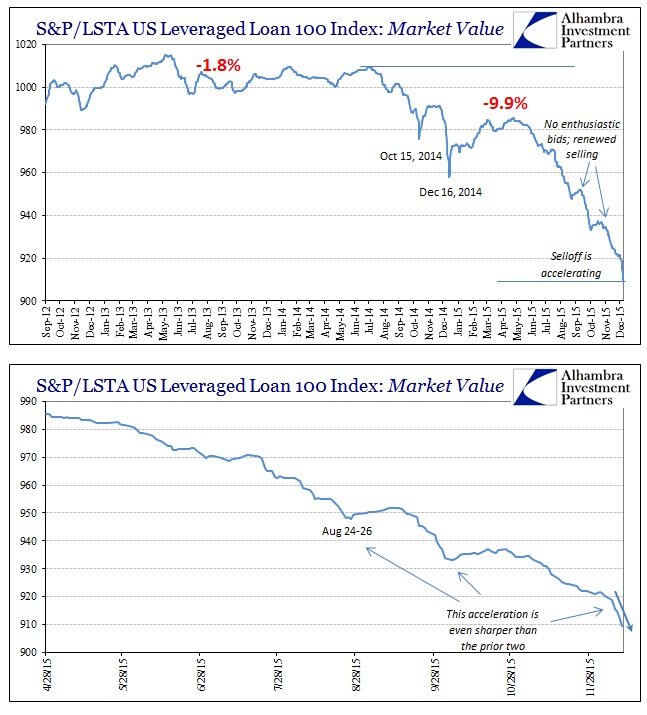

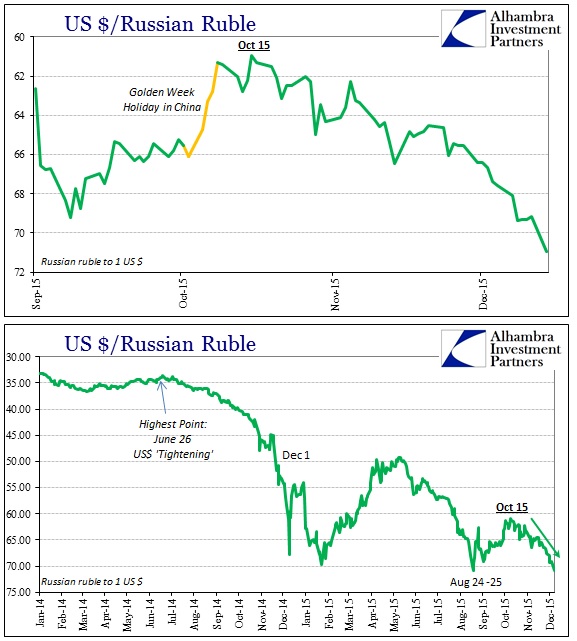

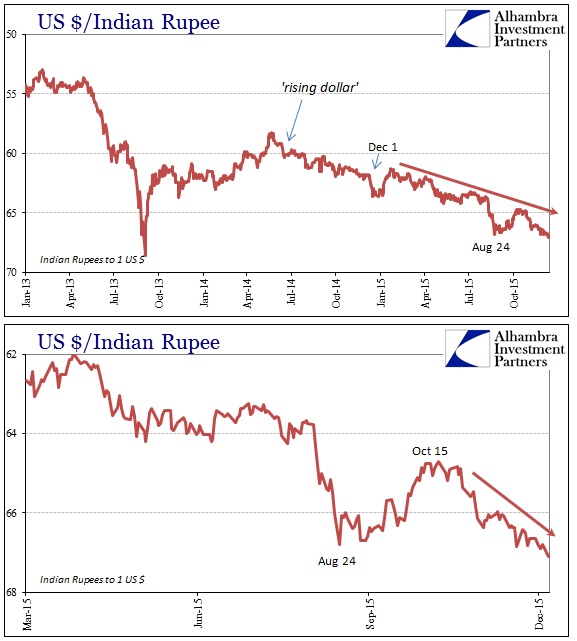

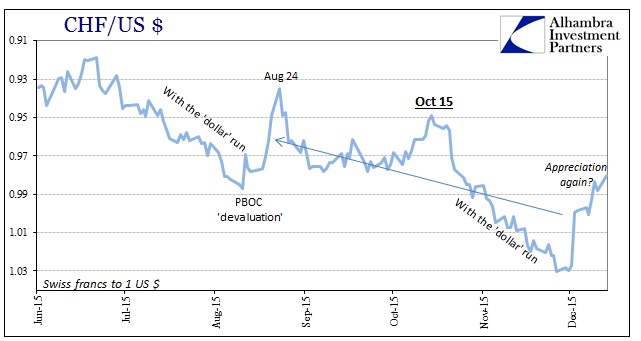

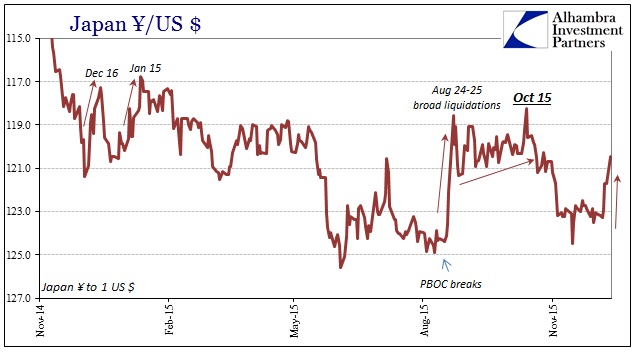

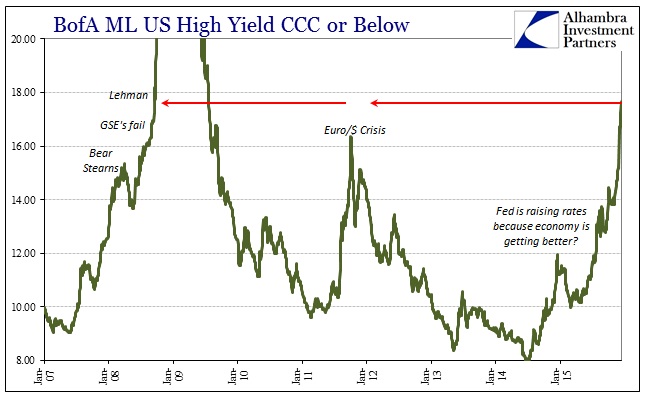

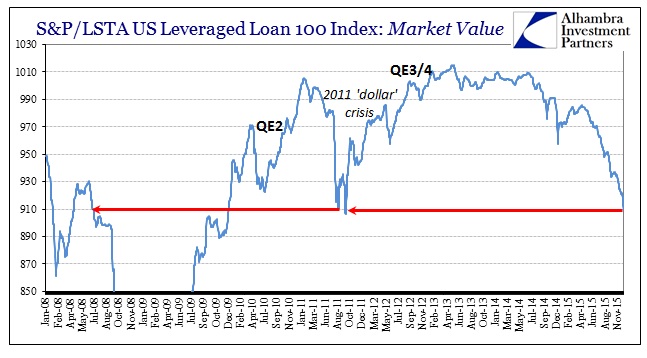

There isn’t much commentary needed here, as the prices and yields indicate everything relevant and important. I would only add that seeing August 24, October 15 and now the change (in acceleration) in December all add up to something different than the FOMC’s whatever influence. There is no monetary policy reason for the August 24 global liquidations to show up in not just oil and credit, but the ruble, rupee and other currencies.

In any case, starting from whatever it was that blew apart in triple CCC, events (selloff = illiquidity + shift in risks) are accelerating and spreading.