With the housing recovery, it is perhaps because it has been much more visible and earnest that the disparity is more easily appreciated and understood. Prices have surged in some places as much as the housing mania portion of the great bubble of the 2000’s, yet that has taken place despite levels of overall activity at only fractions of that prior period. Thus, it is what looks like recovery with all the characteristics in price and momentum yet suspiciously devoid of true depth that would really define the very idea of “recovery” itself.

That real estate void is a microcosm of the “recovery” in the full economy. In many ways, it has looked like recovery but it has also suffered from this shocking lack of broad participation. If we really want to understand what has happened in especially the past two years (where “overheating” that was supposed to occur has given way to contraction and even recessionary imbalance) it has to start with appreciation for the narrowness with which the recovery narrative was defined. It really started in the summer of 2014 in what was really confirmation bias bordering on a state of full circular logic:

Wall Street is smiling. Although the economy is getting better, the Federal Reserve is probably not going to raise interest rates until the summer of 2015 at the earliest.

The Fed said Wednesday that it continues to believe rates should remain low for a “considerable time” after its bond buying program is complete — which should happen following its next meeting.

Investors were pleased. They sent the Dow to a record level in the afternoon — crossing 17,200 for the first time ever. The index closed at a new high of 17,157.

That article was written in the middle of September 2014 under the headline Thank Janet Yellen: Stocks Hit New Record. She was giving both the “market” and the economy what it supposedly wanted, which was both ultimate economic success coupled with no rush to prove it. Stocks were at new highs because the economy was getting better and “everyone” knew the economy was getting better because stocks at new highs said so.

Only a few weeks later, the “market” would be jarred by the “dollar” events that would culminate in the UST “buying panic” on October 15, 2014; and it was only a few months before that repo markets were rocked by a sudden and very sharp rise in repo fails (suggesting the combination of acute and systemic collateral shortage of the highest grade, one of the predicate conditions for a UST buying panic). Those credit and funding events were simply brushed aside in the afterglow of especially GDP and the burst in statistically conjured payrolls. Any disruption emanating from the financial and credit arena was believed wholeheartedly to be “transitory” because of the assumed economic strength.

Testifying to the Senate in February last year, Janet Yellen noted this jump in GDP as if it were meaningful.

At the same time that the labor market situation has improved, domestic spending and production have been increasing at a solid rate. Real gross domestic product (GDP) is now estimated to have increased at a 3-3/4 percent annual rate during the second half of last year. While GDP growth is not anticipated to be sustained at that pace, it is expected to be strong enough to result in a further gradual decline in the unemployment rate. Consumer spending has been lifted by the improvement in the labor market as well as by the increase in household purchasing power resulting from the sharp drop in oil prices.

A lot of what she said then, and what is still just repeated now, had no basis in reality and was instead just recycled boilerplate “conventional wisdom.” The basis for cycle completion rested upon the idea “consumer spending has been lifted” by both what she believed the unemployment rate suggested but also how helpful the “sharp drop in oil prices” was supposed to be. By that time, there was already a significant body of data that strongly suggested this just wasn’t the case, including preliminary predicates that were already signaling that Q1 2015 would be very weak.

Even as the mainstream turned to “residual seasonality” as a scapegoat, it only obscured the full issue which was that GDP even with BEA reconfiguration was still suspiciously unstable – good quarters of high growth never seemed to last beyond short spurts and always gave way to “unexpected” mini-downturns. No matter all the factors that were supposedly going right, the economy still managed to seem wrong even in the places where it really should not have (GDP is constructed to be the most charitable view of the economy). From there, these points of “conventional wisdom” only started to further unravel rather than confirm what was in late 2014 unquestionable.

No matter how much everything would reverse throughout 2015, Yellen and economists continued to stick to the script. As late as December, she was still telling a Washington, DC, gathering that, “Job growth has bolstered household income, and lower energy prices have left consumers with more to spend on other goods and services.” Despite saying those words, there was nothing to be found of what those words suggested. Retail sales had dropped below 3% (including autos) and stayed that way as if only consistent with past recessions. And by December she knew that GDP was yet again ready for betrayal, not anywhere close to what she was saying about all those assumed positives.

GDP was the best shot for Janet Yellen to try to convince anyone that the Fed has it even slightly correct. It is, again, the most highly accommodating economic statistic toward presenting growth and it utterly failed in 2015. If LBJ gave up on Vietnam supposedly because he “lost” Walter Cronkite, might we see something similar here? In other words, if you can’t even get GDP on your side, then you’ve lost. Market prices start to make a lot more sense under that heading.

As of the current Atlanta Fed forecast for Q1 2016 that is barely positive (+0.4%), that weakness is only expected to continue in GDP (other estimates for Q2 are at best around 1%, potentially a third straight quarter at 1.5% or worse). Her statements about oil prices and the job market somehow never changed or wavered, but the rest of the economy did including GDP. These are not meaningful statements as any rational human would take them, she (as economists and the media) uses them almost as ritual incantations trying to conjure the very thing being spoken about:

Finally, interest rates for borrowers remain low, due in part to the FOMC’s accommodative monetary policy, and these low rates appear to have been especially relevant for consumers considering the purchase of durable goods. [emphasis added]

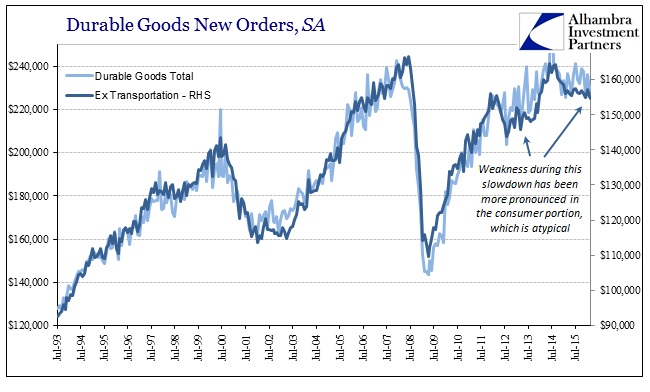

In other words, “stimulus” works because it works and she’ll keep claiming it works no matter how definitively it is shown not to have worked. As noted this morning, durable goods orders have been contracting going back to 2014, a condition that she must have been aware when she tried to claim that low rates have been good for durable goods. Worse for her, durable goods have been falling more so due to consumer-driven activity than the overall course. There is no ambiguity here, nor in the GDP version of durable goods spending, thus again raising the issue of what she was talking about – mere words repeated out of habit? Blissful ignorance in deference to blind recitation of past correlations?

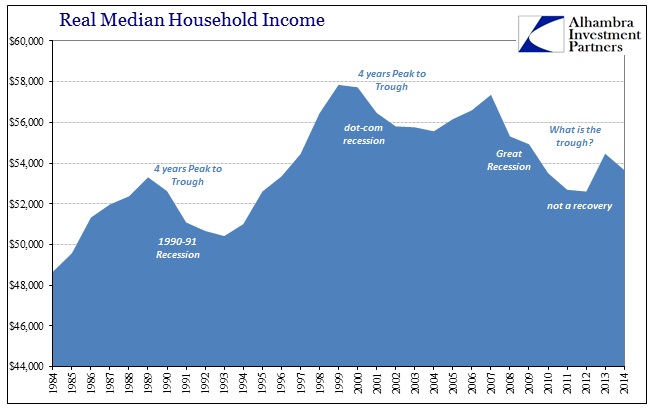

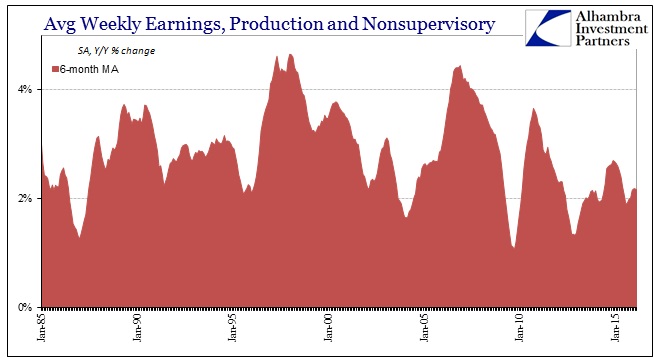

Jobs and oil prices remained a staple of commentary and spoken assurances as if they would be true long after it was obvious they were not. The fact is, the difference at the outset, they should have known better all along. The recovery was never more than the same façade put together of housing (and stocks). It has been missing the only factor that matters all throughout, the lack of which completely tore apart all those wondrously hopeful inferences back in 2014. There has been no income.

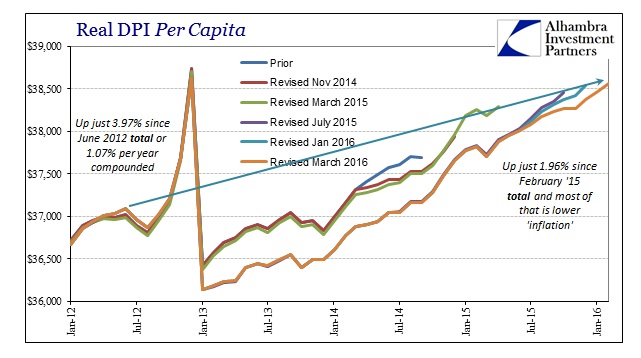

Economists and “markets” were projecting positive numbers as if they were meaningful, when the view from national income and especially earned income suggested very strongly otherwise. Thus, when GDP jumped in the middle of 2014 it was nothing more than this same variability and wasn’t in any way an appropriate foundation upon which to rest this expectation of “overheating” because it was never confirmed in the one place it should have been (which Yellen herself knew on some level, as she kept referring to wages and income as an element of caution). It was, again, hollow.

That much has been revealed already in the “unexpected” events of 2015 that were only unexpected because continued, persistent weakness in income was always dismissed as if the unemployment rate were just about to rectify the matter. No matter how low the unemployment rate pressed, however, income conditions never really changed. That is what all this is really about, as all economic interpretation is intended in only that one direction; GDP is meaningless unless it correlates with actual conditions of a high degree of fruitful circulation (earned income); the Establishment Survey can only supply one piece of inference that the imputed number of total employees is meaningful in determining the future course of spending via income.

Economists and policymakers knew well that income was the primary problem long before 2014. The difference was that in 2014 GDP in the middle turned up just enough (5% pre-revisions) along with the sudden (and questionable) appearance of the “best jobs market in decades” for them to see what they wanted to see out of “stimulus”; that despite all evidence (uninterrupted slowdown) elsewhere, it had to be working. They took a highly dubious anomaly in data and turned it around into projecting their own biases about QE so that GDP would to them suggest income was about to turn higher when in fact it was the continued lack of income that showed GDP (and the labor stats) was the illusion all along. Causation never reversed.

The recovery was always hollow or shallow, for a short time in 2014 it just came in a more appealing package; so appealing, the mainstream never looked beyond that cover. With 2015 a wreck and 2016 looking at best more of the same, they just keep right on reciting all the past cliches because to admit the actual circumstances is just too traumatic.