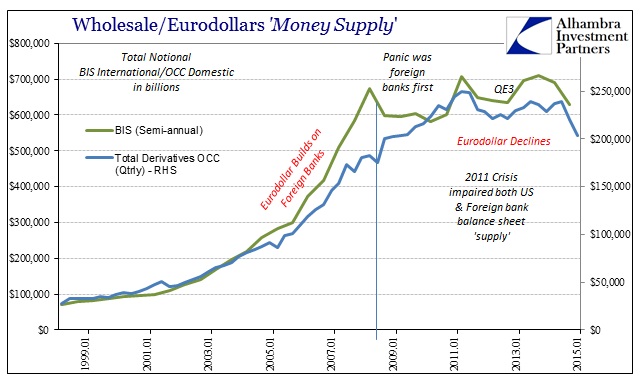

In case it isn’t clear, and it really isn’t, the lack of bank capacity matters in ways both indirect and direct. Indirectly, banking and the “dollar” are supposed to support the global economy. Instead, the eurodollar system came to dominate and now we live in its absence as economic trends developed from that domination (hello China), serial asset bubbles as economic momentum, no longer provide any “lift.”

More directly, at some point this…

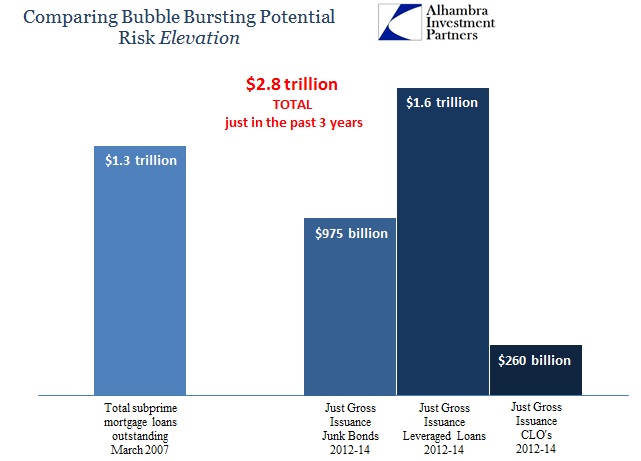

…will be called on to support this…

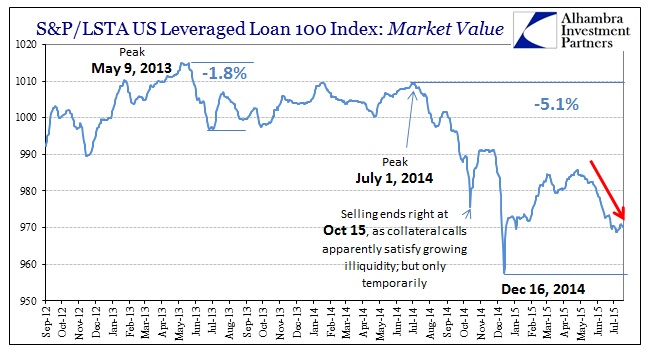

…or not…

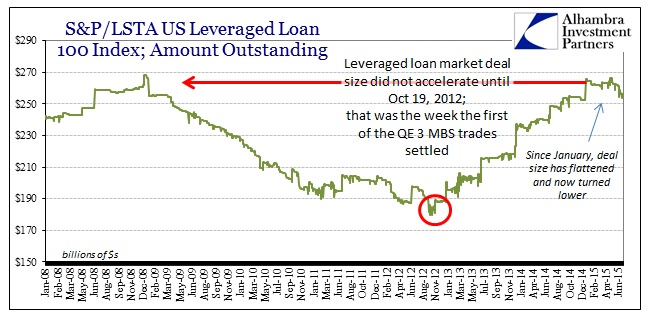

…along with everything else. The “everything else” part has already been bashed, as you can ask any Brazilian, Canadian, Swiss, etc.