By Mark St. Cyr

The week that passed has been nothing short of a roller coaster ride for many nervous investors. And for some: a realization that the once hyped, hawked, and levered Billion dollar babies can indeed “come off the rails.” Turning the once joyride into something more in common with a free fall into the abyss.

And just like at the carnival the progression is the same: The barker takes your money, you get to ride and scream in fits of mania and terror, and if by chance it careens out of control? It’ll be insisted that such things can, and do happen which are clearly stated in micro-print on the back of your ticket. And – there is no refund. Only issue is the cost for such a ride isn’t comparable to some expensive latte – it’s your future retirement savings, and whether or not you’ll ever have enough left to buy another latte after this ride is through.

However, you’re told not too worry: For if you loved the ride when the prices were higher, then surely you should be ecstatic to “ride again” since the new ticket prices are clearly “on sale!”

Is it any wonder why “carnival barker” seems so easily interchangeable with the next in rotation Wall Street fund manager, analyst, economist ___________(fill in the blank) on the financial media shows than not?

If you dared question the meme “everything is awesome” you were branded as some “data denier.” If you weren’t branded with that moniker you were surely scolded to have: “No understanding of Fed. monetary policy.” Or, you’re insulted for using common sense backed up with actual business acumen for questioning their premise to which they proclaimed people like myself as: “Idiots.” (yes, that’s an actual quote) Well, I have only one “idiotic” question: How’s all that data working out?

Now the meme coming from the so-called “smart crowd” (i.e., Those earlier insisting the 5% GDP print proved this economy is destined for take off) now contort their “analysis” of the latest data points in a messaging base of: “This recent 0.2% GDP print is an aberration. We recommend to ignore it as such. Things are much better than what this data now shows. Trust us.”

The real issue is that the once beloved and cherry picked data used ad nauseam by all these barkers of “stocks are reasonably priced at these levels” is precisely that pesky thing that’s putting both fear and terror into their own roller-coaster ride of terror. i.e., Concerns regarding their commissions and bonuses.

The once sanctimonious explanations used then whirled as a bludgeoning tool to support all their prior thesis have let loose from their handles and are smashing the very glass once used to construct their house of mirrors. Now it’s getting harder to conceal with no more outright QE to burn giving smoke cover of the obvious cracks, while one listens and hears the smashing of one meme after another proving it truly has been nothing more – than smoke and mirrors.

And there’s no better examples of this than the once Billion dollar darlings of Wall Street in the industry of both tech, as well as social media. Twitter™ and LinkedIn™.

Back in October I opined: Welcome To A “New” New Normal Earnings Season. In that article I made a case of what I felt would be appearing on the financial landscape with more and more frequency. This was the first earning season where the realization QE was in fact going to cease. Although it would not be final until November warning signs would and should indeed begin to appear in earnest. From the article…

“With the Federal Reserve’s QE policy set to end this month all these “new economy” juggernauts are going to have to prove that giving away the store for “free” as to entice users, customers, and more; will have to prove they have the ability along with the quantifiable hard numbers accompanied by real “cold cash” they can pay those promised returns to Wall Street.

If this proves to be the case the term “trap door” will not be used in reference to some new gaming app available. It will be to describe serious consequences to people who assumed investing in these markets has been nothing more than a game to be played by “players.”

Just watch how fast the “players” in the world of algos and High Frequency Trading can change the meaning of “liquidity trap” when they decide – it’s not in their best interest to play.”

To Wit: Twitter…

And LinkedIn…

This is what happens when the “fast money” no longer wants, or is capable of playing fast and loose. Once there’s no longer any “free money” to put to work at the speed of light via HFT: the game as well as players gets smaller. For once those endless resources of “free money” are reduced, so to will where, and how they’re allocated. Sometimes with dramatic results.

This is what happens when the “fast money” no longer wants, or is capable of playing fast and loose. Once there’s no longer any “free money” to put to work at the speed of light via HFT: the game as well as players gets smaller. For once those endless resources of “free money” are reduced, so to will where, and how they’re allocated. Sometimes with dramatic results.

In my opinion the above are clear and indicative examples of what the years of incessant QE has wrought. What should also be just as clear is how dangerous to risk exposure these once heralded new economy bellwethers can, and have become.

When “free money” was plentiful and for the taking investing in “eyeballs” reminiscent of the dot-com days was the play of the day. Now that the “free money” for liquidity has turned into preservation of their own liquidity? You see the results in stunning detail. Not too worry though. It was probably just your money liquidity that vanished near 25% in a nanosecond – not theirs. Still believe HFT is good for providing “liquidity” and “trade execution?” I’ll bet those terms have far different connotations now than earlier.

As disheartening as the above shows just how adulterated the capital markets have become since the interventionist monetary actions of Central Banks, along with the mechanisms to obliterate true price discovery via High frequency trading algorithmic wars on bid, and stop runs. Just like an infomercial on late night TV: “But wait – There’s more!”

One of the other dark sides rearing its head within this latest earnings period was brought to light I believe unwittingly. Nevertheless if one was listening to the arguments bantered about it was obvious just how insidious the Fed. policy of holding interest rates at the zero bound has become. e.g., ZIRP

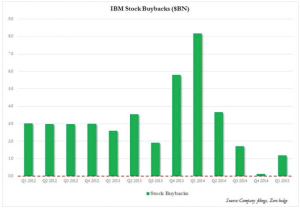

Regardless of whether one agrees or not with a company buying back their own shares (for there are sound arguments for and against depending on timing and strategic reasoning) In today’s world of ZIRP one doesn’t have to be a rocket scientist to understand far too many companies were using buy backs as a crutch in hopes of alleviating scrutiny and garnering accolades via the “fast money” class to continue holding, if not purchasing more, based on financial engineering. Rather than the need to actually innovate their core businesses themselves. And the current poster child of such is none other than IBM™.

The so-called “smart crowd” loves to pontificate how ZIRP doesn’t effect or cause a stifling of innovation within the economy. They’ll point to innovative companies such as those I listed earlier as proof “innovation is alive and well and monetary policies have nothing to do with them.” However I’ll state – Oh contraire…

Earlier this week I was listening to a discussion that revolved around the company Salesforce™ where it may be for sale and would need to be purchased by some larger corporate entity. Personally I find it amusing this company which raison d’être is to help others increase their bottom line, is itself, a company that basically has no bottom line. i.e., No profits but they sure have “eyeballs.” But I digress.

One of the names that was brought up as a possible suitor was IBM. Yet, was near immediately discounted as such. The reasoning? “Their balance sheet was a mess.” Wonder why?

Is it current expenditures into new and exciting innovations or engineering? Well, no. Unless you now count financial engineering as Innovative. Problem is, many do just that and it’s now showing its dark side where because of this rush to prop up a share price at any cost, the cost may indeed – be the future of any further true innovation. To wit:

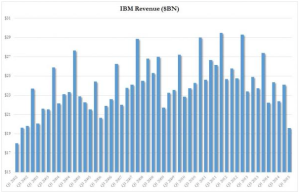

And what great new innovative products generating more and more net profits to warrant such spending? The chart below speaks for itself…

And what great new innovative products generating more and more net profits to warrant such spending? The chart below speaks for itself…

A further breakdown of the above in a short concise article can be found here reported by ZeroHedge™: “IBM Reports Worst Sales Since 2002; EPS Beats…” You be the judge on whether or not Fed. policies are adulterating the markets. After all, in a market where true price discovery and market forces were allowed to operate in a manner and form in which capitalism was intended: Would any of this discussion even be allowed to be contemplated? Let alone still persist?

This is what happens when “innovative” thinking at the board level is allowed to reach for the lowest rung on the ladder and take the instantaneous “free money” initiative, rather than the hard road of actually procuring innovation that may in fact build lasting revenue and profits for the future. And like I’ve stated many times: We are only in the beginning throes.

These suddenly illuminating spectacles of the once darlings of Wall Street where a reduction in the areas of 25% can be thrust upon investors pocketbooks in seconds are not outliers. They are now becoming increasingly more frequent. The above two are just the start in my opinion of this “new normal” earnings seasons that is far different from the “new normal” the so-called “smart crowd” proclaimed we were in. Here is more from my previous article…

“Lately it has worked in this “new normal” they have told everyone is upon us. For we were all not as sophisticated to understand that other mantra – “It’s different this time.”

Well, I may not be as sophisticated as those on Wall Street, but I will make this observation. It just may be “different this time.” Only not for those that have been trying to weed through all this smoke and mirrors. Rather, for all those architects that put these houses of cards together in the first place.

Suddenly this other “trap” analogy is showing its hand and it has a great many that pontificate that stocks are “fairly valued” and other such drivel very nervous; for its implications can have a great effect on their own investing future.

For how does one explain a “trap door event” to a client, when they’ve been assured their investment thesis was on solid ground?”

And here is where the proverbial rubber will hit the road in the coming months and quarters. For as we’ve seen “trap door” events are far from becoming trivial. They have very real implications for the markets as a whole.

What also is quite disturbing is if the above examples of “Billion dollar babies” can drop into the abyss faster than a 401K participant can open their statement. What happens when this type of price action happens within the major ETF’s?

What happens to investor confidence when these now seemingly endless gyrations of down 1 to 2% only to rocket back within a day on little if any volume suddenly don’t come back as is the case with the above examples? What happens when or if there’s such an event that took place similar to Twitter or LinkedIn only this time – it’s in the SPY™, or DIA™, or QQQ™, or IWM™? What then?

Will a proclamation of QE4ever solve such an issue? Hard to say because it might only be used by many as to help get out rather than get in, or add too. It’s all an open-ended question waiting for an answer that will only be known once brought through to fruition.

And that alone is a scary proposition in itself. But you’re told and reminded by the “barkers” not to worry.

Just trust them. After all – it’s only your money.

Source: Suddenly “You Can’t Ignore The Data” Has Turned Into “Trust Me” | MarkStCyr.com