Repetition is the signal of the unnatural. With stock prices moving back toward a positive daily trade, such immense volatility in what was surely a junior flash crash will be swiftly discharged as unimportant; the bull must stand. The NASDAQ at one point this morning was down to 4292 and the DJIA off about 1,000 points at the worst. And so it has already started that the end is much more important (should it hold green, of course) than how it got there.

Yahoo!Finance provides a couple helpful illustrations, as the featured article at the moment is 5 Reasons to Stay Calm As The Stock Market Quakes. The piece helpfully describes, “It’s not Armageddon – and you may actually find some bargains.” Another Yahoo! article written closer to the bottom tells us this is now “a bull with claws.” It must be far more than that, something even mythical, as to any of these nothing, apparently, can ever kill it.

The odds still favor this being a bull market until proven otherwise. It’s not common to get more than a 20% drop in U.S. stocks – typically defined as a bear market – without a U.S. recession, and no such things appear imminent. But financial panics can cause swift damage near that magnitude, and the cycle of fear and flight from risk can be self-reinforcing for a while.

That is an odd perspective, because “self-reinforcing” is quite a relevant qualification. It’s clear that the author is using it quite differently as I would, since his perspective is that “this” just started. For one, the market itself has been exhibiting weakness going back a year and more now. Second, liquidity and the “dollar” have been warning for months of acceleration in the run. What happened this morning isn’t the first time we have seen high stakes commotion.

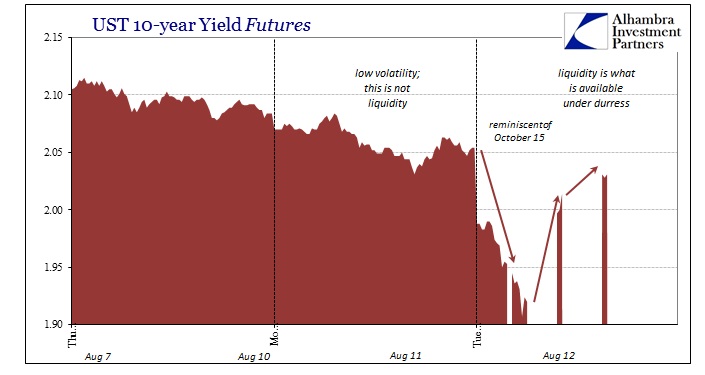

In many ways, already, today has the look of October 15. The 10-year US treasury futures fell from about 2.20% at the open that day, hitting a low of about 1.90% before finishing down only about 10 bps in yield. This morning, as stocks were offered to few takers, the 10-year yield similarly experienced that “V”; sinking from a prior day close of 2.05% down to 1.90% at a low. It wasn’t, however, all at once as the bid in UST kept at it until about 10:00. I have no doubt that officials will find some way to describe it as “concerning” before denigrating themselves with some other extraneous stooge.

The point about liquidity, especially in wholesale “dollars”, is not what it appears on the day-to-day even when there are “bad” days interspersed. Liquidity is what might be available when everything is going wrong, pressed tenfold in amplification. Just a week ago (how’s that for disqualifying timing), FRBNY’s ill-named Liberty Street Economics Blog published a “study” about liquidity in the UST market. They found it, unsurprisingly, quite filling and supportive:

Overall, our evidence is fairly favorable about the current state of Treasury market liquidity. Direct measures such as the bid-ask spread point toward liquidity that is quite good by recent historical standards. Other measures such as quote depth and price impact imply some recent deterioration in liquidity, albeit from unusually liquid conditions. The evidence suggests that market participants’ liquidity concerns are not emanating from average levels of liquidity in the benchmark Treasury notes.

Yet, here we are a second time wondering how a massive and sustained bid right at the open accompanies rather stark global disorder. These central bank economists took recent history as if it tells us anything about stressed condition, when instead they could have easily found stress first and extrapolated from there – which is essentially what the post admits straight after the above “conclusion.”

If average liquidity is generally good by historical standards, then why all the liquidity concerns? One possibility is that the unease is not so much about on-the-run Treasury securities, but about less liquid Treasury securities or other fixed-income securities such as corporate debt securities, which we have not examined here (and for which there is less detailed data to assess liquidity).

Or perhaps the concerns are not so much about average liquidity levels, as we examined, but about liquidity risk. Indeed the events of October 15 and similar episodes of sharp, seemingly unexplained price changes in the dollar-euro and German Bund markets have heightened worry about tail events in which liquidity suddenly evaporates. Liquidity risk, or really illiquidity risk, is harder to measure than liquidity itself, but we attempt to do so in a future post.

This disclaimer classifies the entire post as entirely a useless piece of propaganda. It could have been summed up as one quick “liquidity is great until it isn’t.” The same is true about every market that has existed, exists now or will exist; they work well until they don’t. The point is one of recency bias, whereby you are supposed to imbibe that since nothing bad has happened nothing ever will. The great study of crashes and asset bubbles is exactly that, find the “until it isn’t” parts and actually understanding them rather than in steadied denial.

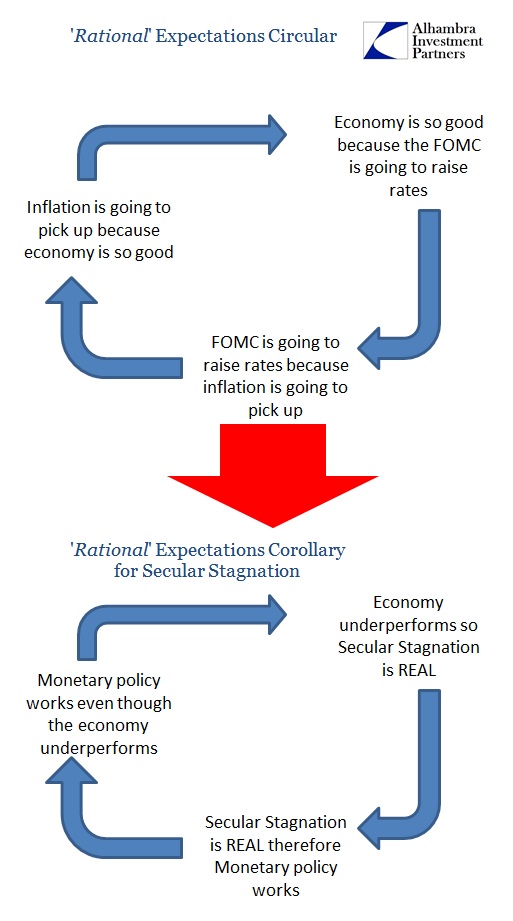

Except in more recent months, going back to June last year, the “nothing bad” becomes far more subjective and much more debatable. These “dollar” tremors have only gained in reach and especially depth or scope – all of which points unwavering in the direction of “until it isn’t.” It is easy to ignore them and say no “recession is imminent” but the basis of all that is descriptions and promises of economists who are enthralled by the idea of a one-way market or economy. It’s ridiculous to the point of only being able to disregard how these “anomalous” disruptions continue to recur, with perhaps greater frequency and certainly reach, and to an almost exact duplication. The continuation of glitches does not suggest persistent omitting of them, but rather how those “anomalies” might actually be the whole point.

The events of the past month have aligned in close proximity to a chained sequence of singular purpose and reading, but none of that matters as the “bull has claws”? Maybe, but it’s looking less certain all the time.