It may be more than a few, but increasingly some central bankers like the courageous Richard Fisher of the Dallas Fed and Chuck Plosser of the Philly Fed are speaking up, joined by a few well known money managers. They’re echoing the complaints that I and others have made for years about the insane (and immoral) policies of ZIRP and QE that the world’s major central banks have been promulgating since 2008. At a meeting of central bankers held by the Banque du France in Paris last week, a few of those people spoke out.

Among the gripes: Central-bank stimulus has relieved pressure on governments to revamp their economies, punished savers, inflated asset bubbles and left financial markets overly reliant on liquidity [emphasis mine] and prone to volatility when it reverses.

via Central Bankers Join Investors Warning on Easy Money – Bloomberg.

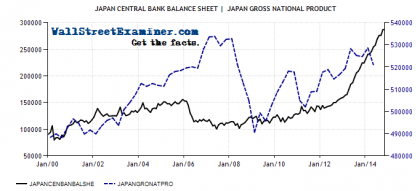

That says it all in a nutshell.Finally a few people in the mainstream are expounding on those themes that I have hammered on in futility for years. In time, the longer that QE and ZIRP continue to fail in increasingly obvious ways, the more the groundswell against them will grow. Meanwhile, hidebound jackasses like Yellen and Kuroda remain in denial. Hey Janet! Hey Haruhiko! Riddle me this. If QE and ZIRP are so essential to stimulating growth, why with the BoJ’s balance sheet tripling in size and rates held at zero for years, is Japan’s GDP now no more than it was in 2006?

Could it be-e-e-e-e-e that QE and ZIRP actually don’t stimulate growth? Could it be that the financial engineering, speculative excess, and labor suppression that results from QE and ZIRP are actually detrimental to real growth? Maybe, just maybe, higher interest rates would promote thrift, and rational, real investment that benefits everybody, not just the bankers, speculators, and corporate executives engaged in the constant easy money wealth transfer schemes that you promote and enable?

Just askin…