Here’s the truth about today’s stock market: The bull market in stocks is ending. That bull market was phony and fueled by years of Fed money printing. Now it’s rapidly breaking down.

The reason?

Raising interest rates requires draining liquidity out of the market. When the Federal Reserve does that, it causes a selling-crescendo. It will soon begin and will grow greater in time. Expect the market to go lower.

The “buy the dips” strategy that’s worked for the last seven years is over and done. Many investors are going to learn that lesson the hard way.

Instead, you need to “sell the rips.”

One way to do this is by shorting stocks — which is a part of my Stockman’s Contrarian Portfolio. You can also read our essential investor module on shorting, right here, for the nuances of how that works.

But there’s another strategy we recommend using to investors who want to generate a larger return from a falling market. It has some advantages over outright shorting. I like to call it our Bubble Finance Trading strategy.

I’ve been working to develop this strategy for a lifetime. And now I’m happy to be working with Agora Financial to bring it to you. I spent 20 years in Washington as a congressman and as a budget director under Ronald Reagan. I spent another 20 years on Wall Street — particularly in the leveraged finance business.

I think I have a pretty good view of how things work on Wall Street and in Washington. We’re at an important intersection of events that is going bring the financial markets back down to Earth.

You’ll need my strategy to help you. I have invested my own money this way. Now there’s a way for you, even in what will be fairly scary times, not to be punished by the consequences of failed policies in Washington. There is a way to preserve and grow your portfolio even as things begin to unravel and fall apart.

You need to play the market downside with a limited risk strategy. I call this “bubble finance trading.” It’s one of the best ways to profit in the markets in the weeks and months ahead. I’ll explain what this strategy is once I’ve given you some context…

Let me be clear. The Federal Reserve and the markets have painted themselves into a corner. The market will plunge sharply in the coming months if…

- The Fed fails to raise interest rates as now promised; or…

- If it does raise interest rates, thereby draining liquidity as now proposed; or…

- If it is confronted with the recessionary forces and bursting bubbles that it absolutely does not see on the path ahead.

You should consider any rally in the market right now as a flagging effort by the casino players to levitate another last gasp “rip.” In a selfish sense, these gamblers buying is welcome. As they drive the market even higher, they give you a chance to pick entry prices for our Bubble Finance Trader recommendations that offer even more upside when the inexorable bursting of the bubble fully incepts.

They may even succeed in generating one last Santa Claus rally before the recessionary forces spook the remaining gamblers out of the casino in the coming months. As I explained in the bonus chapter of Trumped!, recession in the early days of the next Presidential administration — whether it’s Donald or Hillary — are unavoidable. Gamblers, we might add, who no longer have a friend at the Fed.

Age of Bubble Finance → Crackup Phase

Today, we have a rogue central bank. It’s destroyed honest price discovery in the money and capital markets.

I once said, “Invest in anything that Bernanke can’t destroy, including gold, canned beans, bottled water and flashlight batteries.”

You can say the same thing about Yellen today.

The Fed’s monetary injections, “puts” and safety nets under the price of risk assets now drive everything. Accordingly, investors ignore risk and mechanically “buy the dips.”

This irrationally inflates asset prices — that is, until the bubble becomes unsustainable and then splatters violently, as it has done twice already this century.

The vital core of capitalism is the capital markets. That’s where capital is supposed to be raised and allocated. It’s where future profits are rationally assessed and discounted. And it’s where entrepreneurs and business enterprises are honestly rewarded for their contributions to free market prosperity.

Now all of that has long disappeared. The Fed has turned the capital markets into casinos where speculators and gamblers are showered with ill-gotten gains. Financial operators strip-mine the Main Street economy.

I call this the “Age of Bubble Finance.” And I’ve been working with Agora Financial to produce a publication called Bubble Finance Trader that helps you make trades in this unique environment in transition.

The timing could not be better…

It is not merely that the financial markets have drastically changed — even from where they stood in the mid-1980s when I was working in the Reagan White House. Washington’s crony capitalist bailouts and the massive flow of cheap money and artificial credit from the Fed have wholly corrupted them.

In this crazy Fed-distorted market, the first thing you should focus on is capital preservation. Rule No. 1 is don’t lose money. That’s where Stockman’s Contrarian Portfolio comes in. This is a long-term strategy that will have very little turnover.

Having a basic portfolio allocation is more important than capital gains when government and central banks have gone rogue and have chronically violated every known rule of fiscal rectitude and sound money.

That means getting out of harm’s way in all the financial markets — debt, equity, commodities and derivatives — because when the big correction comes, they will all experience a thundering collapse. The second thing you should be aware of is that short-term liquid investments and cash are not as bad as their microscopic yields imply.

The 20-year worldwide central bank credit boom has generated vast overinvestment in mining, manufacturing, transportation and distribution capacity worldwide. But now that the credit inflation is reaching its outer limits, and we are entering what I described as the “crackup” phase. During this phase, the forces of global deflation will drive down the price of goods and many consumer services as well.

When the next crisis fully materializes, cash will be king. It will buy more everyday goods and services and will have command over drastically marked-down financial and real estate assets of every kind.

The third thing you should know is that the impending collapse of the global central bank credit bubble will generate unprecedented volatility and drastic movements in asset prices of all kinds.

I describe four important forces driving this process right now, below. Read on for the results of two decades of bubble finance…

Four Market Signals That the Crack-Up’s Begun

Easy money is always the wrong medicine for what ails the market.

The inflated and unsustainable growth that the Greenspan Fed engineered by encouraging Main Street households to stage a massive raid on their “home ATMs” has sharply reversed… and properly so.

This is no small number. Compared to the peak MEW (Mortgage Equity Withdrawal) rate of 8% of disposal income, today’s negative 2% rate means there has been about a $1 trillion downward swing in household “spending.”

Our Keynesian central bankers lament this as a loss of “aggregate demand.” And they intend to remedy the problem by printing more money. In truth, it was always phony demand. It could not be sustained and had not been earned through production. Its disappearance simply marks the fact that households have been forced back to the old-fashioned virtue of “living within their means.”

Stated differently, the supply side is back in charge after a 30-year spree of one-time debt and leverage expansion. Consumer spending now depends on income, which means production, investment and enterprise are once again the source of growth, jobs and true national wealth.

The implication is that our monetary politburo is out of business. “Monetary accommodation” is nothing more than a one-time parlor trick of central bankers.

Unfortunately, like the politburo in the Kremlin, the incumbents in the Eccles Building will not stop until they are finally chased from office by a massive uprising of the people. That is: Savers, workers and entrepreneurs of America who have been shafted by the bubble finance policies of our monetary central planners.

We’re in the crack-up phase now. As such, four things are going to shape the way the economy and the markets unfold as we go forward.

First, you are going to see increasing desperation and extreme central bank financial repression. This is because central banks have painted themselves so deep into the corner that they’re lost and desperate.

Almost week by week, we have another central bank — most recently it was Sweden — lowering their money market rates into negative territory. The Swiss National Bank is already there. The Danish National bank is there. The European Central Bank is there on the deposit rate. The Bank of Japan is also there.

All of the central banks of the world now are desperately driving interest rates into negative territory. I believe that they’re lost. They’re in a race to the bottom whether they acknowledge it or not.

The People’s Bank of China, for example, can’t sit still much longer when the renminbi has appreciated something like 30% against the Japanese yen because of the massive bubble of monetary expansion that’s being created by Tokyo.

Central banks are out of control and in a race to the bottom, sliding by the seat of their pants and making up incoherent theories as they go.

The second thing that’s happening is increasing market disorder and volatility. In the last four months, the stock market has behaved like a drunken sailor. But it’s just a bunch of robots and day traders that are mindlessly trading chart points. It has nothing to do with information or incoming data about the real world.

Today we have the 10-year German bond trading at a yield of just 0.09%. The German economy’s been reasonably strong, having been fueled by the Chinese boom. But that export boom is over. The Chinese economy is faltering. And Germany is going to have its own severe problems soon.

But clearly, 61 basis points on a 10-year bond is irrational, even in the case of Germany. This is to say nothing of the 125 or so basis points available today on the 10-year bond for Italy and the 90 basis points for Spain. (Note: A basis point is 1/100th of a percentage point.)

Both Spain and Italy are in deep, deep fiscal decline. There is no obvious way for them to dig out of the debt trap they’re in. It’s going to get worse over time.

There is huge risk in those bonds. Especially because there’s no guarantee that the European Union will remain intact or that the euro will survive.

Why would anybody in their right mind own Italian debt earning 125 basis points a year?

Maybe those who anticipate the massive purchases that Mario Draghi at the European Central Bank has promised and the Germans have acquiesced to over the next year or two. But that only kicks the can down the road.

One of these days, central banks are going to falter. And the market is going to reset violently to prices that reflect the true risk on all this sovereign debt and the cloudy outlook that’s ahead for the world market.

There is now nearly $3 trillion of sovereign debt spread over Japanese issues and the major European countries that are trading at negative yields. That is irrational. It’s also completely unsustainable. And yet it’s another characteristic of what I call Bubble Finance.

The third thing that’s happening is that global malinvestment, fueled of course, by central banks, is now coming home to roost. It will be driving a huge deflation of commodity and industrial prices worldwide. You can see that in iron ore, which is now barely holding $55 per ton from a peak of almost $200.

You can see this in the oil patch too. Look at the Baltic Dry Index. That’s an index, created by the London-based Baltic Exchange, that tracks changes in the cost to transport raw materials by sea.

This is a result of faltering demand for shipments and overbuilding of bulk carrier capacity as a result of this central bank-driven boom that we’ve had in the last 10 to 20 years. And it is going to be ripping through the financial system and the global economy in ways that we’ve never before experienced.

It will become extremely hard to predict what all the ramifications and cascading effects will be. But the degree of overinvestment and excess capacity in everything from iron ore mines… to dry bulk carriers… aluminum plants… steel mills… and so on is something we have never seen before.

Fourth, demand has run smack up against peak debt.

There was a tremendous study that came out in February 2016 from the McKinsey Global Institute. It did an excellent job of trying to calculate, track and total up the amount of global credit outstanding, public and private.

According to the report, we’re now at the $200 trillion threshold. That’s up from only about $140 trillion at the time of the 2008 financial crisis. So we’ve had a roughly $60 trillion expansion worldwide of debt since 2008. Over that same time, global GDP only increased by about $15 trillion (roughly speaking, from $55 trillion to $70 trillion).

Owing to central bank money printing and all of this unprecedented monetary stimulus, we’ve added about $60 trillion of new debt. And we’ve gotten somewhere around $15 trillion of extra output in return. That’s not even one-third of the amount of debt.

The numbers from China are even more startling. In the year 2000, China had $2 trillion of credit outstanding. In 2008, Chinese debt was $7 trillion. It now has an unbelievable $30 trillion of credit outstanding.

And at the time of the 2008 crisis, China had allegedly — if you believe the numbers, which no one really should — $5 trillion of annual economic output. It’s now $10 trillion. So officially it’s doubled its GDP.

But China’s debt is up more than $20 trillion while its GDP is up just $5 trillion.

These are extreme unsustainable deformations. They just scream out, “Danger ahead. Mayhem has happened.” As all of this unwinds and becomes resolved it is not going to be pretty.

When you see that kind of minimal yield from the vast amount of new debt, it should tell you that the boom is over… and that the crack-up is under way.

So I have two specific recommendations…

On the wealth-building side, you should consider deploying your discretionary capital — money you can afford to lose — by shorting vastly overvalued stocks such as Tesla. This could reap huge rewards in the next crash. I describe which stocks to short and in what proportion to the rest of your portfolio, right here.

On the wealth preservation side, you should also be sure to buy the one asset that will be left standing tall when the central bank money printers finally fail: gold. That’s also listed on our Stockman’s Contrarian Portfolio page.

As you employ these strategies, you’ll see the Fed-driven casino start to crumble and profit from it.

But the most high-powered way to invest in this environment is with my Bubble Finance Trading strategy…

Bubble Finance Trading: The Best Strategy for Profiting From a Crashing Market

We’re at one of the greatest financial market inflection points since 1929. The market is down for the year… and headed much lower. But that doesn’t mean you have to lose money. In fact, it’s just the opposite.

It’s a basic truism that you can make a profit in a rising market if you “go long” and you can make a profit in a falling market if you “go short.”

The $64 million question, of course, is always how can you know the direction?

There are all kinds of financial advisers and market seers and chart readers and fancy investment formulas to report to answer that question. All of these assume some kind of world in which the future unfolds in a grand cyclical continuum that’s anchored in past history. They’ll tell you that with the right pattern recognition software or system like they advertise on financial TV and you’ll make a killing.

Don’t believe that for a second.

We’re in uncharted waters after nearly 20 years of madcap money printing by the Federal Reserve and other central banks. Over that time, everything was wildly inflated: Stocks, bonds and real estate. Now the credit bubble has reached its apogee, its maximum extent. From now, on it’s “look out below.”

That begs the questions: How do you profitably invest in a falling market? How do you profit the huge correction of this immense bubble that’s popping? There are two ways…

You can short stocks. Or, you can buy “put options.”

Put options are easy to use and an effective way to execute my bubble finance trading strategy. Here are the basics.

There are two types of options: “Call options” and “put options.” Both give you the right, but not the obligation to buy or sell a stock at a certain price.

You buy a call option if you think the market is going up. A lot of people have been making a lot of money doing that during the entire expansion of this financial bubble.

You buy a put option — which I’m recommending to you — if you think the market is going to fall. That’s our thesis. The market is going to fall further, faster, soon. Put options are a safe way to take a profitable position where the facts and analysis overwhelmingly suggest that a stock or exchange traded fund (ETF) is going to fall.

I say they’re safe because you can never lose more than the money you pay for the put options. Your risk is limited. Meanwhile, if you bet correctly, you’ll earn your money back plus double or triple your original investment if the stock in question falls.

The worst case scenario is that if your timing is wrong, or the market moves in the opposite direction you’ve bet you can lose all of the money you purchased the option for.

This is the best strategy to use right now. Because the inflated market valuations of the past seven years have gotten so out of hand. With the Federal Reserve raising interest rates and signs of recession spooking investors, you can expect the selling momentum in many markets — especially those that were most inflated — to intensify.

So far, I’ve helped readers of my Bubble Finance Trader readers close out seven trade recommendations. Five of these have been winners, and the average gain for the group has been 44%.

This is not to say that bubble finance trading is automatic or guaranteed. Don’t believe anyone who tells you their strategy is foolproof. But buying put options is the ideal way to profit in this new market environment. They can make you two, three and four times your money as the most overvalued stocks and ETFs take a big fall.

This doesn’t mean I think that the stock market will go down every day — there will be up days, too — but there won’t be relief rallies like we’ve seen. Rational investors in thought will drive the market, instead of robo-traders and machines. As 2017 unfolds and the recessionary forces become manifest in our economy, the markets will go even lower.

Everything You Need to Know About Trading Options

First, let’s start with the very basics about trading options.

An option is a tradable contract that gives you the right but not the obligation to buy or sell a specific underlying financial instrument at a specific price within a set period of time.

Let’s break down that definition piece by piece.

First, a tradeable contract means that you can buy and sell it. In fact, stock options trade alongside stocks, meaning you should be able to buy them from any stockbroker. Their prices fluctuate just like stocks too, meaning you can buy one now and sell it either for a profit or loss down the road. The price you pay for an option is called the premium.

Options give you the right but not the obligation to buy or sell a specific underlying financial instrument at a specific price. In our case, the specific underlying instrument will either be a specific stock or an exchange-traded fund that covers a country, region or industry. In most cases, stock options give you the right to buy or sell exactly 100 shares of the underlying instrument. The specific price is called the strike price.

There are two types of options, calls and puts.

A call gives you the right to buy the underlying instrument at the strike price. For instance, if you buy, say, a call option on AT&T (T) with a $30 strike price, you have the right to buy 100 shares of AT&T for $30 each — no matter what the current price is.

A put gives you the right to sell the underlying instrument at the strike price. For instance, if you were to buy, say, a put option on AT&T (T) with a $25 strike price, you have the right to sell 100 shares of AT&T for $25 each — again, no matter what the price is.

You only have these rights for a set period time, known as the option’s expiration date. If you haven’t exercised your rights to the underlying stock on the day it expires, your rights disappear and the option becomes worthless. That means you stand to lose every cent you paid for an option if you’re not careful. On the other hand, that means your risk is always known and under your control.

And those risks tend to be low. You can often buy options at a fraction of the cost of the underlying stock they give rights to. And their price fluctuates alongside the price of the underlying stock. A call becomes more valuable as a stock’s price rises, and a put gains in value as a stock falls.

But since each option is worth 100 shares, their prices react sharply to changes in the stock price. A 10% change in a stock’s price could translate into a 50% price change in the option.

There’s a little more to it than that, but it should be all you need to know to get started. The bottom line is that we buy options hoping to sell them for a profit before they expire.

Now that you know what an option is, let’s discuss how to trade them.

How to Make an Options Trade

As I said, you’ll need a brokerage account to make options trade. If you don’t already have a broker, you’ll need to find one. We can’t offer any advice here; all we can do is give you the names and numbers of some of the most popular ones:

TD Ameritrade — (800) 454-9272 Fidelity — (800) 343-3548

Charles Schwab — (877) 832-4330 Scottrade — (800) 619-7283

Even if you already have a brokerage account, you may need to take some extra steps to start trading our recommendations. Many brokers require clients to apply for permission to trade options. The type of permission differs from broker to broker, but they tend to break options trading into different tiers.

To make the trades we’ll be recommending, you’ll need permission to “buy puts and calls.” (You may also see it as “trade long puts and calls.”) This is generally considered a less-risky type of trading, so you should only need to fill out a few forms to get permission. Check your broker’s website or call their customer service number for instructions on how to apply for options trading.

Once you’re approved and have funded your account, you’ll be ready to trade options.

In our sister publication, Bubble Finance Trader, we send options trades every other Thursday. I start by sharing my analysis of the current market, identifying bubbles in individual stocks, countries or industries that look like they’re ready to pop. Then our senior analyst, Dan Amoss, offers a specific options play based on my analysis.

We could target an individual stock or exchange-traded fund. An exchange-trade fund represents a share in a basket of stocks tied to certain countries, regions, industries and more. For instance, the WisdomTree Japan Hedged Equity ETF represents a basket of Japanese stocks.

Again this is just an example, but maybe we’d target its shares if David expects Japanese stocks to in ate further or pop and head lower. Or, say David predicts the price of gold will shift dramatically in response to central bank policy, we can buy the SPDR Gold Trust, an ETF designed to mimic shifts in gold’s price.

Once Dan has laid out the case for his recommendation, you’ll see his specific action to take.

For example, he could say:

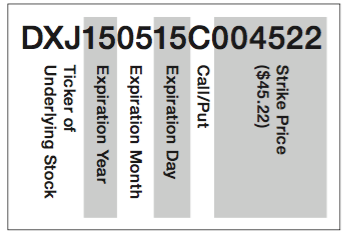

Action to take: “Buy to open” the DXJ May 2015 $45.22 call option up to $5 per contract.

Keep in mind this is just an example, not a live recommendation. But notice how everything you need to know about the option trade is in the sentence.

He also gives you the option’s formal symbol in our online portfolio. Like stocks, every option has a standardized symbol. It includes everything you need to know about the option — the underlying stock, the expiration date, the type of option and the strike price.

Be careful, though — because not all brokers use the standardized symbol. So don’t worry if your broker’s website doesn’t recognize the symbol Dan gives. In this case, look for a button on your broker’s Web page to trade options, enter the stock symbol and then look for an “option chain” or a way to manually enter the expiration and the strike price. When in doubt, call your broker to figure out where to find the option you want to buy.

Also note the words “buy to open” in the recommendation. You may see those words on your broker’s website when you enter a trade, and you’ll need to say them if you make a trade over the phone. It simply makes it clear that you wish to enter a new position.

(When you close the position, you’ll “sell to close” to make sure your broker understands you wish to exit an existing position.)

Dan’s instructions will also tell you to buy the option up to a certain price. This is the maximum you want to pay for the option — otherwise known as a limit price. When you try to buy using a limit order, your broker will not execute the trade unless the option is currently selling for a price below your buy limit.

So using the example above, if the option were trading for $5.25 when you placed a limit order at $5 per contract, your broker wouldn’t make the trade unless the option fell to $5 or below. On the other hand, if the option were trading below $5, he’d execute the order at the lower price.

This way, you’ll be sure you never pay too much for an option.

As for the number of options to buy, that is completely up to you. You could buy a single contract in each recommendation or buy multiple contracts so you can sell them to lock in profits as they gain in value.

Keep in mind that buying more options also increases your risk — and you should never spend more money than you can afford to lose.

As you receive more and more alerts, you might also wonder how much of your portfolio should be dedicated to options trading. Unfortunately, without knowing you and your situation personally, I can’t tell you what’s best for you. If these plays work out, you could make 300% or more in some cases, but if we’re wrong, you’ll lose 100% of the option premium, which may be worse than going down 20% or even 50% on a single stock.

I can tell you that it’s important to maintain some cash and liquidity at all times. And I firmly repeat that you should not to put all of your money into these plays. Consult with your broker, lawyer, accountant and tax adviser on all important financial decisions.

Once you’ve bought the option, it’s time to monitor your trade. In Bubble Finance Trader, we send portfolio updates the Thursday after an alert goes out. So subscribers get one email from us each week. Subscribers will see a new alert one Thursday, followed by an update the following Thursday. Then a new alert again the Thursday after that and so on.

Depending on the situation, we may recommend you “sell to close” your position. Again, that phrasing is important — it makes it clear to your broker that you wish to exit an options position.

We will always try to sell profitable options before their expiration date. If you’re not careful, your broker may automatically exercise profitable options on expiration day — meaning he’ll automatically buy the underlying stock for you or sell the underlying shares in your name. So Bubble Finance Trader subscribers can look for our sell alerts as expiration draws near.

This is not a concern if an option expires worthless. In fact, if an option is not performing well, we may decide to let it expire worthless — it’s often cheaper than paying commission costs to sell it.

No matter what, once you’ve sold to close an option or it expires worthless, you’re out of the trade.

How Bubble Finance Trader Works: The Big(ger) Short

David Stockman’s Bubble Finance Trader is my premium trading research service. It taps into my 40-year career at the intersection of D.C. and Wall Street to help you make big, fast gains as the Fed’s financial bubbles slowly go pop, one by one.

While most everyday Americans panic, you’ll be able to make seasoned market maneuvers like the most plugged-in investment banker. You’ll earn the investment returns of one, too. My background in accounting, government budgeting and economics has led me to this unique way of identifying which individual stocks are in a bubble — Bubble Finance Trading.

These stocks will often shoot to the moon during their bubble phase. Then, when they pop… drop like a stone. That point — right as the bubble is about to pop — is where you can make triple- and quadruple-digit gains.

We publish a new recommendation every other week. My team and I do in-depth research and make specific options recommendation on a particular bubble stock that’s set to pop.

If you remember the book and movie, The Big Short, the investors that shorted the Housing Bubble and financial sector waited and waited and waited. Then, the big bang finally come.

Today, we feel the same way. The market is hideously over-valued and we’re on the cusp or an inflection point of change in the financial markets, as well as the macroeconomy. Yet, we have no crystal ball just like everyone else. You don’t know exactly when that black swan is going to show up. I firmly believe that the coming months will be an inflection point, however.

The reason I emphasize this is because our Bubble Finance Trading strategy relies on recommending long-term put options — we’re betting against the market and giving ourselves a lot of time to be right.

Think of this service as “The Big(ger) Short.” In The Big Short, the men that were profiled have used the turmoil of 2008 to make handsome returns.

When the housing market collapsed in 2007, for example…

>> James Mai and Charlie Ledley took $110,000 and turned it into $120 million with well placed bets…

>> Michael Burry made $100 million for himself betting against mortgage backed securities….

>> And Steven Eisman and his FrontPoint Partners made hundreds of millions shorting risky collateralized debt obligations…

I believe these types of returns are possible during the next crash that’s coming, too.

Normally, our recommendations have been a year or longer in terms of the maturity or the expiration point. That means like the guys in the movie, in The Big Short, you can be waiting for weeks and months and quarters and even longer for the investment thesis to pay off. That is just another part of why we think this is a safe strategy.

Now, it is very possible that from time to time, we could be early particularly when we believe a bubble stock is way overvalued and is going to correct. Some of these options could expire with very little return or any return at all. On the other hand, options do have leverage, as we say.

Given the directional call here and the possibility of 100% or 300% or even 700% annualized gains more than outweighs the risk that occasionally will be early in an option even though it has a year or more to run could expire early. I think that’s an important element of the strategy. We’re trying to buy time for the investment theory and strategy to materialize.

Call Our Team at 866-361-7662 for More Information

I hope that after reading this primer, you feel confident in our ability to analyze this major inflection point in financial markets.

Now, you have two choices…

You can ignore the warnings we’ve made. You can stick your head in the sand or choose to believe that the mother of all financial bubbles will not — cannot — pop as soon as next month. In which case, we wish you all the luck in the world…

Or, you can become a Bubble Finance Trader. You can embrace the thesis and the strategy we outlined in this primer… and start acting on the actionable recommendations and regular guidance we provide our readers.

We’ve done the hard part for you. We’ve put these ideas into simple language. We’ve “opened the kimono” to let you see what it is we have to offer you… and how we operate.

I trust you’ll make the prudent choice and join our ranks. Call my team at 866-361-7662 as soon as possible for more information on how to put this to work.

How Stockman’s Bubble Finance Trader Ties Into Contra Corner

What’s the connection between Contra Corner and Bubble Finance Trader?

Simple, Stockman’s Contra Corner is a daily commentary and data service. It gives you actionable modules which you can find in our reports section on our website… as well as a basic Contrarian Portfolio recommendation. But it’s true function is helping you understand what’s happening around you.

We will have our daily report called Adler’s Data Dive which is a skeptical contrarian view of what the mainstream financial media tells you when they report the headline number for say, retail sales or the monthly jobs report or the GDP number or any of the rest of the so-called incoming data.

We think you have to look at historical context to understand the world around you and make good decisions with your money.

You have to look through the manipulations and seasonal adjustments and revisions that constantly occur in all these government data. My colleague, Lee Adler will be posting very insightful analysis as many viewers may have noticed in our publication already on a daily basis in this column, we’re going to call the Daily Data Dive.

We also continue to curate and post other salient or timely or insightful articles written by other analysts who from other publications that we think amplify or clarify the viewpoint that we’re conveying.

Yet, while we have a portfolio, it’s not something to be fine-tuned and adjusted everyday like the Fast Money Traders do on Wall Street, but one that will be consistent in terms of a weight of gold and short position on the stock market and other overvalued sectors that we think will generate very solid returns as we go into the “Big(ger) Short” of this 21st century, so far.

That’s where Bubble Finance Trader comes in. Bubble Finance Trader is an in-depth research service that analyzes specific companies that are high conviction shorts using our Bubble Finance Trading Strategy.

As I’ve explained, that strategy has time and patience and helps you position yourself for the big breaks in the market. I firmly believe that you’ll find it most helpful and supportive if you’re both a Contra Corner reader and our premium level research service, Bubble Finance Trader.

For full pricing information and a special deal, please call my team at 866-361-7662. Tell them that you’re a Contra Corner subscriber and David told you to call.

Regards,

David Stockman

with Dan Amoss, CFA

P.S. I hope that after reading this primer, you feel confident in our ability to analyze this major inflection point in financial markets.

Now, you have two choices…

You can ignore the warnings we’ve made. You can stick your head in the sand or choose to believe that the mother of all financial bubbles will not — cannot — pop as soon as next month. In which case, we wish you all the luck in the world…

Or, you can become a Bubble Finance Trader. You can embrace the thesis and the strategy we outlined in this primer… and start acting on the actionable recommendations and regular guidance we provide our readers.

We’ve done the hard part for you. We’ve put these ideas into simple language. We’ve “opened the kimono” to let you see what it is we have to offer you… and how we operate.

I trust you’ll make the prudent choice and join our ranks. Call my team at 866-361-7662 as soon as possible for more information on how to put this to work.