For decades the slander against Herbert Hoover went unchallenged. He was branded a “do nothing” in the 1932 campaign, a charge which looks sillier the more time passes. The proper slander of Hoover is that he was Roosevelt before FDR was, only in miniature. From this view we can appreciate the intentional change in perspective; Hoover’s interventions failed to stop the depression while FDR’s larger versions failed on the recovery.

It was Hoover not Roosevelt who carried out the first wide-scale fiscal tactics that are commonly associated with Keynesianism. His Reconstruction Finance Corporation in 1932 gave us the phrase “pump priming” (then it was called priming the pump) that John Maynard Keynes so thoroughly embraced. The mission of the RFC was to make funds available for industry to supplement what was already being done in the realm of public works (shovel ready with actual shovels).

The difference from one administration to the next was not the method but the size. In June 1934, Dr. Keynes advised the Roosevelt administration that it needed to finance $400 million per month in order to restore full economic capacity. Ever receptive to the idea of always more, the FDR government still fell far short of that. Keynes, always confidently brooding, told economist Alvin H. Hansen that, “I don’t think your President Roosevelt knows anything about economics.”

If that didn’t birth the idea of always more in these kinds of “pump priming” activities, it was very near to it. Fiscal and monetary stimulus thus never fail, they are just never enough. E. Cary Brown, the head of the Economics Department at MIT during the time when almost all of today’s policymakers, it seemed, flowed through the Massachusetts institution, claimed that fiscal policy:

…seems to have been an unsuccessful recovery device in the thirties – not because it did not work, but because it was not tried.

From that perspective the operative theory of all orthodox practice is that stimulus isn’t really stimulus unless it works. Heaven help us; it is exactly like Communism in that it fails everywhere but its proponents vehemently deny the observations on the grounds it was never the “true” version that actually blew up.

That has been the fallback position in the mainstream over the past few years. As QE after QE comes undone by grim economic reality, we are told that it wasn’t proper QE or proper Keynes. I wrote in October 2014 back at the start of this rehash, the “rising dollar” has had these kinds of effects, the called-for resurrection of Keynes would be a surprise to almost everyone.

That seems to be a critique of all fiscal and monetary “stimulus” undertaken in the past seven years, and it is. But that setup is as my setup, mainly that the good doctor needed now, according to Peter Coy at Bloomberg, is Keynes. That would come as a major shock to almost everyone outside of the ideology as they might rightly ask whose theories have policymakers and authorities been following all this time?

Coy’s response is that it may be Keynes to some degree but not pure enough to be potent. Potency is really the problem, given that we see the “purer” doses of modern Keynesian to be poisonous, and thus their full measure might just well be fatal. As I have said far too many times to count, every single DSGE model used by central banks right now, including BoJ’s destructive influence, is Keynesian. The policies that are derived from those models may not be exact translations from The General Theory of Employment, Interest and Money but they are perfectly consistent with how Keynes saw the economy and really the world.

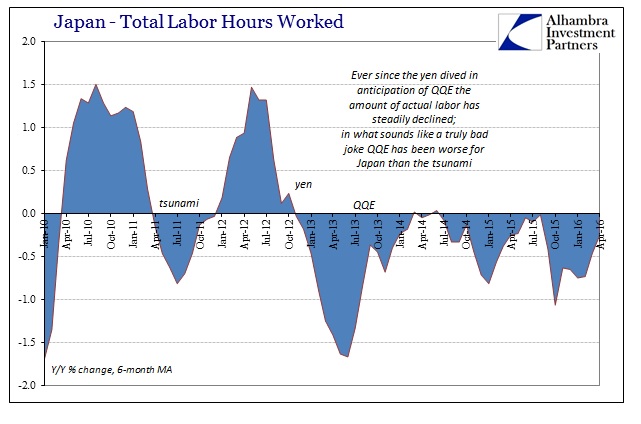

While Europe and even the US contemplate only more of the same, it is Japan, always Japan, where it seems to get the “next” step of interventionist poison first. The Japanese government announced last November that it would raise the minimum wage by at least 3% every year, and that it would further study ways in which to prod Japanese businesses to also do that much.

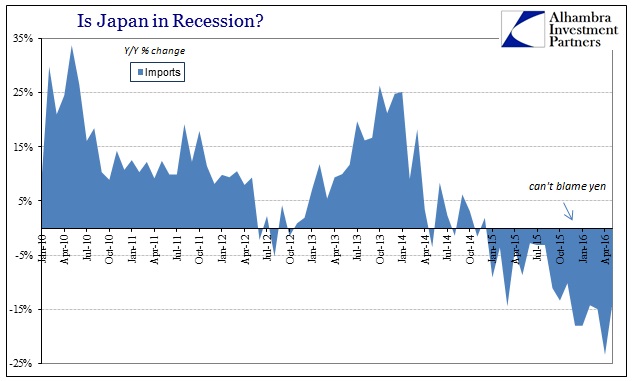

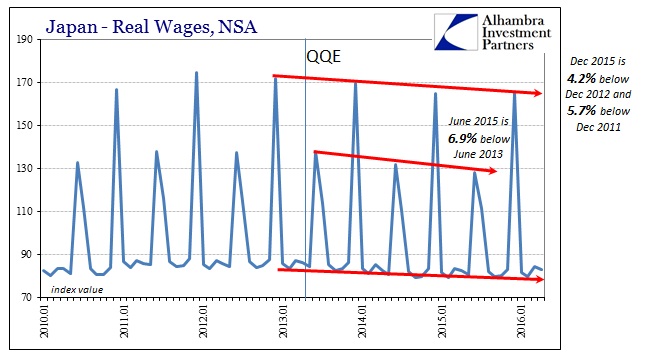

Having originally worried that QQE would fail because, as the IMF wrote in October 2013, “Monetary policy alone cannot counter a potentially rising fiscal risk premium under current policies”, the institution now presumes that the problem was never government but “pump priming.” In its latest report on Japan, released yesterday, the IMF congratulates Abenomics for “initial success” before launching into all the ways that meant very little. The pump was primed but never fully released. Wages are the most pressing issue, especially since QQE and the tax hike removed so much of household income.

To counter this lack of success no matter how originally primed, the IMF is calling for statutory redress; the government setting not just minimum wages but now minimum wage gains.

The government can introduce a “comply or explain” mechanism for profitable companies to ensure that they raise base wages by at least three percent (the inflation target plus average productivity growth) and back this up by stronger tax incentives or—as a last resort— penalties, given that the latter would be contractionary if they failed to trigger higher wages.

It was Keynes and Hansen that first laid the fork in the road, but by never being held to full accountability their descendants have left the realm of economics entirely. The answer to increasing control and centralization is always more control and centralization because the “proper” amount of control and centralization is always more than what it was; even when those advocating control and centralization fail to specify the correct amount ahead of time. In that condition, which is always, the answer is that the “correct” level of socialized dictation is never enough. It is an infinite loop devoid of any self-correction because its advocates are the only beneficiaries of it. If the economy does not wish to obey on its own, it will now be literally commanded.

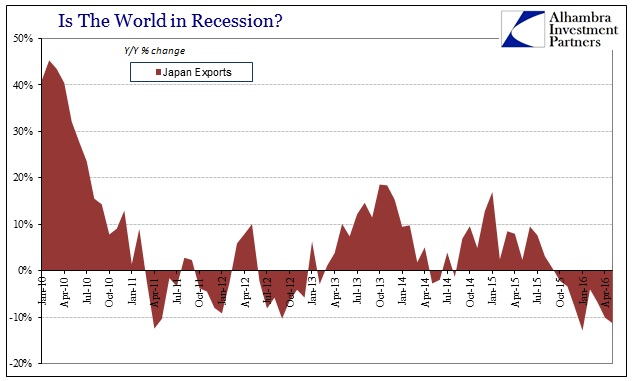

The Japanese experiment has utterly failed, and it only gets worse. That is why the IMF is framing this critique around “initial success.” In other words, it didn’t really fail, they claim, just as the economy in the 1930’s didn’t fail, it just didn’t succeed for “other” reasons; always other reasons.

Japan is not just a disaster but a blueprint to what happens under the stalemate of political economics. They will not stop themselves. It does not matter that Japanese workers have less to do now than before, they must be given a raise as if that were consistent with true economics. The proper accounting would at least ask the question as to why QQE didn’t create value and wealth such that Japanese workers would be far busier now than before it, where wage rates in both nominal and real terms wouldn’t have to be commanded. That was the stated end result all the way at the beginning.

There is no such thing as pump priming; there never was. Even Alvin Hansen came to realize that an economy runs on profit, not command or even activity for the sake of activity. It was Hansen who gave us the term “secular stagnation” as he saw too much reliance on the artificial, including interest rates.

I venture to assert that the role of the rate of interest as a determinant of investment has occupied a place larger than it deserves in our thinking. If this be granted, we are forced to regard the factors which underlie economic progress as the dominant determinants of investment and employment.

In other words, you can’t really fake a recovery. The more you try, the less you get; business profit expectations get more and more clouded especially by the never “right” amount of “stimulus.” The results are every bit as predictable except to economists and their dutiful media that still reports “stimulus” as if it ever was that.

The real minimum wage is always zero, meaning that the true minimum wage gain is quite negative. If raising the minimum wage leads to more at zero, then we needn’t guess what statutory command of the minimum wage gain might lead to. Whatever it ultimately is, it is not an economy.