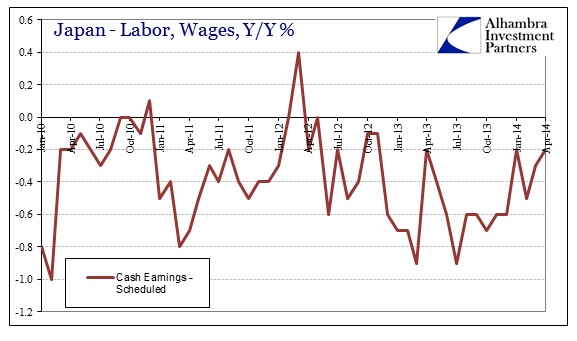

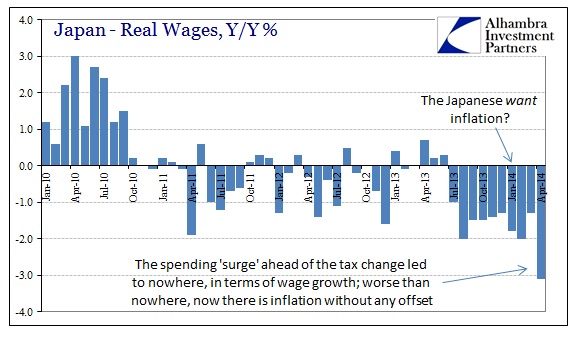

There is very little that needs to be said about the April estimates for Japanese wages. The prolonged agony was extended yet again despite the purported “surge” in the Japanese economy. What the latest figures show is exactly what I suspected when the spending data first came out – that the Japanese are so pessimistic about their wage situation they felt compelled to overcompensate for the tax variation wholly out of savings. That is indicative of growing poverty, not growth.

The clear jump in spending ahead of the tax change translated into exactly nothing as far as organic economic expansion. While Japan Inc paid some bonuses in April, actual hours worked contracted once more, meaning that all of this process of intrusion was simply one elongated dislocation (looking more like 1997 in the process).

Where there may have been a bump in activity at the end of 2013, it has fully dissipated now that the dislocation has passed. From that we are supposed to believe that a new growth trend emerges?

The primary problem is that there is no neutrality from the dislocation, both in the fiscal, tax sense and the heavy monetarism. Abenomics actually wants inflation under “pump priming” theory, and so they are getting it without any offset leaving Japan worse off for having undertaken such disorderly and confused experimentation.

You can forgive and understand, only somewhat, the very basic and naïve idea of inflation as a “solution” here given the past twenty-five years. If you think “deflation” is the problem, changing to “inflation” sounds like the answer. But that lack of distinction misses exactly the diagnosis since the “deflation” that is rampant in Japan is nothing more than the other side of the “inflation” coin – both are symptoms of monetary instability.

Deflation is actually two separate factors that orthodox theory puts together into one incompatible conception. Monetary deflation is wholly different from productive deflation, coming from innovation and economies of scale, actual capitalism, with the former derived instead from unstable finance. Years (decades) of currency intervention and trade protection have limited the course of the monetary system to zombification and now total addiction to central banking. That is not stability any more than inflation is.

Flipping the coin from one form to the other is simply changing the manner of dysfunction and decay. The net result may be slightly different in only one respect, the sign of the numbers that economic accounts measure. GDP may be positive now, as with inflation estimates, but that doesn’t create a true recovery or real economy.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com