I often write about the rise and fall of the eurodollar standard in very abstract terms, largely because most of what occurs there is hidden, opaque and/or terribly abstract. The difficulty is in trying to define and describe “money” under just such a pliable system, a task not easily solved by current conventions. For instance, it was the trend in the middle of the 1990’s which fused finance and money together, making them inseparable so that what mattered about asset bubbles and credit production was not cash and certainly not Federal Reserve notes nor the ledger “reserve account” at the Fed. Instead, liquidity and even money itself was transformed into a multi-dimensional mélange of bank balance sheet factors, all of which conspire to make traded liabilities the basis for modern “money.”

In other words, this is how the dollar became the “dollar.” And we can actually observe that transformation if only in discrete, whittled down pieces exposed individually within the context of the overall paradigm. I have used the Swiss banking system and their massive allocation to “dollars” especially in money dealing activities as just one such glimpse into the foreign extract of the eurodollar system. And while the eurodollar system was and remains highly foreign in nature (on multiple levels) the domestic transformation was no less significant and useful to understanding where we are now; and might “have” to go next.

I am going to use just two “banks” as anecdotes that almost perfectly describe eurodollar building and then decaying. I picked these two for specific reasons but it could have been any of their peers as the process is immediately recognizable in every “bank.” I use the scare quote on the word bank in the same manner as I use it on “dollar”, as what these institutions are now is not what a bank used to be or what is commonly understood of one. The wholesale system makes banks into, really, hedge funds and once your understanding penetrates that barrier the more everything falls into place (and the less what central banks have done makes sense).

When LTCM failed in September 1998 (always two weeks before the end of a quarter), the process was instructive in not just how it came about but in that LTCM as a hedge fund was perhaps the first of the giant modern “banks”, as all the rest of Wall Street rather than recoiling from the vast dangers of wholesale and math combining money into finance instead wholeheartedly embraced this brave new world and all its unrecognizable distortions:

Collateral, in other words, wasn’t collateral as Greenspan understood it from his days as a banker. Rather, collateral was actually currency; and in a dynamic arrangement as wholesale finance was even then, it was a highly fluid currency. Worse, from the Fed’s perspective, though they did not know it and would not for almost two more decades, the functions of money-like behavior extended especially into the derivative book which was what Wall Street was really scared about. If LTCM had to liquidate, the hedges LTCM was counterparty on (the private balance sheet risk absorption that LTCM was offering as a counterparty) would disrupt bank trades far and wide – globally – just as we saw starting in August 2007. What that meant in practical terms was that any bank would have to re-mark everything from VaR to hedge prices to then re-adjust “capital” charges that much lower in a single stroke. In short, systemic leverage would have to contract and nobody had any idea how that was even possible or where it would all lead (the results in 2008 suggest they were both right to worry and stupendously wrong about why and what to do).

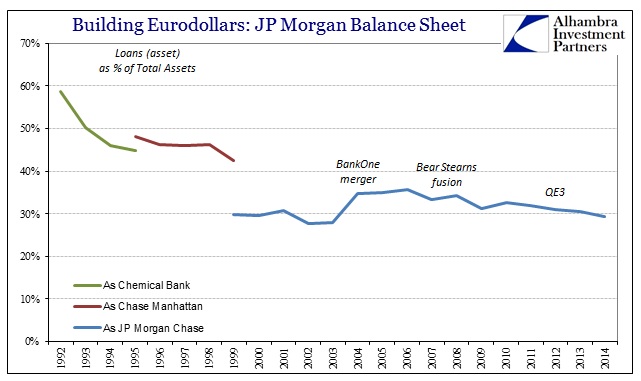

It was JP Morgan that pioneered this VaR means to reinvent “capital”, so it makes sense to use that “bank” as the first to be identified with wholesale finance. What is revealing about doing so is that the antecedent banks that came to be the basis for JP Morgan as it is now, Chemical Bank and Chase Manhattan, were traditional banks with some minor exposure toward wholesale finance in the 1990’s. But as each of the pieces was put together finally with JP Morgan itself, you can plainly see how traditional banking became the basis, and far too easily absorbed, for this eurodollar-type transformation.

That was true of all the parts that were engaged thereafter, including the large merger with BankOne in 2004. I think that fact was itself supremely important, in that it was, in the end, the wholesale part of the conglomerate that swallowed up the traditional banking functions in the years after Gramm-Leach-Bliley; that was no accident. It was the “banks” that were set without limitation on the eurodollar buildup phase and the traditional limitations of banks made them inevitable “prey”, unable to compete with such an unequal footing (which was, again, the whole point to begin with).

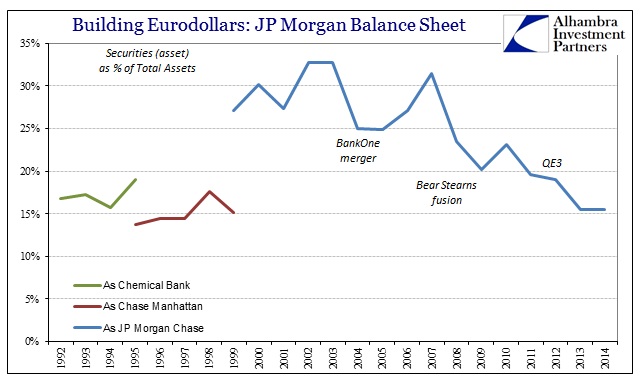

In the early 1990’s, such banks were institutions that made loans, but JP Morgan became what other wholesale hedge funds were and it was not loans that were driving the primary growth on the asset side. Even after the BankOne merger, total lending never got more than 36% of the total asset base. Instead, wholesale banks were all about securities.

It is important to note that when JP Morgan took over BankOne, the level of securities fell as the combined portfolio contained then more loans from the BankOne’s more traditional operation – but not for long. By 2006 and especially 2007, the combined “bank” was right back at marginal growth through securities, which means that throughout this historical view it was the traditional banks that were being converted into the wholesale format; at least until 2008.

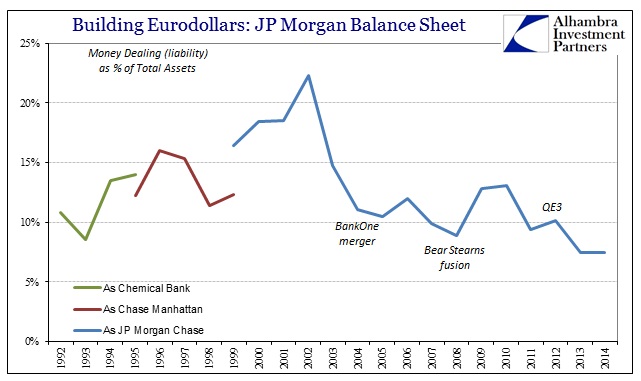

Along with a securities-based portfolio, the wholesale bank engaged in greater “money dealing” activities that form the foundation of wholesale eurodollar existence. These were transactions such as federal funds, repos and securities lending (borrowing) that surged throughout the mid-2000’s partly because of Greenspan’s repression but also because it was a direct offshoot of the traded-liability format (where “hedging” for warehouse and dealer activities, for example, flowed into proprietary trading and lucrative gain-on-sale accounting).

What is of particular interest above, presenting both sides of the ledger, is how money dealing (defined on the liability sides as federal funds purchased and repos) on the liability side dropped once BankOne was added, while money dealing on the asset side (defined as just federal funds sold) continued to rise. That meant that JP Morgan was using the deposit liability funding from its traditional bank parts to finance its continued transformation into a “bank.”

The other “bank” I want to highlight is Goldman Sachs. In an almost opposite manner, though still complimentary in how that fits within the eurodollar intrusion, Goldman started as almost purely a money dealer – after all, the firm was a securities broker at root much farther back than 1999 when the firm went public (and first filed publicly available balance sheet information). In other words, Goldman’s position as a broker allowed it to harness the growth of wholesale and position the firm for the eurodollar penetration post-1995.

While Goldman was still heavily involved with securities lending/borrowing and the various pieces of wholesale money dealing, the “bank” also started buying up and holding securities in tremendous volume. In other words, what was largely a broker focused on brokerage activities more generally became an enormous securities portfolio funded exclusively via wholesale – an increasingly focused hedge fund. The scale of the growth was as you would expect of the latter portion, the mania, of the housing bubble age.

In other words, Goldman Sach’s ultimate trajectory in the past sixteen years is as the eurodollar standard itself – starting from a small base but steady and high growth and then insanity after Greenspan and his ultra-low interest rate control boosted all sorts of balance sheet calculations, including VaR (through artificial perceptions of low or no “tail risks”). After the panic, the eurodollar standard struggles to be rebuilt even though Goldman’s profits do not. That gives us great indication as to why global banks aren’t interested in money dealing and central eurodollar activities post-crisis – more profit on less balance sheet.

The scale we are observing here is in many ways almost incomprehensible. In 1998, the firm has only about $70 billion in its securities portfolio; less than ten years later, at the apex in 2007, there were $452 billion. In terms of money dealing on both sides, growth was of similarly impressive magnitudes. In other words, Greenpan’s “conundrum” was no such thing at all, as it is easily quantified within the bowels of the dominant “bank” structure of that time.

Where did the housing bubble come from, including its origins dating as far back as 1995? Wholesale finance along the eurodollar framework. But in many respects this view, while important, is both incomplete and perhaps even secondary. The true nature of wholesale “money” isn’t quite revealed by what is or was on the balance sheet. To get a sense of a more comprehensive eurodollar/wholesale feel, I’ll go back to JP Morgan in Part 2.