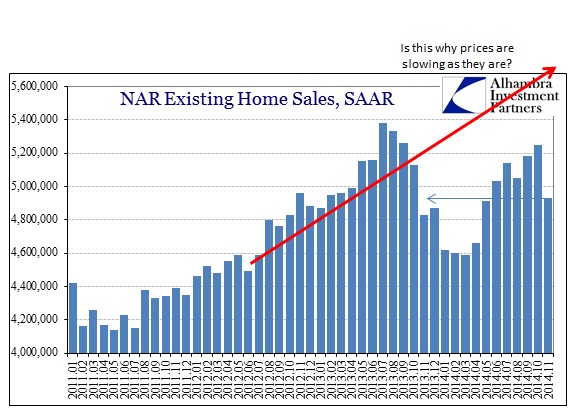

Adding to the disfavor in real estate and housing, the National Association of Realtor’s projection for existing home sales (resales) in November was just as ugly (if not more so) as home construction estimates. Resales were down a rather steep 6.5% from October (SAAR’s), and were up only 2.1% compared to November 2013. I say “only” because the calendar has wound into what should have been very favorable comparisons as the prior year period is well into last year’s epic decline. For November 2014 to be essentially flat with November 2013 is not a good sign.

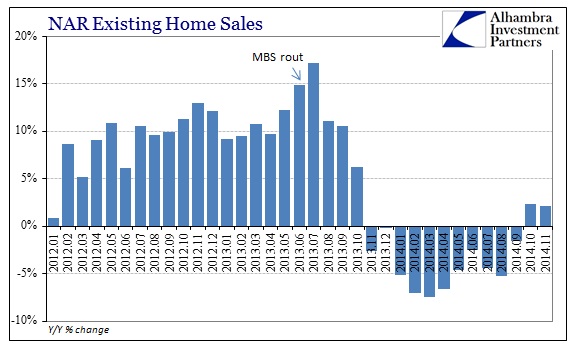

Had resales merely matched October, the Y/Y growth rate would have been just less than 9%, which was the average growth rate during the mini-bubble period. Perhaps this is a one-month aberration, but I am more than a little skeptical in that the “rebound” from last winter had clearly lost some momentum over the summer. If that wasn’t perfectly clear in the pace of existing home sales, then it was surely showing in the downswing trajectory of home price appreciation.

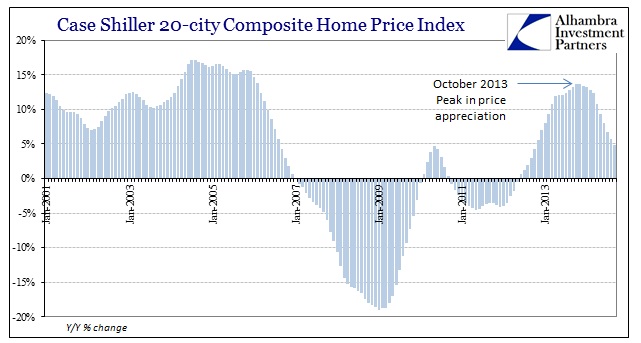

While the latest figures from S&P/Case-Shiller are for September, there is no mistaking the inflection points in prices – October 2013 was the highest Y/Y pace of price acceleration. That month is prominent not for the government “shutdown” that occurred then, forming the basis of no end to ridiculous excuses about what was transpiring in housing, but because it was the very tail end of the pre-taper mortgage pipeline. After October 2013, the MBS market went into a coma. Despite constant optimism in commentary this year, it still has not emerged.

The problem for the real estate market in 2014 is that the mortgage market is not making its return to the pre-taper state. While mortgage flow has been proportionally driven by refis in this “cycle”, the skim off of purchase activity has been rather severe in its own right.

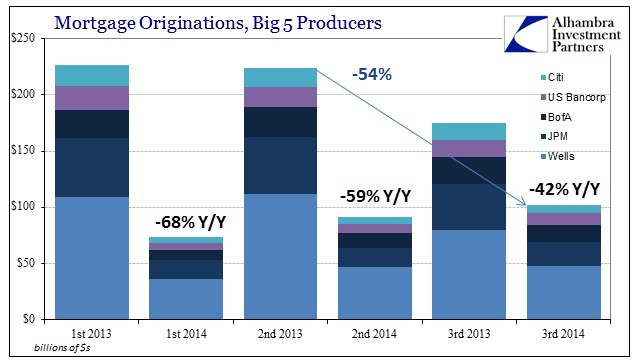

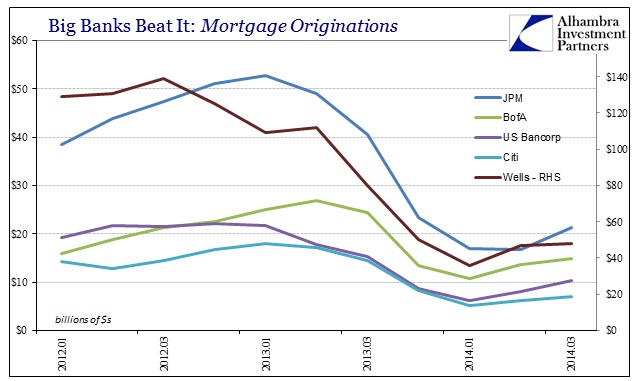

The narrative about the Big 5 mortgage origination firms, listed on the chart above, is that they have re-entered the mortgage market and thus provide lift for the idea that housing is back on its prior upswing. It is certainly true that volume is much better in Q3 2014 than Q1 2014, but that isn’t the relevant standard or comparison. Originations at the Big 5 banks are up 35% in Q3 vs. Q1, but that only shows how bad Q1 actually sunk. Compared with Q2 2013, volume is still less than half even after this “robust rebound.”

Most of the decline in volume is attributable to the top two banks, JP Morgan and Wells Fargo. Neither of those firms have increased capacity this year despite the “narrative.”

That doesn’t seem like a random occurrence, particularly as it relates to dealer capacity betrayal and interbank systems function. In other words, it was the biggest banks that were most badly burned in the taper selloff of mid-2013; and have yet to return. That affects not just the mortgage market but also intersystem liquidity for credit and funding, meaning that there is a supply problem in mortgage finance as these large firms are not dedicating resources to MBS or even originations (it goes without saying about how that created a vacuum in liquidity).

But the problems with mortgages include a decided lack of demand as well. Regardless of capacity for lending, which the GSE’s “decision” to loosen standards may be addressing a problem that doesn’t actually exist, the coincident movements in mortgage interest rates more than suggests that there is little appetite for real estate-related borrowing in 2014.

Conventional rates have been declining steadily with the flattening UST curve, and now sit well-inside the same rate range which produced nearly twice the mortgage volume in 2011 and 2012. It is a significant change in the basic element of mortgage finance that is being totally ignored. For “some” reason, people are reticent to borrow even though mortgage rates have fallen back well below 4% yet again.

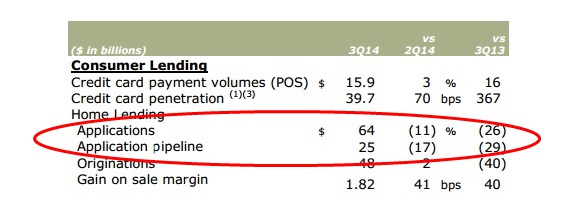

While it is possible that demand will rise in the future as volume may lag interest rate dynamics, recent bank earnings reports show pipeline volume is not at all indicative of that interpretation. Wells Fargo’s pipeline heading into its fourth quarter is down significantly already despite this drop in interest rates.

Taken together with construction data, it’s as if most people in the US are quite pessimistic not just about borrowing in terms of mortgages in real estate, but in their own personal situation. Nobody, at the margins, seems to want to take out a mortgage or move out and into a new home. None of this conforms to the idea of the best economic climate in decades.