Perhaps the BEA should have moved the GDP release up a few days to allow mainstream commentary its unbridled and unstained euphoria. Almost as soon as the GDP revisions were released, the upward appearance of economic growth was seriously undermined by income results and the nature of spending “gains.” That was soon followed by a rather dire look into business investment through capital goods. And the pre-holiday data dump took one more leg out of the fun with new home sales that continued the trend of the growing and prior real estate funk.

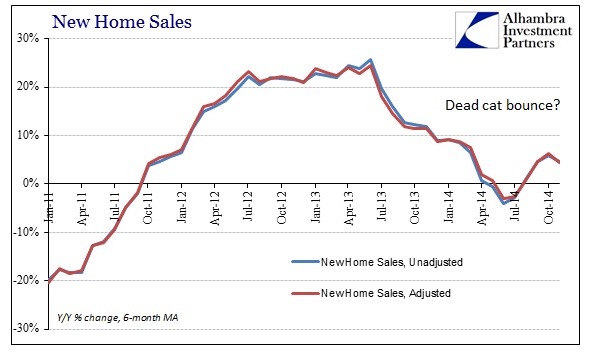

The decline in existing home sales released yesterday was matched by not just tepid new home sales in November but revisions that continue all in the “wrong” direction.

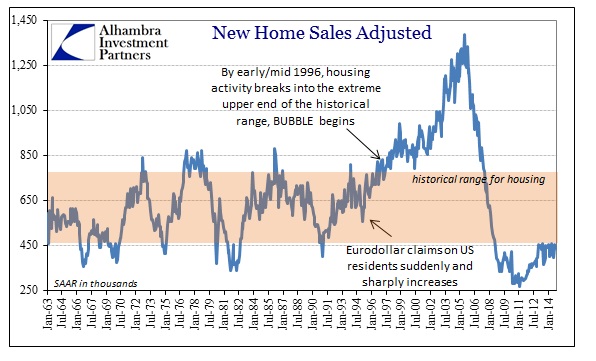

The total seasonally-adjusted annual rate (SAAR) of sales in November was just 438k, continuing the rather noticeable slightly sinking rate going back to the early part of 2013. The fact that new home sales have not appreciably gained since then goes a very long way toward explaining why builders continue to avoid building. It’s not as if the current pace is difficult to best, as new home sales, as construction, remains stuck at a level historically reserved for massive complications.

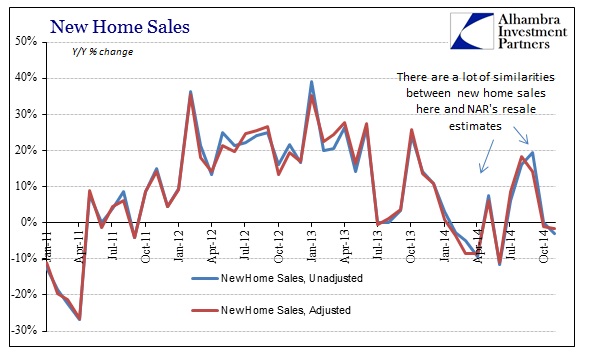

Again, the trajectory of new home sales is very much confirming of the NAR’s estimates for resales. And that is the problem, as this is supposed to be the best economy in decades so there really should be a sustainable advance in housing – certainly in new home construction and sales which are still so highly depressed.

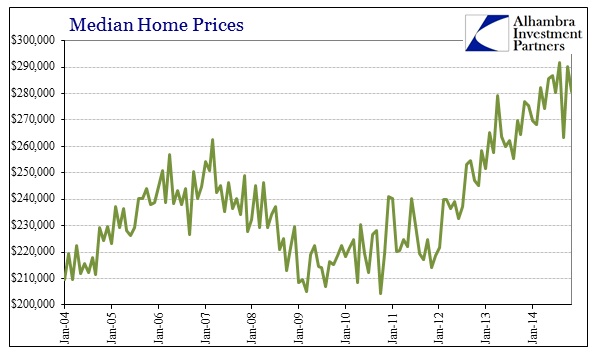

As with so many other factors, it really is just as simple as the lack of income growth. With prices having been pushed, artificially, so high, incomes just cannot keep up regardless of mortgage standards (which aren’t really as tight as they are projected to be; and are about to get even looser yet again). That would certainly, as I noted yesterday, offer a compelling explanation as to why mortgage demand continues to languish despite a nearly yearlong, significant decline in mortgage rates.

There is nothing that adds up here to anything like what GDP is reporting. The inferences from 5% GDP growth are not showing up downstream where they should. If anything, these latest economic accounts are suggesting, or continue to suggest, contrary interpretations. In my analysis, economic advance is all about income not just as a basis for spending but as a proxy for true wealth. If incomes were rising, producing an actual broad and sustainable advance, these concurrent accounts would confirm it.

I think that is why the revisions to the Personal Savings Rate are so important, especially in the context of increasing healthcare “spending.” If a significant proportion of households at the margins cannot fund even these increases then it would make sense that they are unlikely to take a significant risk in buying or building a new house. That is especially true of those that “should” be driving household formation, younger people that are probably most exposed to health insurance mandates. Again, a lack of income is at the bottom of all of this regardless of how the Establishment Survey projects for expectations. Clearly, the constant noise of robust commentary isn’t enough. Temporary statistical euphoria is not the same as the free flow of income else home construction would be easily besting these pathetic levels.