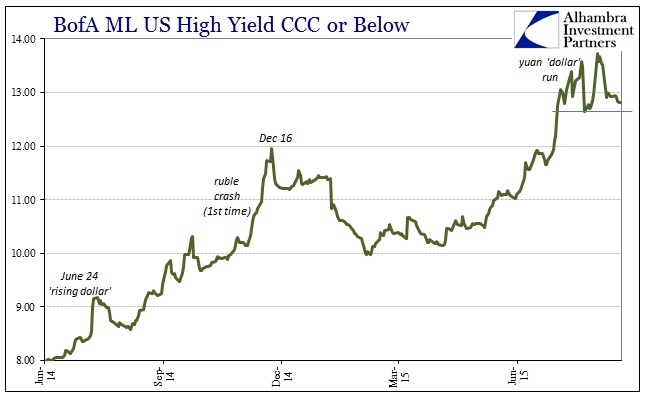

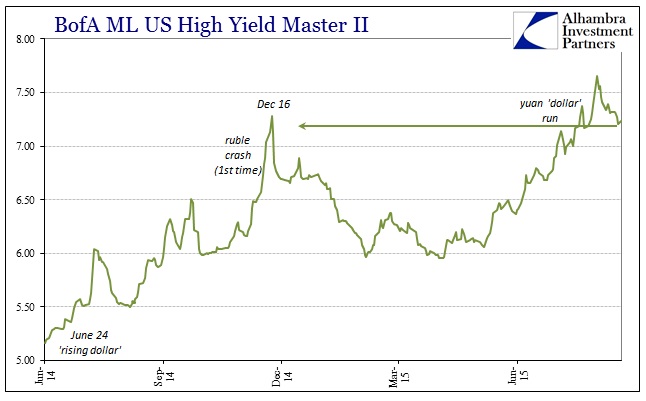

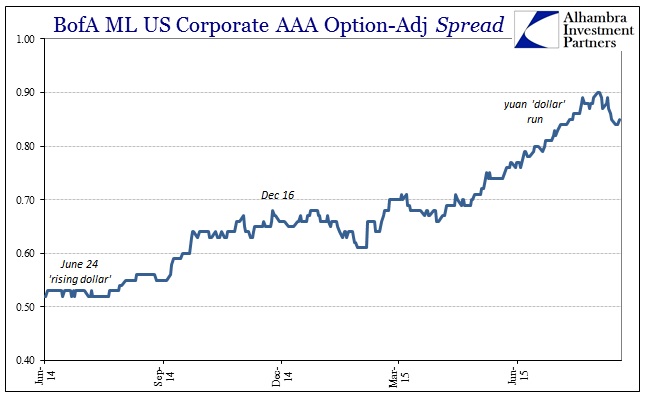

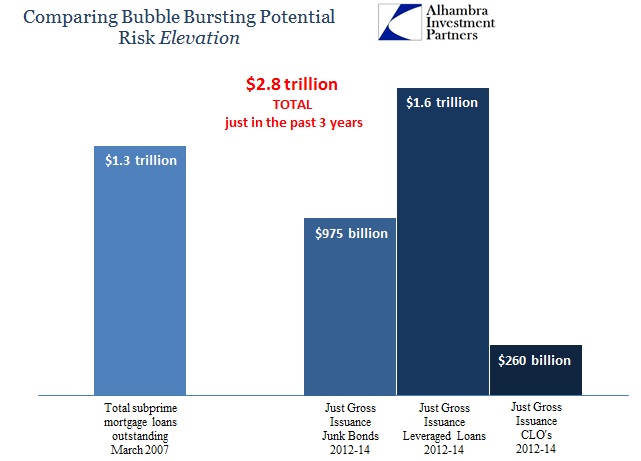

The new week opens much the same as last week traded, with narrow ranges abounding in risky asset prices. From leveraged loans to junk debt, funding markets continue to run the correlations. From this “dollar” view, the lack of “buying” interest in the corporate bubble, bargain value or not, may more properly be understood as lack of “funding” interest. On that point, as noted earlier today, banks are the only aspect to really consider as both the near-term acceleration and long-term decaying structure.

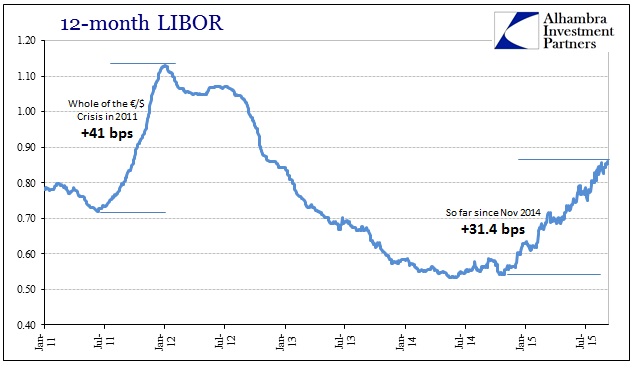

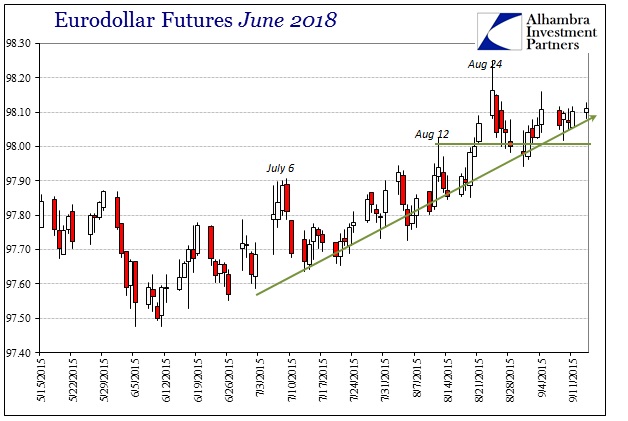

From unsecured eurodollars (LIBOR) to eurodollar futures, the funding market structure remains unkind toward assuming risk again. There is an uncomfortable closeness to the worst parts around August 24 that more than suggests an almost uniform aversion; data and events since then haven’t exactly been reassuring (and not just China), so there is, for once, some sanity and sense here (another indication of how much the cycle has turned already).

While 12-month LIBOR has been the been the primary mover since December, it is really 3-month LIBOR that I think is perhaps the focal point or central axis of (il)liquidity. Friday’s read of 33.72 bps is the highest since October 2012 just before the first MBS trades on QE3 settled. In eurodollars, the curve inside of 2020 remains largely the same as its flatness of August 24. Given that the outer maturities have steepened that portion, it is significant that the “money part” of the curve (where about $10 trillion in open interest is traded and held) refuses to budge no matter the do’s and don’ts of this week’s FOMC melodrama.

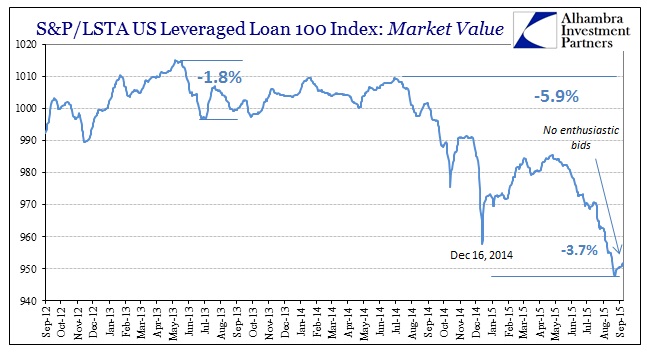

The funding view seems quite proportional to the corporate bubble pricing regime. On the S&P/LSTA Leveraged Loan 100, the market value index remains barely above 950, not really much different than the August 26 low of 947.85. The rest of the junk bond pricing views are similarly depressed to differing degrees.

As mentioned last week, the primary problem here is time. August 24 was three weeks ago and it is increasingly clear that nothing was settled by the liquidations and disruptions. That possibility threatens to turn what might have been temporary adjustments in not just risky positions themselves but open and easily offered leverage into a more permanent and structural shift.

Obviously, that has been the case going back to last year’s “dollar” turn and even to the high point in the junk credit cycle in May 2013. But as each of these individual “events” fail to find a durable point of stability (like even a potential bottom) and the downside momentum only accelerates with each, the risk systemically becomes more about the size of the exits than whether they would actually become necessary. The fact that outward liquidity and prices seem so very linked in the aftermath suggests we may have already arrived at that point and that institutional positions remain far more than wary of it.

The real downside is where those two points intersect; funding contracts further, narrowing the exits, while the volume of those reaching for them at the same time increases exponentially into a self-reinforcing spiral. It is very much like two massive armies having already been mobilized staring directly at each other awaiting only a small spark to set “it” off.