It may come as a surprise to some, but that is exactly the sentiment that central banks have been expressing for years; decades even. The economists at the Federal Reserve, ECB, BoE, BoJ and elsewhere see themselves as scientists, the equivalent of nuclear engineers sitting inside the control room of a nuclear reactor. They have gauges and math telling them exactly what inputs to make to control (not influence) output.

But the economy is not the physical world where you can tell with precision the probability of the angular momentum of the W boson at a given state. You simply cannot say that the probability of federal funds rate hitting zero and staying there for eight consecutive quarters is so much less than trivial as to be impossible (as the Fed did in early 2008). There are measurement problems to begin with in economics that only increase the difficulty of adapting, at best, incomplete theories.

Reuters tells us that the former Chair of the Federal Reserve, Ben Bernanke, speaking out of the country in the UAE, makes somewhat of an admission of omission regarding 2008 – that there existed too much “overconfidence.” The timing of that “admission” is priceless (pun intended) given the recent release of the 2008 transcripts that leave no doubt about that. Bernanke was pretty much forced to state the obvious.

But beneath that simple explanation lays the deeper trouble that remains unresolved, as we get QE after QE. It is very illuminating in how the former Chairman sets up the inequity he believes was at play:

That was actually very hard for me to get adjusted to that situation where your words have such effect. I came from the academic background and I was used to making hypothetical examples and … I learned I can’t do that because the markets do not understand hypotheticals.

In other words, he is too smart for the markets since his complex theories are not easily understood by the simpletons that exist far beneath his awe-inspiring intellect. You cannot wipe away the hypotheticals that “subprime is contained” and “the worst is behind us” so easily, unless you really believe that markets are too stupid to follow orders. Again, this is not a unique expression of central bank frustration. The Bank of Japan repeatedly denounces the “stupid” market for not conforming to its genius. The trouble is markets, not central planning; a sentiment very emblematic of Janet Yellen’s ascension.

This is a timeless expression from the economic elite, embedded in the very fabric and foundation of the Federal Reserve (and all modern central banks that now openly practice central planning). Senator Robert Owen, one of the primary founders of the Federal Reserve, remarked more than a century ago that a central bank was needed to keep the common rubes from destroying themselves:

It is the duty of the United States to protect the commercial life of its citizens against this senseless, unreasoning, destructive fear that seizes the depositor when he has been sufficiently hypnotized by the metropolitan press with its indiscreet suggestions.

If common folk were not so dumb, and could actually understand complex hypotheticals, utopian magic would be ubiquitous. You can practically here it in the common refrain of the gold standard in the 1930’s – if central banks had not been tied to this relic, it might only have been just a bad recession. In other words, gold (representing market power) undermined 1930’s centralized virtuosity.

Some people express trite dismay about dwelling so much in the past, particularly on policy regimes that are now distant. They miss the larger problem here, namely that these central planners have not abated in their attempts, but have rather increased their intensity and distrust of markets. These sentiments are very much relevant to understanding not only how we got in the current mess (again!) but how it will likely resolve itself in the future. If there is science in economics, it may only be how inevitable the ending of such hubris ultimately is.

Getting back to Mr. Bernanke’s “admission”, the independent variable which was not properly calculated amounts to, in his words, “overconfidence.” He doesn’t specify the exact pathology of that overconfidence, merely expressing that it applied to, “the first thing we learned is that the U.S. is not invulnerable to financial crises.” What he doesn’t say, and what we can safely assume here, is that he believes that the overconfidence lay not in his “hypotheticals”, but rather in the market’s ability to comprehend and follow the combined inputs of both the FOMC and Federal Reserve Board.

While this does seem to destroy the orthodox notion that markets are both rational and efficient, it is obvious that this overconfidence has remained remarkably constant.

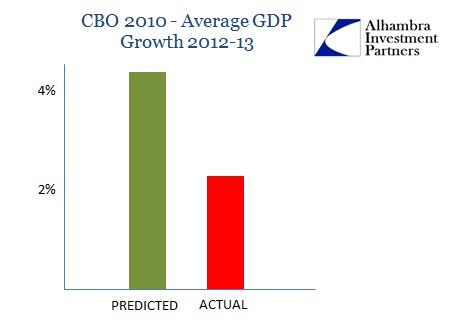

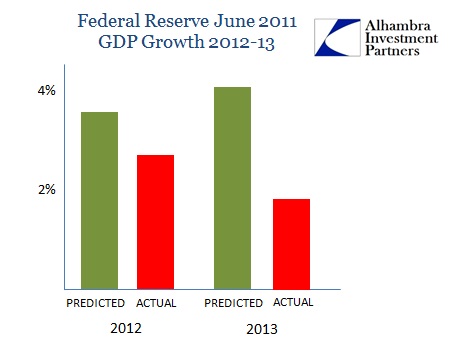

The orthodoxy continues to overestimate its ability to “engineer” a recovery. This is particularly galling given the expectations of the plucking model. The Federal Reserve itself has been the biggest offender in that regard, still “overconfident” in something about markets and the economy.

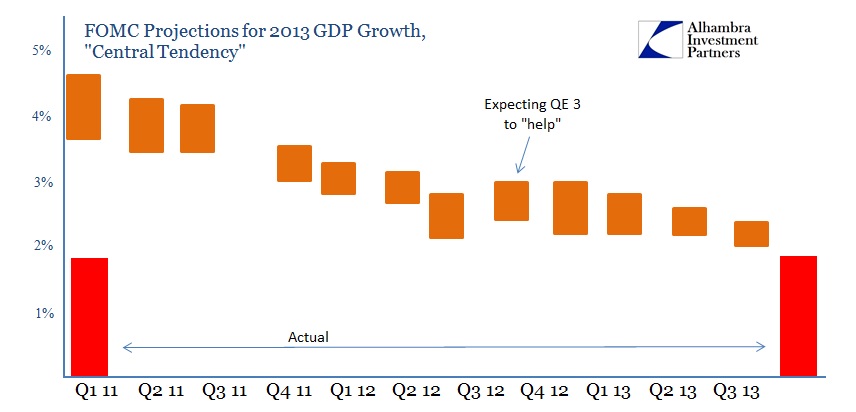

That extends not just to more distant predictions, but also to those very recent. For 2013, for example, the FOMC maintained its more robust expectations right up until the end.

This would seem to refute Mr. Bernanke’s general assumption that he remains the genius and markets (and by extension the economy) are simply resistant through ignorance. Perhaps the calculation is actually skewed in the other direction, that the hypotheticals are simply incapable of measuring and predicting a complex system (technical term) to any degree of accuracy, meaning that the practitioners of mainstream economics really don’t know what they are talking about.

The implications here are as obvious as they were in 2008, thus making the focus on the past, again, very relevant and direct to future expectations. Primarily, the market participants that were basing decisions on Bernanke’s hypotheticals were ultimately destroyed or bailed out (meaning they would have been destroyed). It wasn’t that they couldn’t understand them, it was belief that Bernanke and his comrades possessed actual prowess to carry them out – itself a byproduct of careful and intentional communication dating back decades (what was the “Greenspan put” if not this same exact hypothetical/market duplex setup?). That included stock investors as well as credit participants – even when they bet against credit. What was the S&P 500 telling us in October 2007, as it hit new highs months after the eurodollar market fragmented irreparably?

As it turns out, it really was overconfidence, but in Bernanke and his hypotheticals. The real markets emerged throughout 2008 to refute them in historic fashion. Fool me once…

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com