There is a growing bid for safety in almost every corner of the globe at this moment, save for a few outliers. Even the 10-year JGP sits at 50 bps today despite the spike in consumer inflation engineered by the Bank of Japan’s QQE. Of course, with BoJ buying up almost everything in sight, that may not be a relevant indication of anything but a huge scam by which banks can sell bond inventory to a central bank at any obscene premium they wish.

QQE aside, however, there is a persistent flattening across the globe. Yield curves are coming down in what looks like an almost coordinated fashion. The timing in each isn’t exact with regard to initiation, but the broad-based movement is, I believe, quite telling.

In Europe, fears over re-re-recession are now growing loudly despite the first major instance of a central bank establishing a negative nominal rate floor. No matter what the ECB throws at the hopelessly fragmented euro-denominated financial system, “inflation” continues to head toward zero while the economy failed to even register any significant positives before heading backward again. In short, not much progress was made before giving way, possibly, to further deterioration.

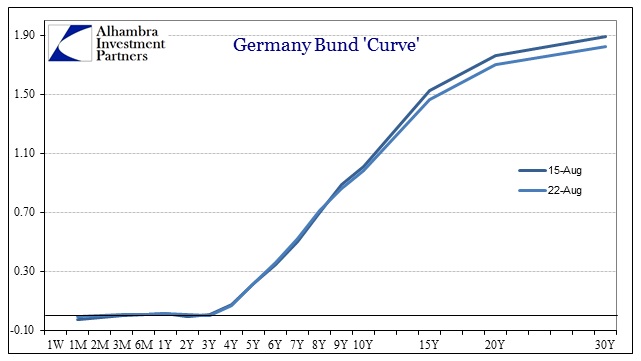

In response to, and in some cases in advance of, that, bond markets are repeating their recent history. Germany and Denmark flirt with negative yields centered around the 2-year maturity, which, however, makes less sense today than 2012 when it at least related to the broadening LTRO’s of that point. Today’s T-LTRO’s should not have the same impact on bond market expectations, but maybe there is simply comfort in that tenor that goes well beyond financial considerations into the emotional.

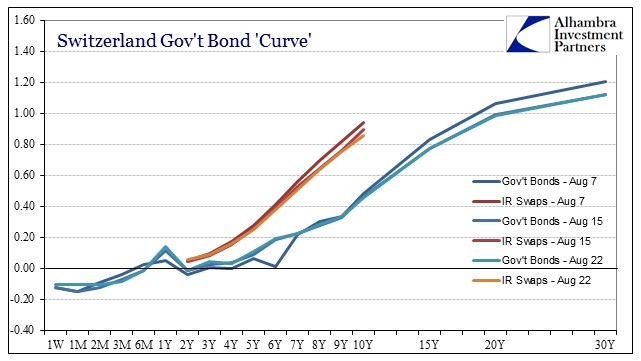

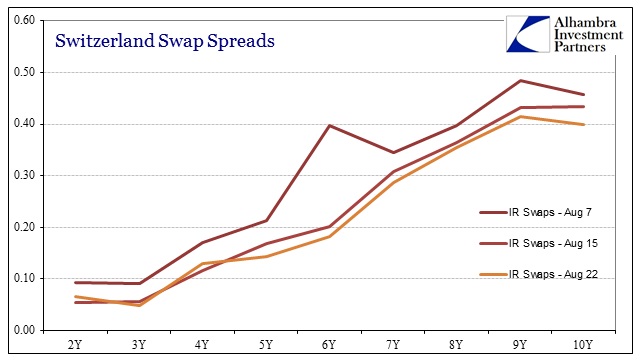

The Swiss curve has moved around in jagged fashion, but the flattening there stands out regardless. But what may be most important is that swap spreads have been compressing quite considerably recently, indicating that there is more than a little expectation for all of this “fear trade” to persist and even lengthen.

In my judgment, what is hitting the credit markets in Europe is not just a dour sense of impending economic reverse, but the beginnings of doubt over central bank effectiveness as it relates to almost everything promised and tried. These movements have been relatively minor to this point, which could mean that only a small segment is heading in that direction, or that perhaps this is nothing but a trivial trend that will extinguish itself without wider participation.

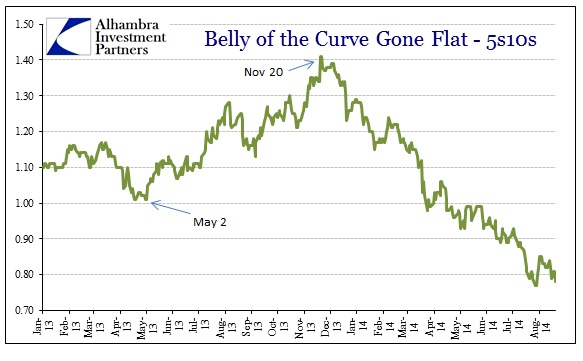

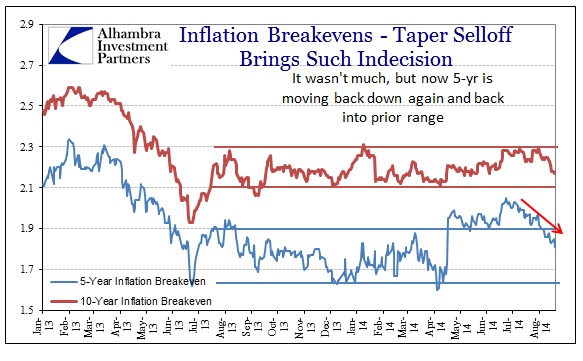

That latter possibility might be more compelling if the other side of the Atlantic weren’t months ahead on the very same track. The US bond markets, like those even in eurodollars, have been bear flattening for many months, and it doesn’t appear as if there is anything (yet) to derail that trend. This has gone well past any possibility of action/reaction, as in a reversion to the “mean” after last year’s selloff. In terms of the overall UST curve shape, this is a distinct event with its own interpretations and implications, none of which are positive reflections on economic and financial considerations.

In a broad curve sense, away somewhat from the immediate impact of QE, the flattening is as compressed as anything since 2009.

If this curve dynamic is reflective of nominal economic expectations, then it follows very closely the track of the economy and its utter disappointment since the “recovery” began. There were great expectations that suddenly died in late 2010 as commodity prices were “tempted” upward too rapidly, and then a broad slowing in 2012. While the Fed tried its best to sell the economy in 2013 as it headed toward taper, that only “worked” in the bond markets and only slightly until the blowout in mortgages. Since then, going back now nine full months, the accelerated flattening has been nothing short of single-minded.

Like that of Europe, this looks increasingly like pessimism writ large in not just inflation expectations, but also long and short-term growth expectations and ultimately much less benefit of the doubt for monetary efficacy. This is, perhaps, the most intense second-guessing in the age of interest rate targeting, soft central planning. Unlike 2007-08, there is no global liquidity turmoil of such scope that might explain decoupling of credit markets from Fed intentions.

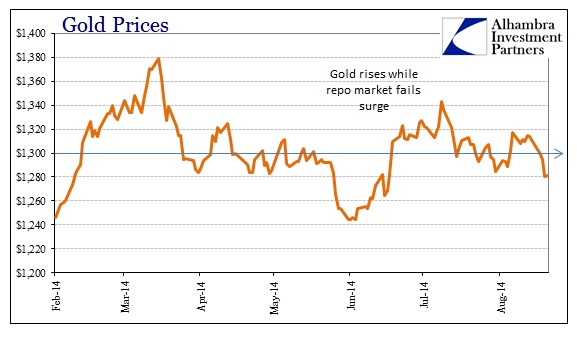

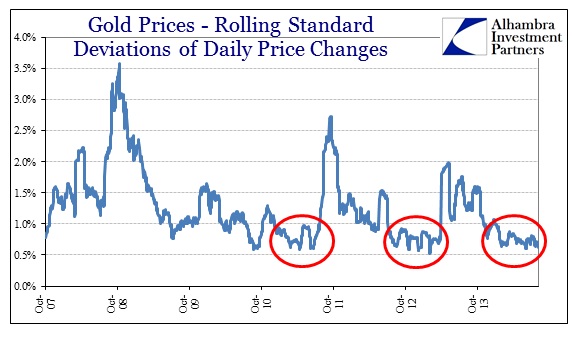

So why haven’t we seen a greater move toward “tail risk” insurance? That is a question without much answer at this point, particularly as gold prices are stuck right around $1,300 without fail. The gyrations centered on that axis are even growing more compressed, as the standard deviations of gold price movements fall to lows.

In gold, however, such limpness in price behavior has not been that uncommon in the past few years. In fact, you can point to similar trends that predated the big move up in 2011 and the big collapse in 2013.

In 2011 as the euro crisis moved similarly from total faith in central banks to near total disbelief in them, a second banking affair threatening a second “Lehman” moment, gold prices were conspicuously left out of the growing fear trade.

For three months during the worst of the rumors and innuendo about a euro breakup, gold was stuck seemingly stapled at $1,525. I’m not suggesting that a rerun of 2011 is close or even much of a consideration at this point, only that gold has its own unique set of circumstances that don’t lend to exact or corresponding interpretations in the shorter terms.

Even with that in mind, I can’t help but think that whatever balance is holding gold prices in check here is starting to weigh more toward demand for “tail risk” than talk about a gold bubble and central bank blind faith. With credit markets around the world displaying those very signals it stands to reason that as pessimism rises, even slow and incrementally, there will come a point when doubt transitions to something like more serious concerns – not necessarily fear, but a displacement of all the complacency stored up since the end of 2011 that was artificially encoded by central banks.

That is what all this amounts to, a reversal, maybe just its initiation right now, of the paradigm that kept favorability running for almost three years. Central banks at the end of 2011 and into 2012 promised all sorts of means by which to create the mythical recovery, which would have cured so many, if not all, nagging problems and imbalances left over from the Great Recession and panic. “Markets” gave central banks the benefit of the doubt about those promises and reacted and priced as if they were to come true; going so far as to even remove all thoughts of “tail risk.”

Even central banks are admitting not just folly about those promises but even deeper problems that run into the longer-terms beyond the reach, so they tell us now, of monetary experimentation. At the same time, there are some admissions of actual costs to having been so intrusive these past years, totally changing the paradigm of expectations.

The rock that begins to roll downhill does so very slowly, almost imperceptibly, at first, long before it becomes the avalanche. I’m not proclaiming that such is the case right now, only trying to suggest a possibility that is large enough to be a paradigm shift, opening up a lot of potential results that didn’t seem to exist only a few months or a year ago – many of which are unpleasant in their ends.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com