The Fed’s serial bubble machine has not only bestowed massive speculative windfalls on the 1%, but it has also fostered a noxious culture of plunder and entitlement in the gambling casinos of Wall Street. After each thundering sell-off during the bust phase, crony capitalist gamblers have been gifted with ill-gotten windfalls during the Fed’s subsequent maniacal money printing spree.

Worse still, this trash-to-riches syndrome has unfolded so consistently since the late 1980s that there now exists a marauding gang of permanent vulture-speculators who impudently claim entitlement to any and all action by the state that might be needed to quickly reflate their gleanings from the bottom. The passel of hedge funds led by Elliot Capital which blackmailed the Obama White House into paying billions for the worthless debt of Delphi during the GM bailout is only one especially odious example.

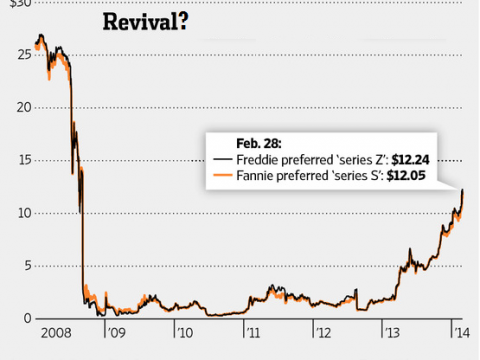

In this context comes Bruce Berkowitz “scolding” and firing “salvos” at Washington from the front page of the Wall Street Journal. As it has happened, the usually craven denizens of the beltway have so far managed to ignore his petulant demands for a multi-billion payday on the worthless Fannie and Freddie preferred stock that his fund scooped up after the housing bust. Recall, these were the securities issued in 2008 at $25 per share to shore up the tottering housing finance agencies just before Hank Paulson’s bazooka sputtered.

Not inappropriately, when the Republican White House nationalized Freddie and Fannie in September 2008 these preferred shares plunged to 25 cents—-their true value all along. The fact is, the so-called GSEs do not “earn” profits; they merely book bloated accounting margins that reflect nothing more profound than the fact that Freddie and Fannie drastically underpay for renting Uncle Sam’s balance sheet. As finally became official when the U.S. Treasury threw them a $180 billion lifeline, the GSEs are now—and have always been—a branch office of the U.S. Treasury Department.

The only reason Freddie and Fannie are not prosecuted for filing fraudulent accounting statements, therefore, is the beltway fiction that they are “off-budget”. This convenient scam was first invented by Lyndon Johnson to magically shrink his “guns and butter” fiscal deficits, but it has since metastasized into a giant business fairy tale—namely, that behind the imposing brick façade of Fannie Mae there is a real company generating value-added services that are the source of its reported profits and current multi-billion pink sheet valuation. In fact, there is nothing behind those walls except a stamping machine that embosses the signature of the American taxpayer on every billion dollar package of securitized mortgages it guarantees and on all the bonds it issues to fund a giant portfolio of mortgages and securities from which it strips the interest.

If we wanted to have honest socialist mortgage finance, a handful of GS-14s could run Freddie and Fannie out of the U.S. Treasury building. Civil servants could emboss the taxpayers’ guarantee on every family’s home mortgage just as proficiently as the make-believe business executives who populate the GSEs today; and in the process we could dispense with the sheer waste involved in applying GAAP accounting to the operations of a mere government bureau.

In an alternative political universe not corrupted by crony capitalist mythology about the elixir of homeownership, of course, there would be no need for a Treasury Bureau of Home Mortgage Finance. The decision to own own or rent would be made by 115 million American households based on their best lights, not the inducements and favors of the state. Markets would clear the interest price of mortgage debt and set credit terms and maturities consistent with the risks involved. Undoubtedly, rates would be a few hundred basis points higher and 30-year fixed rates mortgages quite rare. And like in the seemingly prosperous precincts of Germany, the home-ownership rate might be 55% or any other number not selected by pandering politicians of the type who pinned the 70% disaster on the wall during the Clinton-Bush era.

At the end of the day, having 40 million renter-households and 25 million mortgage-free owner-households provide (in their capacity as taxpayers) trillions of subsidized credit to upwards of 50 million mortgage-encumbered households is absurd. Yet it could be dismissed as just another expression of the capricious and random shuffling of income among American citizens that is the tradecraft of the Washington puzzle palace.

Unfortunately, the reality is not so anodyne. In order to hide this random redistribution mischief, the Treasury Bureau of Home Mortgage Finance has been gussied-up to form the simulacrum of a profit-making enterprise—otherwise known as a GSE. In that posture, the GSEs have been repeatedly plundered by insiders like Franklin Rains, the 90 million dollar man who drove Fannie off the cliff; and by fast money stock speculators who managed to drive the combined market cap of Freddie and Fannie to the lunatic level of $140 billion during their hay-day at the turn of the century; and by the Wall Street dealers and so-called fund managers who inventory trillions of GSE debt securities in order to scalp profits from the economically pointless spread between regular treasury bonds and the GSE variant of the same thing.

All of these hundreds of billions were pocketed by adept cronies and speculators in the various debt, equity and preferred securities of the GSEs during the decades culminating in the 2008 financial crisis. Given the trauma of those events, Secretary Paulson’s desperate and ill-disguised nationalization of Freddie and Fannie should have put an end to the plunder.

But it hasn’t because there is no end to the zero cost-of-goods carry trades by which speculators scoop-up and fund financial assets—busted and not—during the Fed’s money printing marathons. Likewise, there is no end to crony capitalist marauders like Berkowitz, who have the temerity to demand make-wholes from the state, and K-Street hirelings—lawyers, accountants and consultants— who are skilled at the manufacture of specious public policy rationalizations for outright thievery.

So now comes the patented crony capitalist rush. The worthless Freddie and Fannie preferreds have lately erupted from $0.25 per share to $12, meaning that some speculators have already garnered a paper return of 48X. And why did this revival miracle transpire? Quite simply because Berkowitz’s Fairholme Capital and his posse of punters—-John Paulson, Perry Capital and Pershing Square, among others—have taken turns bidding up the paper.

Meanwhile, their deplorable plan to do the American people a favor and swap these bogus securities for those of a new tax-payer underwritten, mortgage guarantee stamping machine, has but one objective—that is, to put a statutory floor under the current $12 per share price and enable them to dicker with Capitol Hill staffs for an ultimate take-out at par($25) under the guise of “privatization”. The larceny intended here is not modest: the payday for Berkowitz and his hedge fund posse would amount to $35 billion on toxic paper which was purchased for rounding errors.

To be sure, Berkowitz and his sharpies blather that Freddie and Fannie have now returned $200 billion to the US Treasury, thereby repaying the original $180 billion drawdown, with some change to spare. But what hay wagon do they think even the clueless officialdom of Washington rides upon? Roughly $50 billion of that was for writing-up a “tax asset” that had earlier been written-down, owing to the fact that absent nationalization the GSEs had no prospect of booking even accounting income in the future. And the remaining $150 billion represents dividends paid to the Treasury since 2009 based on using Uncle Sam’s credit card to issue the bonds and guarantees which fund the assets from which these so-called GSE dividends are scalped.

In other words, the Berkowitz Gang wants to be paid a king’s ransom for ownership shares in what amounts to a bureau of the US Treasury. And yet these con men pound the table demanding to “wake up the (GSE) boards” so that they will execute their “fiduciary responsibility”. Indeed, so shameless are Wall Street’s princes of plunder that Berkowitz told a skeptical CNBC questioner last fall “we’ve helped before with AIG”, and that he now merely seeks a “win-win” to “help with jobs, help with the economy, help with the dream of homeownership”!

That gibberish is the measure of the crony capitalist deformation that has infested the nation’s financial markets and system of political governance. The obvious thing for Washington to do is close the doors at Fannie and Freddie and allow their $5 trillion portfolio to run-off in the manner of any liquidation. And if it must subsidize home mortgage credit, just bring back the metal filing cabinets in the Treasury Building where the so-called “secondary mortgage market” was birthed in 1938. Yet what it dare not do is succumb to the bogus bombast of the punters and sharpies who troll the financial wreckage inexorably created by the Fed’s serial bubble machine.

If it does, the people will find their pitchforks and torches—–one of these days.

Comments are open on this post, below.