By Eric Peters at Eric Peters Autos

Termites start low and work their way up. By the time you notice them, it’s often already too late to save the place. All you can do is rebuild, start over.

This analogy may be useful in terms of understanding what’s going on in the car business… on the lower end of that business. And what that could portend for the rest of the business – ostensibly “doing gangbusters,” according to mainstream media accounts.

You know … like the housing market was “doing gangbusters” a few years back.

Until, of course, it wasn’t.

Well, check this:

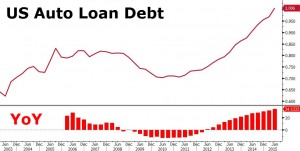

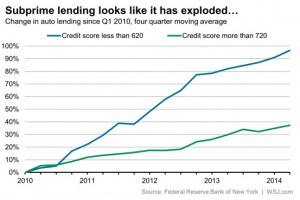

The number of “subprime” car loans being sold is increasing – and so is the number ofdelinquencies on those loans. They are up to 5.16 percent, the highest level in 20 years.

xxx

Consider what this means.

First, a growing number of people cannot get traditional loans for new cars. They lack the verifiable income to qualify – or their credit scores suck. But financial flimflam outfits are loaning them money – often, at exorbitant interest – nonetheless.

Sound familiar?

It does to Comptroller of the Currency Thomas Curry, who recently said “… what’s happening in the auto loan market reminds me of what happened in mortgage-backed securities in the run-up to the (housing) crisis.”

Second – and not surprisingly – these loans are being defaulted on in growing numbers. Apparently, people who can’t swing a mainline loan at 3 or 4 percent interest are having trouble keeping up with loans that have interest rates twice as high.

Who’d a thunk it?

Now, are talking about $25 billion in subprime auto loans. Will Uncle step in – once again – and bail out the shysters issuing these loans with more of our money?

Of course he will.

Spending other people’s money is not only what Uncle does best – it’s all that Uncle does. He hasn’t got a penny of money that’s not been taken from others first. Why not be generous? There’s always more where that came from.

But this rant is not primarily about Uncle and his bottomless generosity with other people’s money.

It’s about what the bubbling trouble in the subprime auto loan mark says – canary in the coal mine-wise – about the health of the car industry generally.

Consider:

If – as the numbers suggest – more and more people are having trouble getting conventional car loans, either they are uncreditworthy or cars are too expensive for them (relative to income).

This latter thing is the canary in the coal mine.

A few weeks ago, I wrote about the average price paid for a new car last year – about $32,000 – a record high. And about the corollary to this: The ever-increasing duration of new cars loans. They are now on average six years long – and seven year loans are becoming pretty common. In order to spread out payments (now averaging almost $500 a month) that have become simply too much to manage for most people.

All these things are canaries in the coal mine.

And the canary’s looking woozy.

Even a slight upticking of interest rates will send him toppling off his perch, to land lifeless on the newspaper below. The private banking cartel that manipulates the American economy for its benefit – you know, the “Federal” (like “Federal” Express) Reserve – has been threatening to raise the cost of money (interest) for some time now. The only thing holding it back has been flaccid spending, a general reluctance on the part of the public to buy stuff with money they haven’t got.

Which includes cars.

There was a time – within living memory – when you didn’t have to hock yourself to a six or seven year loan to be able to drive home a new car car.

Many people paid cash.

Today, almost 90 percent of all new car “sales” are financed.

And more than 55 percent of used car “sales” are financed, too.

The Fed has been attempting to “stimulate” (false) demand by tempting people with low-cost money (i.e., low interest rates) and that is probably the main thing propping up demand for new cars – much in the same way that artificial demand for homes was confected by the very same Fed.

Especially given that Uncle succeeded in executing a kind of mechanical genocide of good (and affordable) used cars via the odious “cash for clunkers” program several years back.

There are not many serviceable used cars available as a result – and the ones that are cost a pretty penny.

Hence the need to finance them.

But the high cost of used cars plus low-cost (even “free”) money in the form of interest-free (or interest so low it pretty much tracks with inflation) loans on new cars makes it very tempting to sign up for a new car loan… even one that’s six or seven years long (about the same time as the typical indenture contract during the early colonial era, if you’re interested in a historical parallel).

But when, inevitably, the cost of money goes up – as it must if the private banking cartel is going to resume its profiteering – it will have the same effect on the car business as the same thing had on the housing /real-estate business.

Better grab hold of something.

The spreading evidence of a new round of subprime rot is just the beginning.

And it won’t be confined to just this one thing, either.

Source: Another Bubble… On the Verge of Popping – Eric Peters Autos