Despite everything that happened in July and August throughout the financial world, there remained a tendency to simply dismiss it as anomalous. That was curious in and of itself, but that the global liquidations then were not isolated but rather the latest in a continuing string of “odd” events strains such determined dimness. We have arrived at a point in time where even direct and widespread observations are no longer afforded much significance, to be shadowed and replaced instead by the musings of credentials. Janet Yellen and various international economic outfits declare the world in recovery, therefore anything that upsets the order is to be marginalized as “temporary” or “anomalous” since Yellen comes first.

China has moved to the frontlines in that struggle between understanding and raw ideology; to economists it just doesn’t make sense that growth would continue to decelerate month after month with no answer to all the “stimulus.” But so it goes on down the line, beyond China and into the vulnerability of the global supply chain. We see the direct line into Brazil, but it isn’t limited to emerging markets. Enter Canada.

Being an oil production giant, Canada is for a “developed” economy related directly to the same financial strains as those plaguing EM’s. The initial oil crash at the outset of 2015 “unexpectedly” plunged the Canadian economy into a technical recession (which is more myth than actual condition; it is only urban legend that claims two consecutive quarters of GDP contraction as that). Then, as oil prices rebounded, Yellen’s “transitory” declaration appeared to be holding on the outside. It didn’t matter that that initial downturn was rather sharp and severe, all that mattered was what economists believed about it – even though, curiously, they had no idea it was even coming (a persistent theme for far, far longer than the past year).

So the earlier weakness, severe as it may have been, was to be written off as a trivial historical artifact troubling only to economic historians:

Well, so much for Canada’s recession.

After pulling back for two straight quarters, the economy is showing new resilience — rebounding in subsequent months and providing hope of more growth for the rest of the year.

“Growth looks like it’s going to be pretty solid in the third quarter,” said Benjamin Reitzes, senior economist at BMO Capital Markets.

“Most definitely, this is among the shortest and most mild (recessions) in Canadian history.”

That was written in the Financial Post section of Canada’s National Post newspaper on September 30. Again, it was a rather amazing display of confidence given that, especially for Canada, the events of August had fervently re-triggered the oil problem that everyone thought at the base of the “anomaly” in the first place. Even the Toronto stock exchange index, the TSX, remains much lower than its April highs unlike US and other stock indices which have at least retraced. Canadian stocks, too, plunged on August 24 only they have more so remained in that state.

There was the same equity rebound during China’s Golden Week off, though far less intense for Canada likely as energy continued to weigh. Even now, the TSX is barely above the August 24 lows, suggesting that at least investors up North are aware of “something” else. That counted as much in the economic statistics, as barely a month after writing the above quoted passage the same author had suddenly lost September’s cockiness by the end of October:

The Canadian economy’s climb out of a mild downturn in the first half of 2015 is now, worryingly, beginning to slow.

And if growth weakens further in the coming months, the promise of billions of dollars in stimulus spending — in other words, deficits — by the incoming Liberal government might just come in handy.

The ubiquitous appeal of “stimulus” whenever the economic narrative falls down. Economists can never lose; if they are proven wrong by “unexpected” economic weakness, it is so easily dismissed as either unimportant or no match for their managerial designs. The Bank of Canada was assigned exactly that role for its central planning in 2015, as it injected monetary “stimulus” and has been given credit for it just by sheer action alone.

Action by the Bank of Canada — two quarter-point cuts in its key lending rate so far this year, taking the base level to 0.5 per cent — has been credited with cushioning the economic impact of the energy crisis.

The problem with such an assignment and interpretation is that it is never matched to actual performance; never. In words and writing, the Bank of Canada was a positive force of stimulus, “cushioning the economic impact.” By that direct and purposeful context, you would presume (should presume) that the worst was now over.

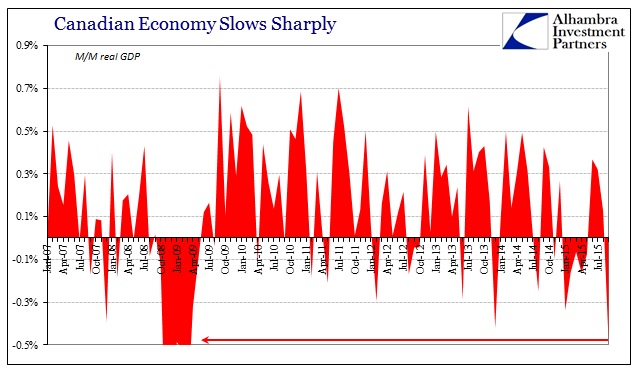

As per usual, that wasn’t the case as suddenly and more “unexpectedly” Canada’s GDP fell sharply yet again. Just released figures from Statistics Canada show September’s monthly GDP falling by -0.48%, which is the sharpest monthly decline since March 2009. Like everywhere else under such central banking mysticism, the most charitable description that can be applied to the monetarism and its intentions is that it maybe produced a temporary contrary effect that in the end isn’t even noticeable.

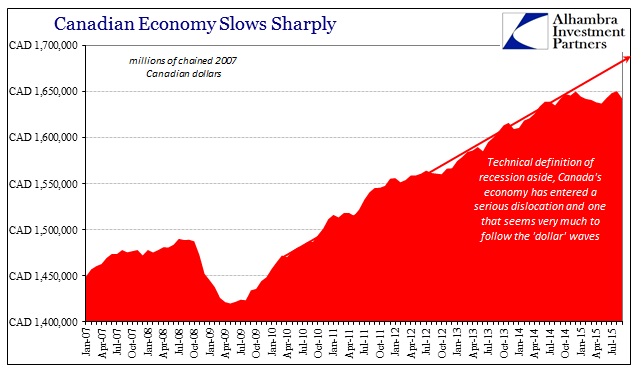

Plotting GDP by its chained Canadian dollar level reveals no need of any technical recession definition – it is by plain observation quite obvious. Further, as anyone outside of mainstream economics would expect, it is easily following the path of oil prices and thus the “dollar.”

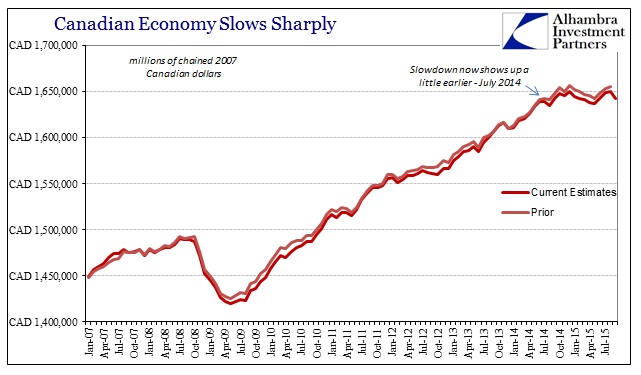

That point has been further revealed in the latest GDP revisions. Statistics Canada now assigns an earlier departure point for Canada GDP, cutting off some growth in late 2014 and pushing the recession start to, unsurprisingly, July 2014.

The September drop in GDP was not all oil and energy, either. The GDP assigned from goods producing industries fell by more in chained CAD terms than the energy sector’s. Unsurprisingly, then, GDP based on industrial production was also worse (larger CAD decline) than the oil patch. There were even declines in the service-producing industry sector as well as business sector industries, the two largest Canadian subcomponents. In other words, “stimulus” and all, Canada’s large monthly contraction in September has widened much beyond just oil.

To orthodox economics enraptured by only credentials, this just doesn’t make much sense; not much of the world makes sense this year to it. In the application of common sense, however, there is little here that is surprising especially given Canada’s susceptibilities in terms of energy and resource production. It was just a matter of time before oil’s continued weakness (and China’s as production proxy for the US’s) would transfer more broadly, a defined negative contribution only further cemented as “transitory” proved yet again complete fantasy.

Economists can produce the most elegant and breathtaking statistical equations and regressions, but that makes them experts in statistics and math with little application in the real world. They are no trusted source on how an economy actually works, a fatalistic flaw that extends first from their determined ignorance about finance and money. You might understand this weakness for seeing it for the first time, but this has been constant year after year – let alone the same exact pattern repeating of 2008. Perhaps it is most fitting that economists were so absolutely sure about the unarguable growth and global recovery that was coming for 2015 only to have seen it turn further and further away from that. Their models are truly something to behold, just not with any relevance to any real economy.

This deficiency is being more openly revealed in Canada, China, Japan and elsewhere, but it applies just as much to the US – in fact, so much of this global economic downturn traces back to the monetary incapacity of the US economy in exactly the same manner.