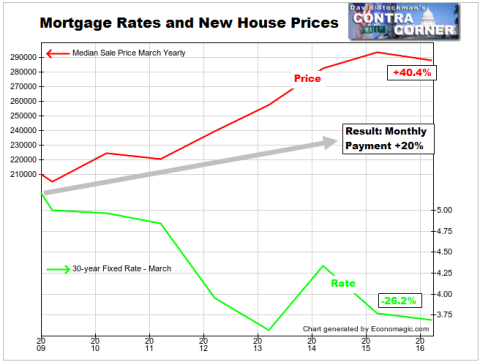

Since the bottom of the housing crash in 2009, the Fed has pushed mortgage rates down by 26%. That has “stimulated” new house sale prices to inflate by 40.4%. At the March 2009 median price of $205,100 and the then current mortgage rate of 5.0%, the monthly payment was $1,101. At the current median price of $288,000 and the current mortgage rate of 3.69% the monthly payment is $1,324. So remind me again how the Fed’s artificially suppressing mortgage rates stimulates housing demand when the monthly payment is now 20% higher?