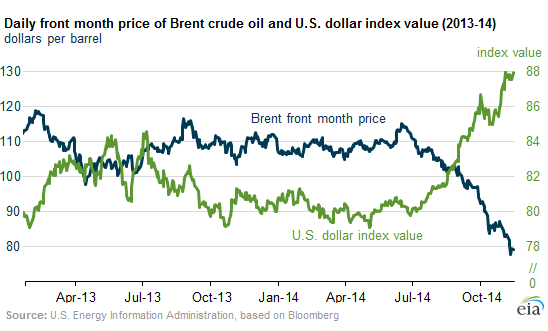

This chart juxtaposes the price of Brent crude oil and the US Dollar Index (the outdated currency basket composed of the euro, yen, UK pound, Canadian dollar, Swiss franc, and Swedish krona). As the dollar has soared, the price of Brent crude in dollars has plunged.

Or we might say that the euro has dropped and the yen has plunged for reasons of their own, including their central banks’ commitment to a total currency war. So the hapless consumers in Japan won’t even be able to benefit at the pump from the plunge in the price of oil, as we’re doing in the US. Thanks to the Bank of Japan’s yen-destruction policies, they have to pay for it with their rapidly shrinking yen.

It gives us a near-perfect mirror image of the price of Brent and the Dollar Index:

There are a myriad causes for the currency moves and the oil price plunge. The US Energy Information Administration pins much of the blame on expectations for lower global economic growth. Europe is floundering, China appears to be losing steam, Japan is in trouble…. All the while, oil production in the US is booming. So that would be a toxic combination for the price of oil – regardless of what the dollar is doing.

But it’s not always this way. The EIA notes: “The current situation, with the dollar index and oil prices moving in opposite directions, presents a sharp contrast to one in which crude oil supply disruptions or geopolitical risks would cause both the dollar index and crude prices to rise.”

How long will this trend continue? In the oil sector, the bloodletting will go on until the money dries up. Read… How Low Can the Price of Oil Plunge?