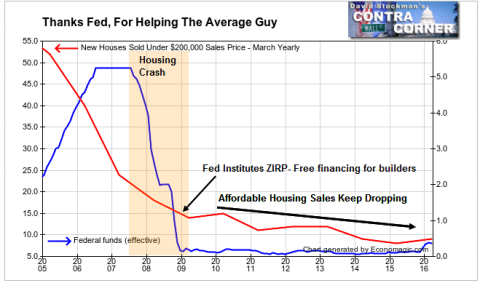

In March of 2005, 52,000 new homes were sold at prices of less than $200,000. At the bottom of the crash in March 2009 that number had dropped to 14,000. The Fed instituted ZIRP and QE around that time. Sales of homes under $200,000 totaled 9,000 units in March. With sharp price rises builders have found it more profitable to build fewer but more expensive homes than selling more lower priced homes where profit margins have all but disappeared.

The Fed has promoted this distortion by enabling builders to finance their construction and holding costs of inventories at zero in real terms.