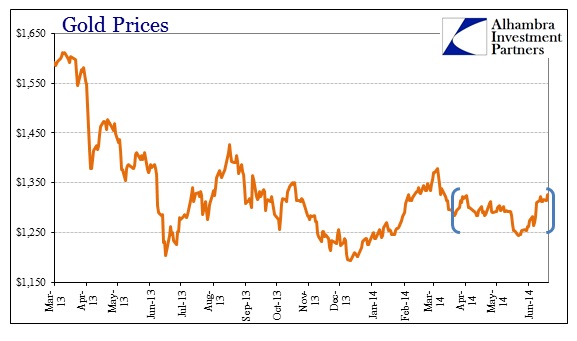

The positive price action in gold of the last few weeks stands out in sharp contrast to other sectors of the funding market, particularly repo. Under last year’s defiling paradigm, such a collateral shortage as pronounced as what we see now would have been disastrous for gold prices (more collateral demand typically leads to an increase in gold “leasing”, which is price negative for gold). That, of course, raises several intriguing issues, not the least of which is what exactly changed.

I have been arguing for a long time that gold will remain chained in terms of dollar price until we see an increased and very determined bid for safety. Part of that relates to gold in the modern financial scheme, having been dethroned as actual money and devolved into just another financial investment. Money, properly defined, is property that is undivided with clear title. Ask any MF Global clients if their gold fit that definition before it was whisked to London and rehypothecated to try to keep the bank afloat a few hours longer.

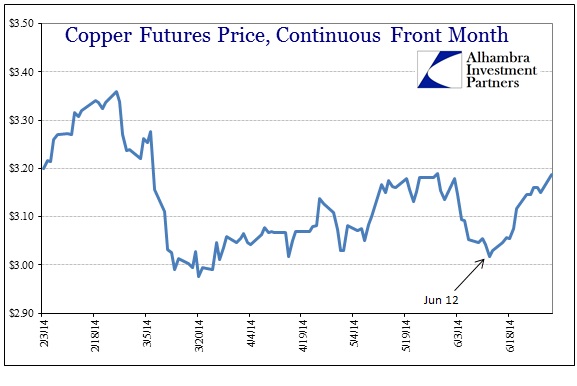

Nowhere has that “standard” been more prevalent than China. All sorts of metal, especially copper, have been used in an offshore/onshore scheme to address the growing and unstable dollar shortage. In doing so, however, that meant not using gold as properly defined property, but just another tortured financial instrument in the service of bending payment clearing of paper currency.

If you have been following the Chinese saga of late, you know that rehypothecation has been not just rampant, as it always is, but excessive. Fake warehouse receipts and overstretched pledges of physical metal have banks, including dollar suppliers, totally re-assessing their activity.

This was always where “gold bugs” were most distrustful of the new non-money gold framework. To the main financial world, there is no difference between a futures contract and a bar of bullion (good deliver, of course), but this may be exactly what has long been feared. Any stretching of gold claims is anathema to what gold is supposed to be as money, but such engineering was bound to go too far (as it did with MBS collateral pre-crisis).

I’m not implying that this is “the” trigger at which the paper price of gold heavily diverges with the physical price, or where the futures markets for some of these quasi-monetary metals comes crashing down, only that the reversal of rehypothecation is likely to drive higher demand for physical. At some point, as the warehousing scheme falls apart (even if only temporarily), banks are going to demand metal (that they may have likely pledged elsewhere themselves) from counterparties first, and then, failing that, from the market itself. The untangling of the web of finance is not a delicate matter.

I do see a faint Chinese resemblance in recent price behavior. It’s not overly large or excessive to the point of obviousness, but there is a cluster of price changes among gold, copper and yuan that add some weight to the theory here.

The yuan, in particular, seems to have a more apparent resemblance to gold prices. You would think that as gold rehypothecation became more precarious that dollar shorts (largely Chinese companies rather than solely “hot money” speculators of media lore) would have to appeal to other means to maintain dollar funding. That would mean, again, a devaluing yuan (a rising, more “expensive”, dollar). It’s nothing like what we saw in February and March, but this (metal) is only a small part of dollar arrangements and is dwarfed by other means.

The behavior of copper is indicative of a scramble for physical metal deliveries. Since copper was the primary dollar financing vehicle, it is not surprising to see it more pronounced here than with gold.

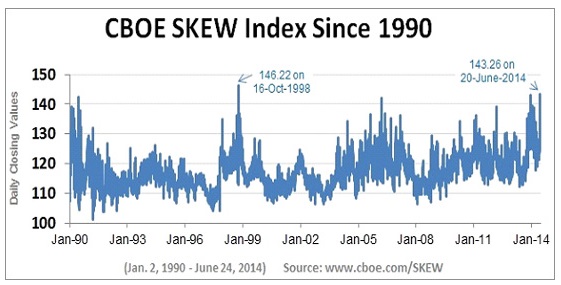

I would also think that “tail risk” is again a consideration, the idea that the world is a much more dangerous place than is currently indicated by “volatility” measures all over the place. This is corroborated not just by gold behaving as it has recently, but also by certain option skews that have suddenly acquired a notice of potential “tail risks.”

A lot of these indications and potential movements are all relative and thus do not hold any clues about absolute changes, or the potential for actual “tail events.” I think what it says is that in the past few weeks, for whatever reason(s), markets have become a bit more risk averse (outside of the stock bubble). I believe that China has some bearing on that, but it is not exclusively Chinese debt bubbles.

In any case, the fact that gold has been rising during a heightened collateral shortage is, to me, potentially significant. Maybe gold prices might finally break out of their range of late. However, strains in finance, if large enough, will always be gold price negative, meaning that there are still risks in terms of price until that safety bid goes exponential once again.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com