By Tyler Durden at ZeroHedge

In early February we observed a a new, troubling trend among Chinese corporations: soaring corporate debt as a result of a surge in cross-border M&A.

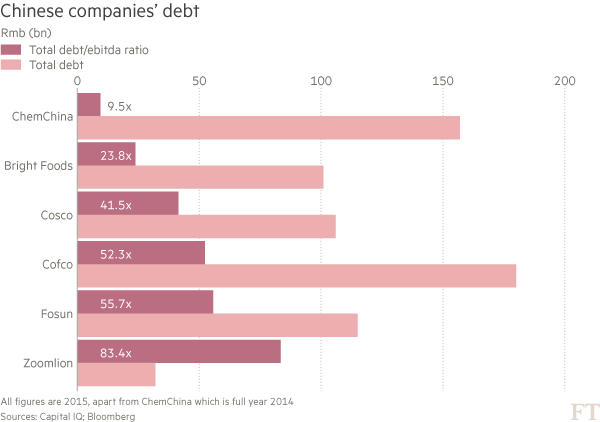

As we said then “Chinese corporate leverage, represented by the traditional debt/EBITDA ratio is, in some cases, absolutely ludicrous, especially among companies which in recent weeks have tried to mask their balance sheet devastation through global M&A activity, such as ChemChina’s recent record for a Chinese company $44 billion purchase of Syngenta, or Zoomlion’s $3.3 bid for US rival Terex last month.”

As the FT noted at the time, “so high are the debt levels at ChemChina and several other companies behind some of the country’s biggest overseas investments that financing for the deals would have been difficult or prohibitively expensive were it not for the backing of the Chinese state, analysts said.”

Looking specifically at ChemChina, FT wrote that ChemChina, which bid $43.8bn for Syngenta, a Swiss company, is in poor financial shape.“It made a net loss of Rmb889m in the third quarter of last year and carried a total debt of Rmb156.5bn ($24bn). The debt load was equivalent to 9.5 times its earnings before interest, tax, depreciation and amortisation at the end of 2014, well above the international standard for excessive leverage of 8 times Ebitda.

But what is most disturbing is that ChemChina’s 9.5x debt/EBITDA is downright conservative among Chinese corporations.

Take Zoomlion, a lossmaking Chinese machinery company that is partially state-owned: its total debt stands at 83 times its EBITDA. “Zoomlion’s bid is a desperate attempt to remain relevant,” said Mr Pillay.

- Or how about Fosun, a serial Chinese acquirer that spent $6.5bn on stakes in 18 overseas companies during a six-month period last year, had a a 55.7x total debt/EBITDA in June 2015. “Fosun has bought brand names such as Club Med and Cirque du Soleil as well as a host of other assets including the German private bank Hauck & Aufhaeser.”

- Or maybe the highly publicized purchase of China Cosco Holdings of the Greek Piraeus Port Authority for €368.5m. Cosco has promised to invest €500m in the Greek port despite having total debt at 41.5x its EBITDA!

- Or Cofco Corporation, which recently reached an agreement with Noble Group under which its subsidiary, Cofco International, would acquire a stake in Noble Agri for $750m (in the process preventing the insolvency of the biggest Asian commodities trader), has total debt equivalent to 52 times its EBITDA!

- Or how about Bright Food, which bought the breakfast group Weetabix for $1.2bn last year, and has total debt at 24 times EBITDA!

And then there was last week’s surprising hostile bid by China’s Anbang to acquire Starwood, which is in process of being purchased by Marriott.

As Bloomberg reported recently, “the scale of this outbound investment wave is so great that the value of deals announced in the third quarter of 2015 exceeded China’s current-account surplus for the same period, according to data compiled by Bloomberg. That trick will be repeated in the current quarter, unless China puts in its best current-account performance since 2008.”

What is going on here? The answer is quite simple: following Beijing’s ramp up in capital outflows, China has found a new and innovative way to export funds offshore.

Bloomberg notes that the surge in Chinese M&A is on track to run this year at five times the pace of 2015, according to Goldman Sachs’s co-head of mergers and acquisitions, Gregg Lemkau. “It feels like this outbound M&A from China is driven from the top; it’s a desire to get capital outside of China and invest it around the globe,” he said in a video posted on the bank’s website. A possible motivation could be a desire to acquire assets in dollars and euros ahead of a devaluation of the yuan, he said.

Or, said otherwise, a perfectly legitimate form of capital flight, one which Beijing can do nothing against, at least not yet.

Who is participating in this exodus?

Fully 63 percent of the value of outbound deals announced since the start of 2015 was driven by closely held companies, rather than those traded on public markets and accessible to ordinary investors, according to data compiled by Bloomberg. That’s up from 47 percent over the previous five years, the data show.

And as Bloomberg adds, “ordinary Chinese citizens, frustrated by the restrictions on moving relatively small sums out of the country, could be justified in asking who benefits from these transfers by companies with vast pools of cash” with the bottom line being that “bigger investors with better connections get on the lifeboats” while everyone else is stuck holding Chinese assets and awaiting the inevitable devaluation.

In the meantime, it means that we will get many more such Chinese “M&A deals” as the following: according to the FT, “a lossmaking Chinese miner is snapping up a British computer games developer in a $300m deal that encapsulates the spirit of China’s frenzied — and often incongruous — debt-fuelled shopping spree.”

It is no longer incongruous: instead of seeking synergies, and clearly there are none between an insolvent Chinese miner and video game maker, Chinese companies merely seek a justification to park existing equity offshore, where it would be “inert” from the Politburo and redenominated in some other currency.

Some details on this “deal” from the FT:

The deal, which will see a fantasy games developer bed down with iron ore miner, comes as insurer Anbang gatecrashes a $13bn deal for Starwood Hotels and Resorts; itself barely 24 hours after sewing up a $6.5bn bid for Strategic Hotels & Resorts.Shandong Hongda, the iron ore miner, may be putting down less cash, but the $300m price tag is six times its forecast net loss for last year. After beginning life as a village-owned iron ore mine in the early 1990s, it is bolting on Jagex, UK developer of online role-playing game RuneScape.

Incongruous diversification is also part of the zeitgeist. Old industry, such as steel mills and miners, are weighed down by overcapacity and debts and turning to new areas — from pig farming to property to finance.

For two decades investment surged into China, initially capitalising on cheap labour, and then in an effort to tap the flourishing Chinese market that was growing at near double-digit rates annually.

* * *

Shandong Hongda’s Liang Xiuhong and other shareholders have borrowed heavily in the domestic shadow banking sector, pledging the company’s shares against wealth management products on at least three occasions, according to documents seen by the Financial Times. It warned in January it could report Rmb350m ($55m) in losses for 2015.

Seen in this light the recent deal in which a Chinese insurer is seeking to buy one of the world’s biggest hotel chains makes all the sense in the world: big Chinese investors are not seeking to actually generate profits on future M&A, they are merely looking to preserve capital and are doing so by overpaying for acquisitions around the globe.

Where have we seen this before? Why the 1980s, of course, when it was not China but Japan whose investors scrambled to acquire assets around the globe, but mostly in the U.S., fully aware the party was ending.

The party indeed ended with a bang when the Japanese mega bubble burst, and all those Japanese “investors” ended up losing virtually their entire investments; this time it won’t be any different although we probably have a ways to go before this particular mega-bubble follows in its predecessor’s footsteps.

Source: China’s Most Innovative Capital Outflow Yet: Bizarro M&A – ZeroHedge