Unlike previous moves in China, this one in the middle of December caught very little notice. Perhaps that was because the big reduction in the eligibility of repo collateral had “markets” and economists on their heels in disarray about what it was all supposed to mean in the context of obviously (perhaps a touch dangerously) slowing growth. To go along with that massive repo adjustment, the PBOC, China Securities Regulatory Commission (CSRC) and the State Administration for Industry & Commerce (SAIC) jointly announced a combined effort to link various agency databases in order to better define debtor judgments.

There has been, as you might imagine in a country run wild for years with monetarists’ dreams, a sort of backroom plague of debtors avoiding assessments on their property. Too often, those debtors in bankruptcy or difficulty have avoided penalty and recourse and simply re-pledged the same “dirty” assets in new financing schemes and arrangements. The linkage of the various state databases on this disparity is completely in-line with the overriding “reform” mandate to crack down on what has been determined as harmful financialism; the PBOC’s end of it is to prevent these debtors, especially those that have committed securities violations, from further accessing capital markets.

This was not the first time these bureaucracies had pledged closer cooperation, as in January 2014, the PBOC and CSRC began a joint effort toward broader and more meaningful “assessments” of financial market infrastructure. The measure meant greater scrutiny over payment systems, both foreign and domestic, and also clearing centers for securities businesses and custodial practices. Again, in the context of ‘reform”, the collaboration confirmed where the PBOC, in conjunction with broader state powers, was trying to focus its new priorities.

When the CRSC shows up again in January 2015 to “discipline” the margin behavior of various Chinese brokerages after the massive surge in Shanghai-borne share prices, the regulatory focus is but consistently maintained. The nearly 8% decline in the stock index is of no concern to “reform” and is actively being sought. I have little doubt that regulators, especially at the PBOC who were undoubtedly consulted here, would prefer more orderly bubble pricking but that is, again, a far more distant priority at this point.

The fact that stocks obviously became the speculative outlet of choice after the liquidity crackdown of the second half of 2014 is in itself unsurprising, after all nobody can uniformly squeeze a balloon as some parts of it will always slip out of grasp. In that context, none of this should be a surprise – at all. Did stock investors really think the PBOC and its kin would not come after them?

The reorientation of priorities in China is staggering in the attempt to end the bubble economy in what is really a race to accomplish this “deflationary” impulse before the economy itself seriously slows. In that respect, stock investors and economists have it exactly backward as they expected slowing growth to turn regulatory favor toward “stimulus” once more; instead they were met with another and coordinated “tightening” against any financial imbalance deemed both excessive and unhelpful.

The seriousness of that economic backdrop only increases this distance between action and expectation where, as I said Friday, rationalizations are in the way of this very open policy change.

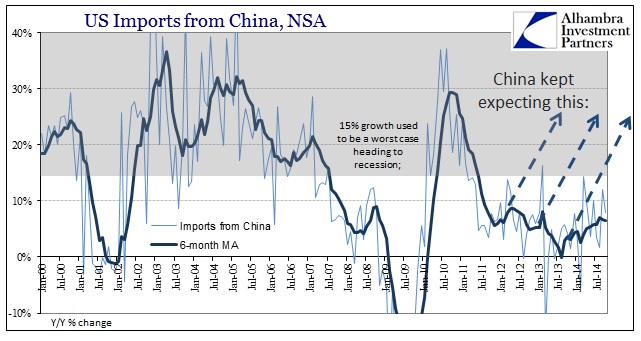

I don’t think the Chinese believe they have any choice at this point, seeing that both past broad flooding of “stimulus” brought nothing but empty waste produced from the bubble economy. The reform idea is an admission that waste (the “aggregate demand” theory) is a setback economically, bubbles are highly destabilizing, especially for China, and the broad global recovery, including the US, is not coming to fix all of it.

Indeed, with GDP presented (some “real time” calculations of China GDP assume a sub-7% rate) at the lowest expansion since the Asian flu, growth is even more in doubt now than at any point, even in comparison to the Great (and global) Recession.

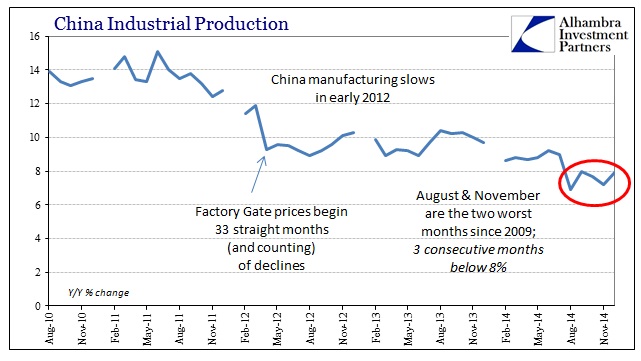

While industrial production was better in December than November, that says very little positive about the state of the primary growth engine in China. In fact, the last three months have been below 8% Y/Y, a run of “stagnation” unmatched this century. As always, mainstream commentary is adamant about this being a Chinese problem, but it is increasingly difficult to see it as such especially as the entire state financial apparatus is now highly dedicated to fighting bubbles in order to survive without any kind of global reflation, US and all.