Going back well more than a year now, every time the PBOC takes some kind of action it is classified immediately as “stimulus.” Last July, the Chinese central bank opened its PLF to China Development Bank and it was heralded as a renewed age of traditional monetarism if in unfamiliar formatting. In November, the first rate cuts since 2012 were talked about in the same manner; that repeated every time there was another “rate cut” (four of them so far). Each and every time the euphoria over the return of “stimulus” extrapolated into the economic bottom it was only to be almost immediately disappointed.

In the entirety of the “reform” era in China, this has been the pattern drawn from utter confusion that the PBOC would not act like all the other central banks – growth must come at any cost, including or especially bubbles. The PBOC would take some meausure, a burst of optimism would result, failure ensued and the repeated call for more. It is entirely possible that the PBOC is acting in that manner and its steps are simply ineffective (that is the eurodollar world now, after all), but it is perhaps much more likely that mainstream simply sees in everything the central bank does that which it “wants” or at least expects as an orthodox apparatus.

The big step last night was what is almost universally assumed as “devaluation.” The proximity to the export disaster, in particular, makes that seemingly so easy of a leap. The monetary textbook says that in an export drag you devalue the currency. It’s just too neat for it to be anything else?

I don’t have any special knowledge of what the PBOC has done and what it intends of what it has done, but neither does anyone else. The central bank under Zhou has been quite consistent for almost two years in its reform pathway so I tend to think that unless something crashes, really crashes, that is still in place. So to interpret what has occurred in China we can only infer from what we reasonably assume is correct.

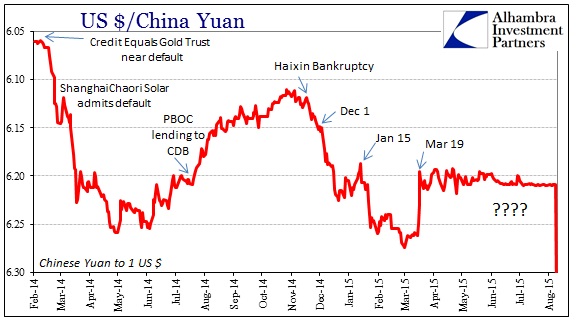

And that starts not with the economy but the yuan itself, or, more specifically, its relationship with the “dollar.” In the past four almost five months, the yuan suddenly ceased to be meaningful. The artificial stillness practically begged for a PBOC relationship, as there is no way that the yuan’s nothingness was itself a natural occurrence. Thus, if the PBOC was intervening there, and there is a great deal of circumstantial evidence that they were, it was clearly only as a means not of “stimulus” but of last ditch stability.

This artificial period pre-dated the stock crash, but to think they are unrelated in terms of instability is perhaps too much of a stretch. That would suggest the internal situation in China finance might be more roiling than is let on – and that seems to be the point. The PBOC dictum in whatever it has engaged under “reform” has been in that direction – to preserve some semblance of stability while trying to manage a bubble decline of biblical proportions. That meant letting the economy go wherever it may go under such conditions, but stability in that decline is and remains, I believe, paramount.

Thus the yuan/”dollar” relationship would be under that paradigm, especially as the “dollar” relates to both real economy trade terms and contributory to the financing environment even internally. In prior episodes of “dollar”/yuan breakout, the direction was exactly the same as today; “devaluation.” That wasn’t as much consistent with the yen and what BoJ has been doing (which, clearly, the Chinese are very much aware of following too closely in Japan’s treading) as just the labor under the eurodollar “short.”

These clear disruptions are exactly that, disruptive. That is why, I believe, the PBOC has acted typically to intervene and reverse those damaging, disorderly “devaluations.” In other words, the PBOC has in the past year and a half acted where the mainstream calls it “stimulus” to stop the yuan from further “devaluation.” Finance over orthodox economy views.

That makes sense under, again, reform and the financial realities it creates. This latest “dollar” disruption, particularly since May, is quite different than the past two clearly shown above. In other words, the “dollar’s” aftermath more recently has caught the Chinese in a particularly precarious situation, financially and economically. That, I think, is why the PBOC intervened and did so in such heavy handedness as to essentially blot out the yuan’s “dollar” problem entirely.

We know from close experience (looking at you Brazil and Russia, even Switzerland) that such deep and persistent intervention is inefficient and over time highly “expensive.” The central bank can only “buy” time and hope that that is enough to cover any imbalance or disruption. Therefore it seems quite consistent that the PBOC at some point was going to be forced to simply give up before it endangered further disorder to the point of internal dynamics far beyond the bubbles.

That would suggest that today’s “devaluation” was not, and that it was simply the yuan expressing, finally, what it would have had the PBOC not been intervening this whole time. The timing of the move, the day after some very troubling export, import and production figures, is not “devaluation” “stimulus” but rather how financial instability even with the yuan pretty much pegged recently grew too much to handle. In other words, those numbers placed China back in a very troubling trajectory against more recent optimism all those past “stimulus” (that wasn’t) had worked; the strain under that more pessimistic view seems too much for them to bear any longer. The “market”, such that it is, seems to have “won” as neither the “dollar” nor the Chinese economy is anywhere close to letting up.

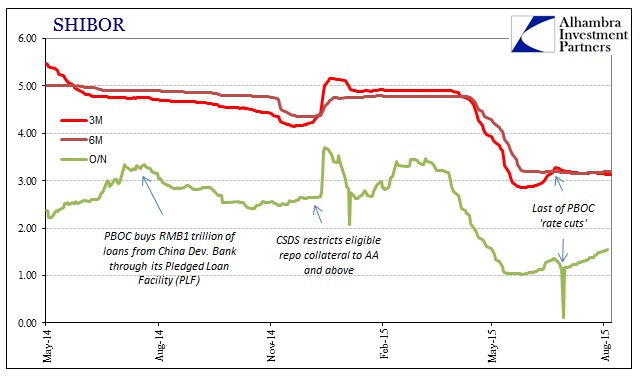

There is some further circumstantial evidence for that view. SHIBOR in the latter maturities, the three-month in particular, had jumped in June flattening out with the 6-month maturity. Overnight SHIBOR has been rising steadily since early June, “against” those rate cuts particularly the last two.

Since, in many ways, external “dollar” financing leads to internal yuan financing, the PBOC intervention into that “dollar” dynamic may have had the very real fact of restraining too much internal mechanisms (try as they might, there is still a working difference between central bank “liquidity” and market-based).

The PBOC had thus reasonably been straining against the “dollar” in the hope that it would relent at some point, and that China would find itself under a far more favorable global outlook with which to run off more immediate pressure. The economic data yesterday ended any such immediate hopes.

It may be that the PBOC intends to devalue as all the rest seem to claim, but in my view the yuan’s move is simply tied to the inability of the central bank to continue to artificially suppress financing volatility and disorder – they reached a moment of maximum pressure and decided, especially in light of yesterday’s very discouraging data, that it would be far too “expensive” or inefficiently stabilizing to continue. Thus, the yuan did as it had done in those prior two “dollar” versions and moved down against the rising “dollar.”

It was, in the end, just a 1.8% move (in the first day) and the rest of the global “markets” aren’t exactly enthused (UST’s bid everywhere, with the 10s down under 2.12%) by this as “stimulus.” In a world still tied to wholesale, wholesale is usually the first place to look.