I recently pointed out that the Fed’s 5-year campaign to drive the 30-year mortgage rate from 6.5% to 3.3% had accomplished nothing except to touch off another of those pointless “refi” booms which enable homeowners to swap an existing mortgage for a new one carrying a significantly lower interest rate and monthly service cost. Such debt churning exercises have been sponsored repeatedly by the Fed since the S&L debacle of the late 1980s.

I further noted that this time the Fed had really outdone itself:

During some periods upwards of 80% of new originations were not money purchase mortgages to finance a new home, the declared purpose of interest rate repression, but just refis of existing debt. By resorting to this maneuver to leave more money in the pocket of borrowers each month, our monetary central planners undoubtedly hoped that America’s flagging consumers would buy another flat screen TV, dinner at Red Lobster or new pair of shoes.

The choice of a flat screen TV or mortgage payment ought to be up to the American people, not the monetary politburo in the Eccles Building. But even within its own terms, the Fed’s massive refi party made no sense. That’s because unless the Fed intended to peg the mortgage rate at artificial, sub-economic levels for all time to come, its refi maneuver could only shift consumer choices and their mix of spending between quarterly GDP reports; it could not generate permanent gains in national output and real wealth.

In fact, the Fed’s interest rate pegging policies amount to an arbitrary transfer of wealth from mortgage investors to mortgage borrowers—and even that is ultimately temporary. Capital markets do eventually, and often violently, reject central bank imposed financial repression—- as they did during the Great Inflation of the 1970s when bond prices plummeted.

So it was evident all along that even the mighty Fed would have to eventually take its thumb off the scales in the treasury market, thereby permitting benchmark interest rates to “normalize”. In that event, mortgage rates would rise and new homebuyers would find themselves spending more on their mortgage and less at the Red Lobster. And on the margin, a higher so-called “cap rate” for residential real estate would mean that housing prices would tend to weaken, not rise. The whole exercise was ultimately a circular delusion.

Even though this cash flow shuffle is perfectly silly, it has been stubbornly pursued by our paint-by-the-numbers Keynesian central bankers because they refuse to acknowledge the reality of “peak debt”—especially in the household sector. Yet only a permanent gain in leverage can cause consumer spending to remain elevated in response to monetary stimulus.

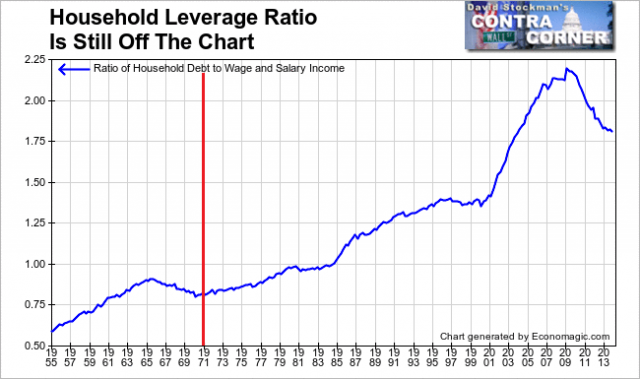

The overwhelming evidence, however, is that America’s shop-till-they-drop consumers have finally dropped. After a forty-year cycle of soaring household leverage ratios, “peak debt” ratios were finally encountered in 2007-2008— and now retrenchment has set in. Accordingly, consumer spending will now have to come solely out of income, not income plus incremental credit drawdowns which fueled the spending party for decades.

Household Leverage Ratio – Click to enlarge

But while peak debt means that the Fed’s entire 5-year money printing spree was destined to fail, it nevertheless has produced massive impacts—–all of them bad or stupid. One of the most crucial is that it generated an artificial refi windfall to the Big Banks which now dominate the home mortgage business. And the profit windfall was a doozy.

Now that financial results for Q1 2014 have been posted, the impact on Big Four financial results can actually be quantified. The four charts below on mortgage originations per quarter during the course of the Fed’s balance sheet expansion binge are the smoking gun.

They show that during the most recent quarter the four banks only originated about $67 billion in new mortgages on a combined basis. That figure is a reasonable proxy for the steady-state condition that would have existed had the Fed not been engaged in a monetary cattle drive to get mortgage rates to the bottom of the valley. That is, had mortgage rates remained at their not unreasonable 2008 levels or oscillated randomly owing to the interaction of supply and demand for mortgage funds on the free market, there would have been no thundering stampede by American homeowners to refi their housing debts.

Accordingly, activity rates in the mortgage operations of the Big Four would have reflected mainly purchase money borrowing by households who were buying a new or existing home. So the difference between the peak mortgage origination rates shown in the graphs and Q1 results roughly measures Bernanke’s gift to the big banks.

On a combined basis, the Big Four originated mortgages at a peak rate of nearly $300 billion per quarter—or $1.2 trillion annually during the period between 2010 and early 2013. So the refi maneuver resulted in up to a 5X gain in the rate of mortgage originations—a process that gave rise to a triple dip of profits, as previously described:

As summarized in the Fortune article below, the mortgage originators were booking up to $3,300 of up front profit per refi.

And that was just the fee on the transaction—before booking the embedded “gain-on-sale” (often thousands more) when most of this booming mortgage volume was subsequently shuffled off to Freddie and Fannie to be packaged and resold as an MBS. Yes, and at that point, such newly minted “mortgage bonds” did flow back to Wall Street where they were doubtless churned many times over by the dealer side of the banking houses in their endless and remunerative chore of supplying “liquidity” to the homeowners of America….So the banking side of the Fed’s refi churn did well too—–enjoying a triple profit dip along the way.

As can be seen in the graphs, the windfall in some quarters was even more stupendous. The peak rate for Bank of America was 10X its Q1 2014 rate and for Citi it was 9X.

Yet the real story is in the Wells Fargo (WFC) data. During the third quarter of 2012 it originated $100 billion more in mortgages than it did in Q1 this year after the Fed’s refi cattle drive had ended. Stated differently, the geniuses who run Warren Buffet’s favorite bank were handed a giant book of totally artificial businesses by the Fed— and the consequent opportunity to triple dip from mortgage volumes that amounted to nearly one-half trillion at an annualized rate. WFC had indeed learned at the knee of the nation’s master crony capitalist.

It should not take more than a moments reflection to grasp the hidden function of the massive mortgage churning shown in the left side of these graphs compared to the meager (and more market neutral) levels shown for Q1.Triple-dipping through their massive mortgage churn, the Big Four banks were able to book net income of $20-25 billion per quarter from originations, gain-on-sale and mortgage trading during much of this period.

It should not take more than a moments reflection to grasp the hidden function of the massive mortgage churning shown in the left side of these graphs compared to the meager (and more market neutral) levels shown for Q1.Triple-dipping through their massive mortgage churn, the Big Four banks were able to book net income of $20-25 billion per quarter from originations, gain-on-sale and mortgage trading during much of this period.

That means that thanks to Bubbles Ben’s largesse they could pretend that their balance sheets were being repaired. Accordingly, raiding their equity accounts in order to fund dividends and stock buybacks was now fully copasetic.

So Uncle Warren along with his fast money trend followers got their reward in a munificent flow of cash out of bank vaults that had been wards of the state only a few months earlier—as did long suffering executives who’s stock options rose 5X in value owing to all the dividends and buybacks.

Indeed, during fiscal years 2009-2013 Wells Fargo disgorged $59 billion in cash to fund dividends and share repurchases and JPMorgan paid out $65 billion during the same 5-year period. Needless to say, $110 billion of cash flowing toward the bank stocks post at the Wall Street casino had the hedge fund speculators who continuously cycle in and out of these names delirious with excitement.

Likewise, their echo boxes in the financial press were quick to pronounce the all clear. The economy is fixed, the banks are back, and their stocks are soaring—surely proof that all is well. Compared to post-crisis lows, WFC’s stock price was recently at 6X (i.e. $60 per share vs. $10), JPM and BAC were at 3X and even the zombie known as Citi was at 2X.

Yes, some of the banks also raised new capital—especially in the early years after the crisis. But that was mainly a smokescreen to give false credibility to the phony “stress tests” concocted by Turbo Tim and Bubbles Ben. But even giving credit to new equity issued—the net cash distribution by WFC and JPM over the five-year period was just short of $80 billion. Adding in BAC, the Big Three distribution of cash for share repurchases and dividends amounted to nearly $35 billion during 2013 alone.

It goes without saying that this all amounted to a lot of “shareholder friendly” action—even if it did constitute horrid public policy. And Washington’s policy of allowing the same big banks—who allegedly brought the financial system to the brink of Armageddon just 66 months ago— out of supervisory lock-up is indeed horrible.

Every dime of big bank profits—honest earnings and windfall gains like these from the refi contraption alike—should have been sequestered on their balance sheets for years and years to come. Or at least until one of two conditions pertained.

One option would have been for some of them to grow up and become real free enterprises. But that would require giving up the Fed’s discount window privilege, deposit insurance and undertaking an irrevocable renunciation of any future bailout claims on any agency of the state.

In the alternative, their balance sheets could have stayed in sequester during the entire five years since the crisis. This would have permitted retained earnings and capital to pile-up so deep that even the weak-kneed pettifoggers of the beltway would not be panicked into throwing the banks a life line next time they blow themselves up.

Neither option was chosen, obviously. Instead, while the Fed’s entire mortgage refi gambit did nothing for Main Street–except to confer cash flow windfalls on the less than 15% of households that actually did the refi— it did accomplish wonders on the Wall Street side.

Not only did it confer massive capital gains on speculators like Warren Buffet and the bank management teams who brought us the financial crisis, but it also amounted to a regulatory get out of jail free card.

Yet what was the all-fired hurry in Washington to open the flood gates to bank dividends and stock buybacks. Supposedly, that was to pepper the market for bank stock—so that they would raise new capital on their own.

Really? In our financialized economy and crony capitalist policy regime there is apparently no need for more bank capital. As was well demonstrated in 2008-2009, when push comes to shove the state treasury will be raided.

In the interim, its all about the secondary market. That is, goosing the price of existing stock certificates held by gamblers who scooped them up at the bottom and management teams who got themselves issued more options after Bubbles Ben pronounced the all clear.