Consumer credit is somewhat useful as a gauge for actual consumer behavior in actual activity, as opposed to consumer sentiment surveys which tend to follow stock prices (and be dominated by the upper incomes) and the theory on the “wealth effect.” In terms of the current “cycle”, or supercycle as it may be, sentiment and debt could not be further apart. That divergence has been offset only partially by the introduction of the federal government as a bank, but that is more illuminating of the cycle/supercycle than any part of the current economic fortitude.

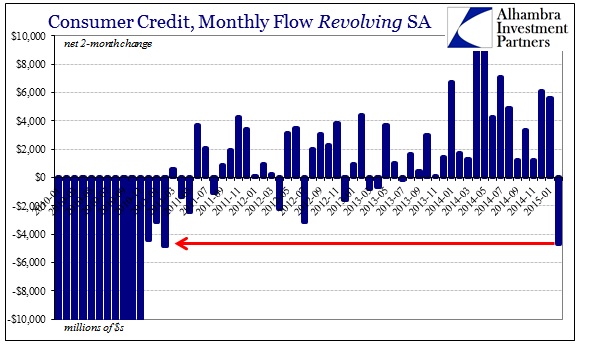

While measured and estimated sentiment has been steadily rising ever since the trough of the Great Recession, revolving credit usage has not. It wasn’t until 2011 that consumers stopped paying down, on net, credit cards. And even at that point there wasn’t a rebounding surge into debt as there had been in previous recoveries, including the “jobless” varieties that are now “somehow” normal. At most, beginning in early 2014, revolving credit has increased only modestly.

If the recovery had truly arrived in 2014 as the Establishment Survey awkwardly suggests, then the increase in revolving credit was fairly tame toward that idea. In other words, if there were indeed a “boom” with proper sustainability expected in not just jobs but wages, then credit card usage should have gained far more. But such interpretations are tricky as any increase in revolving credit is as much related to the end of any cycle as to its beginning.

The reasons for that are obvious, as credit cards for many people represent not an expression of sentiment but a last resort – the final means to maintain spending before being forced by lack of alternate sources to cut back on general and specific activities. That, then, raises the very important question as to whether 2014 was really the inauguration of the front end of the recovery, uniquely belated, or the responsible signal of its end.

When credit usage was found to have surged in April 2014, I suggested that was related to broad economic weakness in Q1. In other words, the last year’s winter quarter was no snow-related anomaly in the economic cycle but rather a very stark warning that there were deeper fissures in what was holding up the consumer end of “demand.” That surge in April proved to be a one-time increase, which would more than advocate that interpretation.

There was a second large increase in credit cards in December which coincided with the worst holiday shopping period in the recovery cycle. The combination thereof would seem to propose the “last resort” scenario as consumers were borrowing just to manage even meek levels of “demand.” Now that the credit card bills have come due, revolving credit has fallen in both January and February (and much more so in February) which is indicative of more dire consumer condition and nothing of a robust economic trend which should have no trouble with any of this.

As with so many other indications now, this is no longer the “typical” weakness associated with the supercycle persistence, as depths are being tested beyond anything seen even last year. This two-month decline in revolving credit is the largest cutback since 2011 when “deleveraging” ended. That alone would suggest something far different than what consumer sentiment projects.

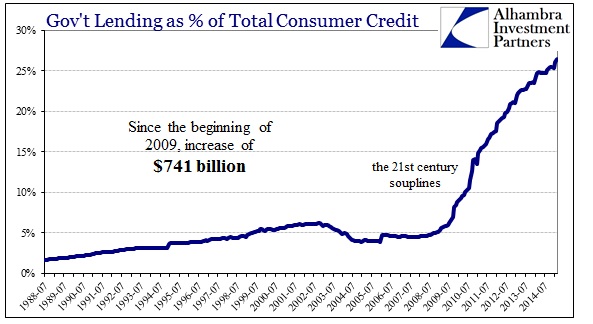

Economists are again emphasizing that this is “transitory” and/or related to winter, which is odd since a credit card is more easily used these days online than after physical conveyance of its holder. The combined effect of more recent revolving credit indications with nonrevolving government takeover (essentially) adds evidence to the idea that we have not left the prior cycle behind, and that the next “event” within that cycle may be far closer than anyone dares to suggest.

The practical effect of this actual fiscal “stimulus” through mostly student loans has not been to add to “aggregate demand” but rather to keep “students” out of the unemployment rate; it is the 21st century equivalent to the soup or breadlines of the Great Depression. Whatever you might conclude about January and February this year, it is clear that there is nothing of an economic “boom” within actual consumer activity totally dissociated from whatever the Conference Board or the U of Michigan assembles out of telephone data. There is an obvious malaise that has not relented, nor are there any signs it is about to. If anything, credit behavior is far more on the “side” of more troubling prospects ahead.