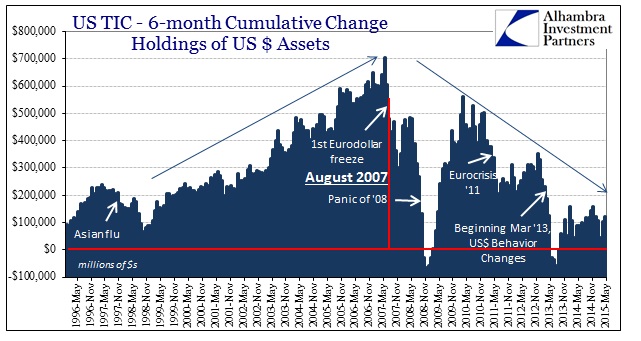

With almost everything turning lower this week under “dollar” pressure, it is imperative to keep in mind the apex asset class. In 2007, it was the ABX indices and various mortgage related structures that signified the how far along everything was; in this cycle it is clearly corporate credit. The disarray starts in the riskiest pieces and then moves inward and eventually, if left unchecked, eroding too much underneath with which to support what was once believed perfectly safe. Once there is no place to hide, the turn really begins.

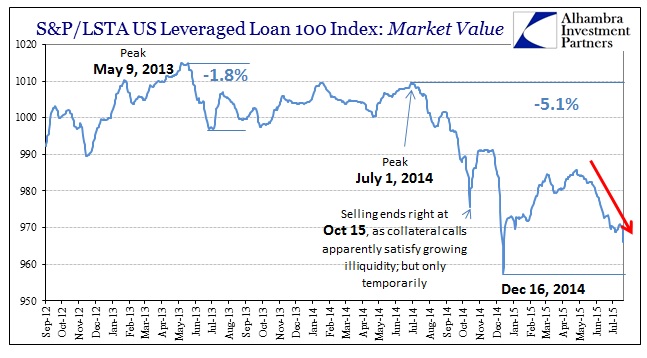

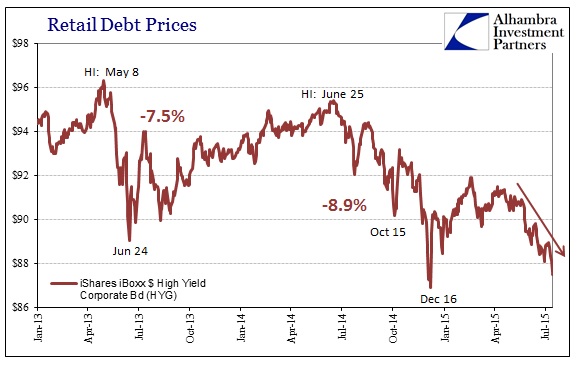

Leveraged loan pricing, among the riskiest of the corporate bubble, had been somewhat tame, even unexpectedly so, as commodities ran aground under the weight of global “dollar” funding. In the past few days, however, leveraged loans (at least what is visible and represented by the index; it is very likely that less liquid issues are faring far more poorly) have been sold as have junk bonds. The market value portion of the S&P/LSTA US Leveraged Loan 100 fell 5 points just in the past two days, all the way to 965.

Both junk bonds and leveraged loans are back down to prices far too close to the nadir of the last selloff in mid-December. That would seem to suggest, as UST’s (and the fast again flattening UST curve), that the broad credit and funding environment has turned far more toward that which prevailed in early December than the more benign mid-March to early May “pause.”

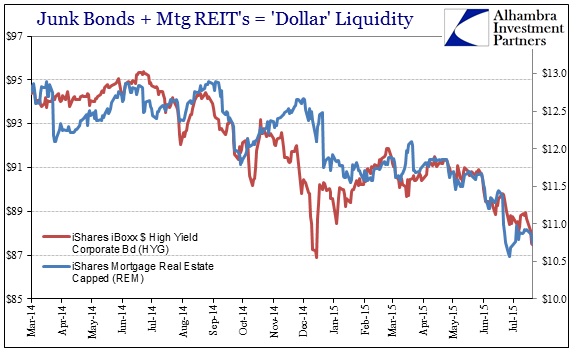

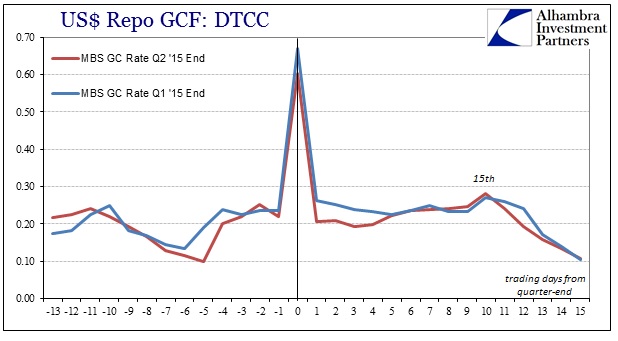

Undoubtedly, there are economic concerns playing a significant part of the selloff but it may be liquidity that is the proximate catalyst (which is just another expression of those economic concerns combined with perceptions about the Fed’s proclivity to make it worse).

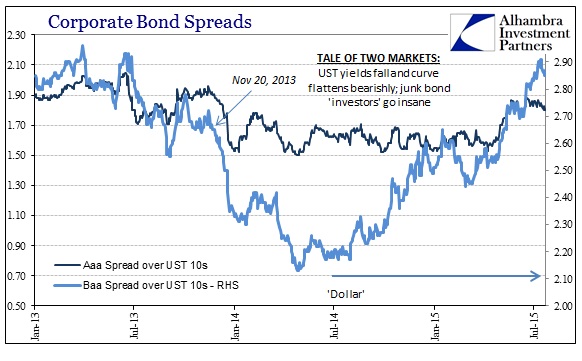

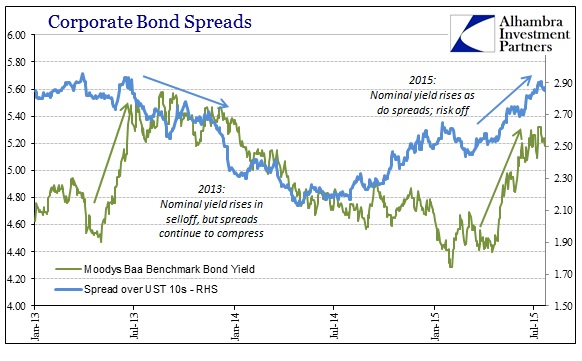

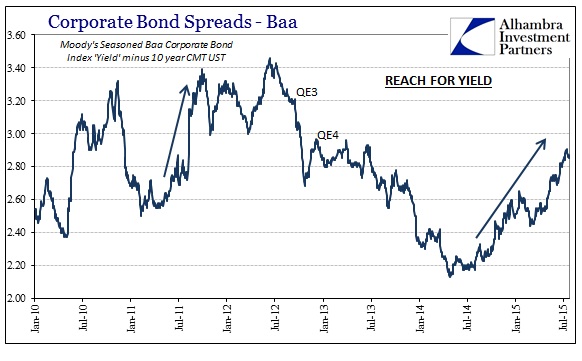

The combined trend in liquidity and the apparently persistent impulse toward selling is a dangerous combination, as systemic capacity is extremely poor and the incongruence of corporate pricing to actual, non-QE delivered risk is as extreme. The divergence between this heightened form of “reach for yield” and what bearishness that beset the treasury market is beyond remarkable, as if there was open bifurcation in overall credit back in 2013. Dating to right around November 20 that year, all bonds were bid but for very different reasons. Corporate spreads, especially junk, compressed until the middle of last year – what a difference two years makes, as the corporate bubble is belatedly catching the warning of UST trading.

The rising “dollar” has meant rising spreads, as the junk “curve” has actually retraced the entire taper euphoria. That is certainly a measure of the ongoing systemic reset for risk perceptions, but in the wider context there is perhaps a long way yet to go.

In absolute terms, this move under the “dollar” is almost as severe as that in the middle of 2011 which triggered the renewed eurodollar decay and eventually two new QE’s: in 2011, this measure of risk spreads jumped 90 bps from February 2011 until the end of that September and the Fed’s renewed “dollar” swaps. The current decompression is already 74 bps dating back to July 2014.

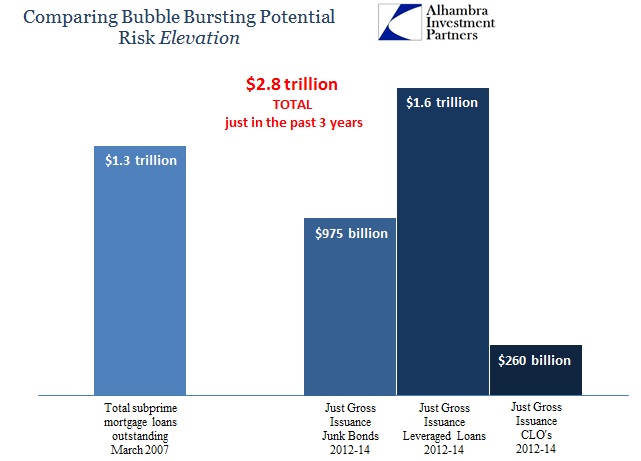

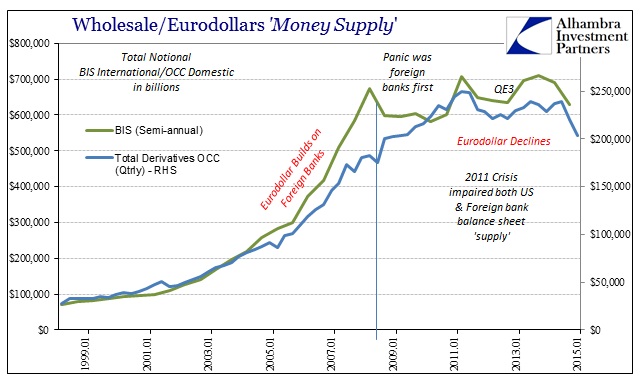

Again, it is the combination of liquidity (restrained and getting worse) and constant selling that ends up taking the next step. The real danger is if this continues past some unknown critical mass the entire herd will turn and there won’t be much at that point to offer support – the dealers are already out as are banks more generally. As a reminder, the size of the “herd” really escapes imagination: