The stock market takes off in holiday celebration of the FOMC being even less clear than it really has been in some time; perhaps going all the way back to Alan Greenspan’s intentional mush. Equity “investors” are happy that the Fed may be happy about the economy, even though there is nothing in actual markets (outside of stocks) to suggest that anything the Fed proclaims carries even the slightest validity. Growth and inflation are going to be good, so the philosopher kings in DC say for the sixth year in a row, this time enough to end ZIRP (after almost seven years) and get to tightening.

Axiomatically, ambiguity is not certainty but the degree to which ambiguous language is taken as a comfortable conviction shows exactly the game being played here. Stock investors expected this exact vagueness and since the received abstruseness was as expected it was certainly reassuring to bid equity prices. This is how far rational expectations theory has devolved.

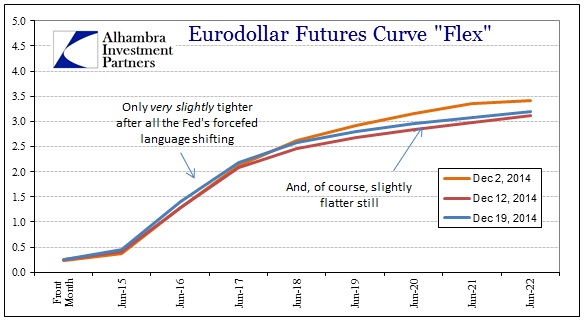

It is very curious, then, to see vastly larger markets unperturbed by anything that occurred at the FOMC this week. Sure, nominal yields rose in the treasury market a bit, though only slightly after an immense buying spree. Overall there was a distinct lack of distinction, and thus positive conviction, in credit and funding. The eurodollar market is only slightly tighter in the shorter tenors to where it was before the FOMC’s “radical” and “revolutionary” semantical modification.

The eurodollar market’s companion forward rate gauge, interest rate swaps, were also less than impressed by so much mushiness. There is nothing but more of the same here:

Given how much noise has been made over this last policy statement, you would think there would at least be a small imprint somewhere. Swap spreads have settled into this spread level going back to the first “dollar” tightening back in late June/early July which coincided with exactly zero FOMC policy shifts. Now, as the FOMC proclaims greater economic accomplishment, spreads remain undisturbed instead of decompressing still further as in stock-based rapture.

That was the case, though again not drawn out by policy language, in certainly the 5-year swap spread that had finally broken above 20 bps for the first time in over a year in late September and early October. However, the end of that trend on October 8 suggests reasoning there had nothing to do with economic confidence and everything to do with hedging against growing illiquidity and downright desperation. The timing of that and the following durability of the flatline trend in swap spreads more than suggests little anxiety about what the Fed might do and instead a concern about the world as it really is.

Again, we see that the illiquidity prior to October 15 was rather narrowly focused, and instead of being the end of the episode contributing to stability it has spread far and wide since then. That is particularly true of December, as there have been no shortage of global instability for stock markets to ignore.

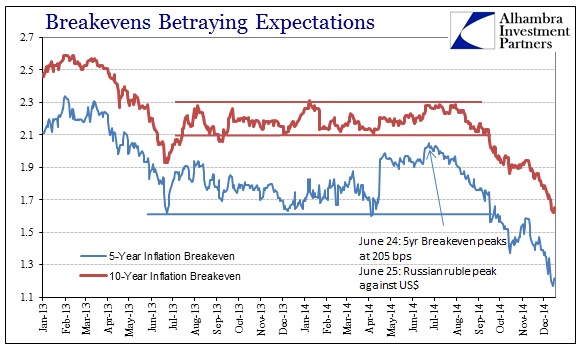

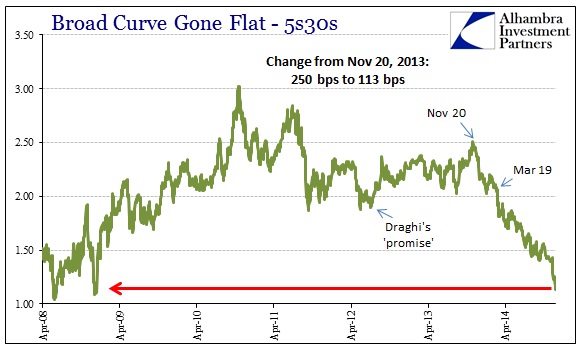

The yield curve collapse (and breakdown of “inflation” expectations) in December is strikingly reminiscent of the tumble in Brazilian reals and even the collapse of the Russian ruble. The treasury curve is plumbing new depths of flattening in a trend that is totally contrary to the end of “considerable period” consideration. The bearishness in credit and funding did not just start this month; not even back to October or June. This is a trend that has been in place for one day shy of thirteen months. That “resilience” plus the unbelievable size of these moves argue that shifting from “considerable period” is totally and completely irrelevant.

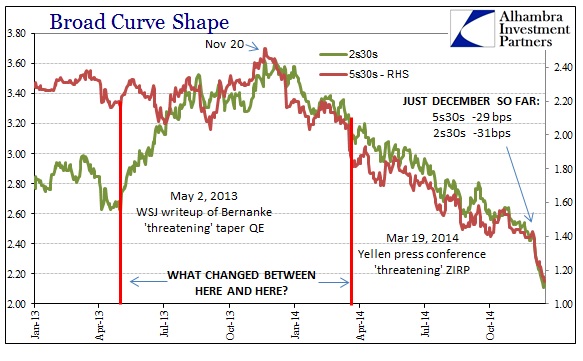

The latest iteration of credit revulsion on October 15, 2014, is shaping up in retrospect much like November 20, 2013. The first “event” back in November last year showed that exiting from QE-driven positions and capacities was going to be fraught with extreme difficulty, to the point, as expressed in the change in yield curve shape going back to that day, that it would be impossible without incurring significant disorder. Thus, the illiquidity that began in June 2014 was really confirmation of that, leading up to the liquidity system deformities that finally broke open on October 15.

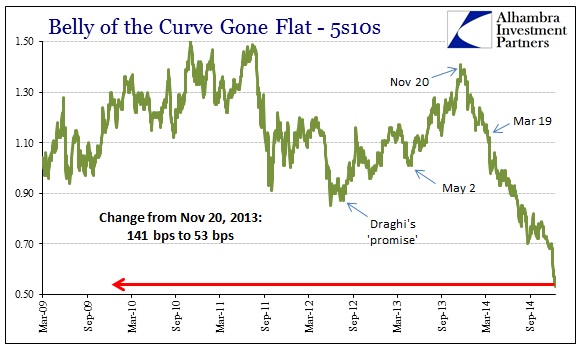

Try as they might to address it differently, the commonality of the eurodollar standard here is actually the erasure of central banks’ last stand. Looking at the charts for the UST curve (below) two aspects really stand out – that the curve had actually drawn steeper starting with Mario Draghi’s July 2012 “promise” to save the euro (followed not long after by Bernanke’s entrant into the “last ditch” efforts) and that “market” expression of economic “normalcy” along those lines has not just been erased but rather completely obliterated these past thirteen months.

So the difference between the credit reaction in May 2013 and that of March 2014, as I keep harping on, was not only that central bank exits would eventually be messy due in full part to the artificial approach which artificially pulled resources in artificially inefficient directions (especially liquidity capacity), but, more importantly, that there was and is no true economic recovery there to cushion the blow. In other words, October 15 and the behavior of the funding markets (the “dollar”) thereafter combines both aspects of monetary failure; that exits are messy and there is no sustainable or actual economic progress to successfully absorb either withdrawal or comprehensive and global recognition of this monetary miscarriage.

Thus, not only has the treasury curve flattening completely unwound any past optimism about what really amounted to nothing more than faith in monetary efficacy (steepening in 2012 and most of 2013), it has gone so far beyond as to revisit 2009 and even 2008. Central banks had only one more shot at it back in 2012 and credit markets have figured out that not only did it fail to work on the real economy, the distortions they created were actually harmful and thus there is nothing really left to support any of this.

The recovery is over because it never was. The Fed is now kamikaze and stuck on this course, having painted itself into a smaller and smaller corner in which to operate. Their only hope is that their confidence turns into your confidence, but credit and funding markets are impenetrable at this moment to such utter nonsense. For many places, it is already “look out below.”