There is a slow but steadily building sense that there is more than a little problem with systemic liquidity as it stands right now. While not quite mainstream, there has been some minor attention devoted to repo problems and now credit trading. An article in Bloomberg today does a pretty good job of sketching out the real world as it exists outside of theoretical DSGE models that the Fed uses to gauge the implications of QE and not-QE.

While the size of the U.S. bond market ballooned by more than $5 trillion since 2008 to $37.8 trillion at year-end, trading in the debt has slumped, according to data from the Securities Industry & Financial Markets Association. Average daily turnover fell to $809 billion last year from $1.04 trillion in 2008.

Unfortunately, the article misses the central timing of the slump, and thus a good piece of what is taking apart liquidity.

That’s partly because banks have pulled back from making markets in bonds as higher capital requirements make it less profitable. The business — where buyers and sellers are primarily matched over the telephone or through e-mails — has also suffered shrinking margins because of regulator-mandated price transparency and the rise of electronic trading.

Both of those factors are undoubtedly having a negative impact on credit trading, and thus liquidity, but, as the article even notes, those are only “partly” explanatory factors. The deficiency in systemic liquidity is easier to spot when you focus on recent chronology.

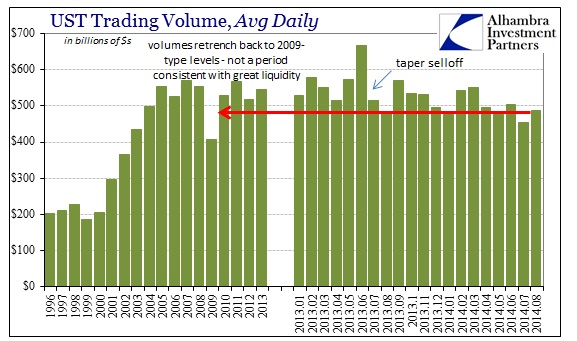

Trading in UST is now the lowest it has been since 2009, a year not exactly associated with great liquidity conditions. The trend lower in recent months began, with some irregularity, right around last year’s massive credit movement that was sparked by nothing more than Bernanke’s hinting at QE tapering. I have said consistently that the asymmetry of that episode is as stark an indication of systemic weakness as there can possibly exist. Unfortunately, we are still unraveling the downside ripples of that “event” more than a year later.

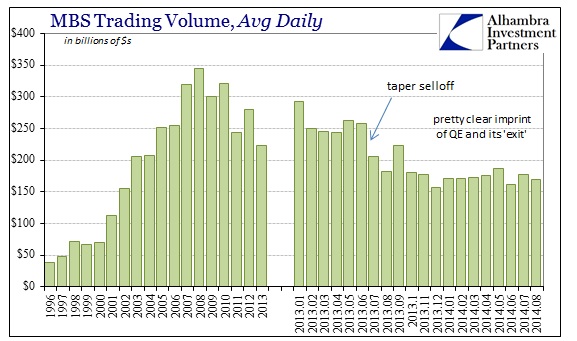

While there is clear erosion in UST trading, it is unmistakable in MBS.

Trading volumes here are back to 2002 levels. The trend is so large that it is easily discerned when viewing the credit market as a whole:

Again, the problem lies with dealers, as the Bloomberg story makes clear about profitability and employment in this area. But profitability was negatively impacted by capital changes and regulatory leverage (less of it) before the middle of 2013. I think it far more than reasonable that the changes in volume here are related to how banks were “booking” profits up to the QE-taper selloff.

It was “easy money” to load up on credit securities of all types when QE “promised” to be open-ended and nearly forever. Price appreciation was, in general, in the positive direction and as an almost matter of policy, given interest rates, that profit was tied more to prices than any kind of traditional or even bastardized and leveraged carry trade. What changed in the middle of 2013 was exactly that, that price appreciation was no longer assured and that actual risk of price reversal, of some severity, far outweighed anything that could be gained of holding large bond inventory. Thus capital charges only made much difference once the price direction changed.

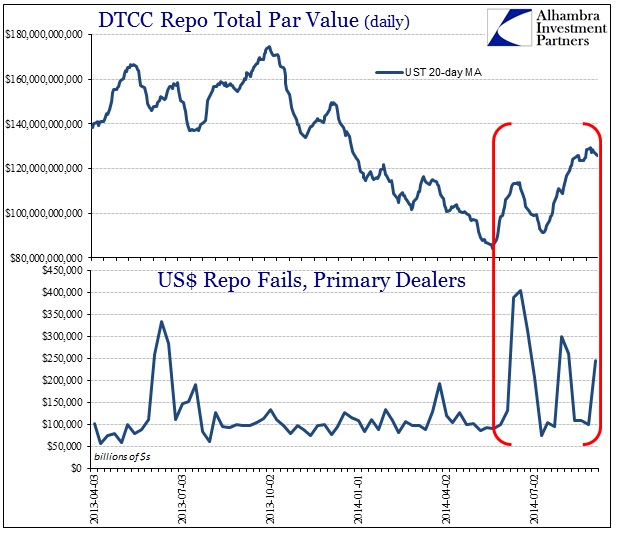

As inventory and proclivities toward credit holdings altered with QE assumptions, trading obviously followed. I have a strong suspicion that this is the systemic transformation that has eroded liquidity in the repo markets, even for UST. The lack of inventory available at primary dealers and other credit participants within reasonable reach of repo counterparties is likely why fails have surged almost regularly as repo volumes have risen since the middle of this year.

There is far less systemic “resiliency” in liquidity as a result of QE’s influence on artificially intruding into how resources were allocated during its run, and how that simply vanished (or severely curtailed) without it. With the Fed’s own reverse repo program an utter failure in that regard, the cracks in the system are open and evident without much by way of actual, sustained selling pressure.

That is the real problem here, as at some point there will be. How can this vastly diminished liquidity “exit” stand up to even a modest increase in uncertainty or shift in sentiment toward something less benign? This same warning was visible in early 2008 leading right into Bear Stearn’s failure. Of course, the level of repo fails then was much larger and more significant, but those were not nonthreatening weeks as they are right now.

The occurrence of repo fails outside of “normal” operation is a signal to what could potentially happen if conditions move toward less-than-ideal circumstances. Again, we saw that in action last May and June when relatively minor shifts produced massive ripples not just in credit, but globally in asset classes beyond just MBS, UST or even credit. That was the same as it was in 2008, where liquidity, or more precisely its absence, ended up with severe price impairment almost everywhere.

That offers a suggestion as to why central banks are so very keen on maintaining positive spirits and the optimistic tendency. They cannot be eager to test the resolve of diminished liquidity that apparently grows worse as time goes by. Janet Yellen talks about how “resilient” markets have become, but in any meaningful sense that is contradicted here. Instead, her proclamation rests upon the type of risky, bubbly behavior that even her own FOMC members now openly question.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com

.