By Tyler Durden at ZeroHedge

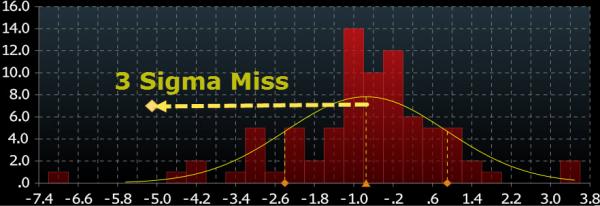

Durable Goods Orders crashed 5.1% MoM, far below the worst Wall Street forecast…

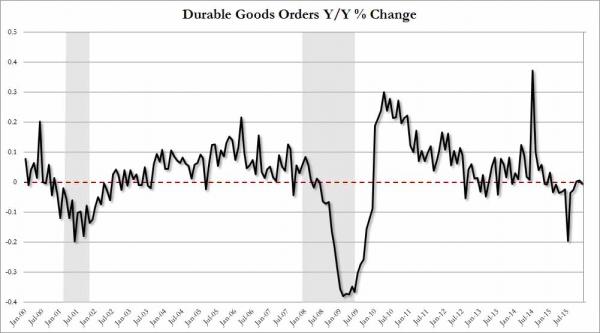

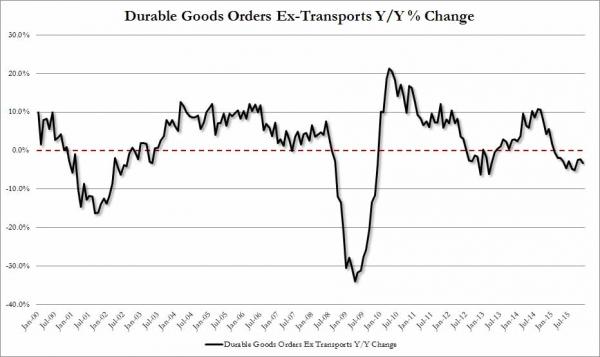

… and turned back negative YoY as both sets including and ex-transports continues to deteriorate, flashing that a recessionary environment is already upon us (if not an actual recession).

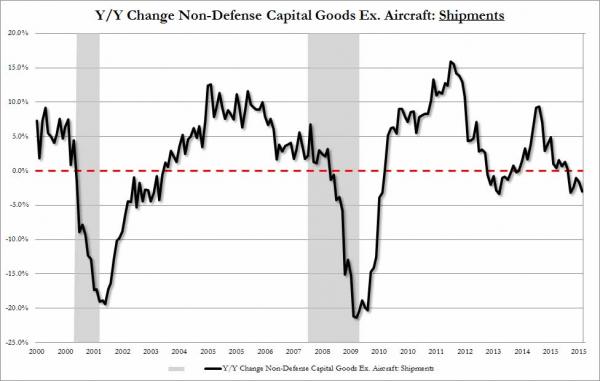

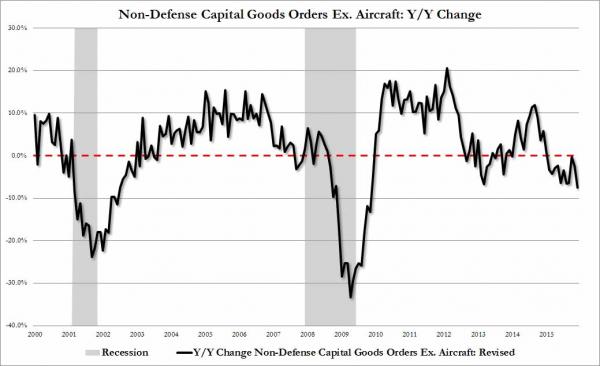

However, it is in the core – non-defense ex-aircraaft – segment that we see the real bloodbath as shipments plunged and new orders collapsed 7.5% YoY – another “worst since Lehman” moment. Of course we still have bartenders and waitresses to maintain the US economy so this is just transitory weakness in the stock market’s most-dependent segment of the economy.

Headline data turned back red YoY.

Ex-transports remains in Recessionary Negative Territory.

Actual shipments of core capex tumbled along with everything else:

And finally the real change – capital goods orders are collapsing at the fastest rate since… Lehman. Note that the US economy has never seen a decline like this in recent history without it being a recession, or just ahead of one.

Of course – this is all nothing that a good rate hike won’t fix, with all its confidence-inspiring sentiment.

Source: Durable Goods Orders Crash to Fresh Crisis Lows, Scream Recession – ZeroHedge