By Tyler Durden at ZeroHedge

One recurring question posed to finanial pundits in the financial media over the past two weeks has been “is this rally real” with the bullishness of the response usually directly proportional to how many assets any given pundit is trying to offload.

While we don’t know if the rally is “real”, and how much longer this unprecedented short squeeze can last, courtesy of a BofA note titled “Where to look for hedges if looking to fade the bounce in risk assets” we now have a breakdown of the cheapest hedges available for those who are eager to fade the rally and to prepare for the next leg lower in risk assets.

But before we lay out the summary of cheapest hedges, it is worth noting that as BofA’s Jason Galazidis observes, in the last month FX vol (average of EURUSD, GBPUSD and USDJPY vols) have exhibited a sharp rise owing to a multitude of factors such as the highly anticipated ECB meeting in Mar-16, a build-up of uncertainty leading to the UK’s EU referendum in Jun-16, and (likely) BoJ policy fatigue. Consequently, FX vol has joined the ranks of equity and commodity vols, all of which currently stand well above their long term median levels. This, to BofA, evokes a landscape of broader and more protracted uncertainty that markets have not witnessed since 2011-12.

As a result, we know that FX hedges are now expensive. So what isn’t?

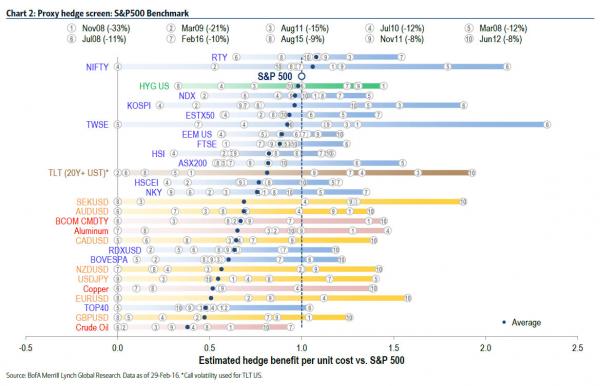

According to Galazidis, proxy hedging the S&P500 with Russell (small/mid cap US equities) puts remains attractive – in fact, even more so than in mid-Jan, when we last highlighted their value in “Here Are The Cheapest Hedges For A Systemic Collapse.”

And here is the punchline for those who believe that the current bounce is temporary and a repeat of the February selloff is just a matter of time, and the best way to hedge, or profit from it. To wit:

Proxy hedging S&P500 with RTY (Russell 2000) puts continues to offer material value: A repeat of the Feb-16 sell-off would see RTY puts generating ~60% greater hedge benefit than S&P puts, at current pricing.

Before we get into the details, here is a quick look at the cheapest hedges across all asset classes, not just the S&P as a proxy underlying.

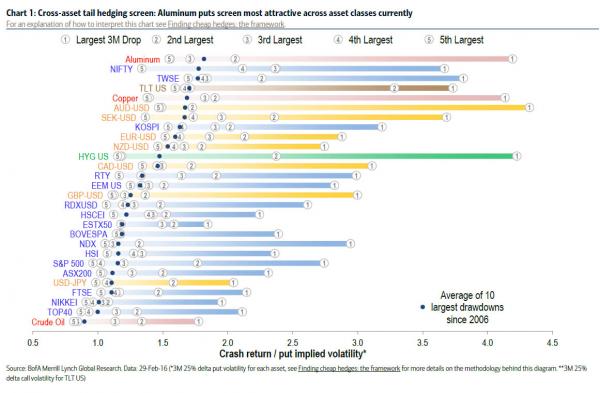

The chart below shows crash returns of different assets during historical tail events per unit of current OTM option implied volatility. Tail events are measured by the 10 largest 3M drops since Jan-06. Ranked by the average, the analysis shows that Aluminum and EM equity (NIFTY, KOSPI and TWSE) puts as well as TLT calls offer most value across asset classes, given the distribution of historical shocks in respective markets.

- Aluminum puts screen as best value across asset classes, perhaps unsurprisingly given Aluminum is one of the few risk assets that is up YTD.

- Interestingly, TLT US calls rank well (4th most attractive hedge across all assets) despite TLT having already gaining more than 5% YTD.

- NIFTY, TWSE and KOSPI puts still offer best value among global equities, while RTY puts continue to stand out as the most attractive hedge in DM.

- NIKKEI and USDJPY puts currently rank as the most expensive hedges across DM equities and FX, respectively. Interestingly, both Japanese assets were offering among the best value as recently as Aug-15. This suggets a higher volatility premium on Japanese assets as well as (likely) diminished BoJ credibility since the introduction of negative rates in Japan.

But what if you don’t care about systemic risk, or coordinated global crashes, and simply want to isolate tail, or just general, risk in the S&P 500?

According to BofA’s calculations, as noted above “proxy hedging S&P500 with RTY (Russell 2000) puts continues to offer material value: A repeat of the Feb-16 sell-off would see RTY puts generating ~60% greater hedge benefit than S&P puts, at current pricing.”

The chart below shows the ratios of historical crash betas (versus a benchmark) to relative hedge costs (see Benchmark proxy hedging in Finding cheap hedges: the framework for a detailed explanation of the methodology). Whenever a proxy asset does not decline for a given sell-off in the benchmark, this hedge benefit is registered as 0, highlighting the basis risk of proxy hedging.

As we pointed out in January, for good proxy hedges, look out for:

- Average hedge benefit per unit cost > 1 (better value than the benchmark hedge)

- Closely distributed hedge benefits in past sell-offs (consistency of proxy hedge)

- Min hedge benefit > 0 (low basis risk to benchmark)

Bottom line: proxy hedging the S&P500 with Russell 2000 (small/mid cap US equities) puts remains attractive – in fact, even more so than on January 25 when we last highlighted their deep value, and which then resulted in substantial gains just days after following the February plunge resulting from the BOJ’s January 29 NIRP announcement.

Source: Don’t Believe The Bounce? Here Is How To Make 60% If The February Selloff Returns – ZeroHedge