It is becoming settled wisdom that the most dangerous aspects of any current financial contours are due almost entirely to some version of HFT or electronic trading. That is undoubtedly true, as far as it might relate to one aspect, but to claim that computers are the single biggest source, let along only source, of financial impropriety is obtuse. The only question is whether that is intentional.

Last week was replete with warnings about liquidity but almost exclusively upon computer trading in treasuries. As with “evolution” in other “markets”, UST traders have left almost entirely the cash market and are dealing “depth” more so in futures. Such a shift isn’t obvious in why liquidity would falter, especially on October 15 which seems to form the basis of so many of these anti-computer tirades. Convenience is, of course, the first parameter necessary for the scapegoat.

The misconceptions about October 15 are growing in that respect, and I can’t help but think that is the goal. On the contrary, so many aspects of “dollar” function seem to have ruptured at that point so that even if HFT was a problem in the opening hour of that trading day, it was but a symptom of far deeper and maybe even intractable instability.

We know this without much ambiguity because of various market breaks documented all over the funding space. Perhaps the biggest and most relevant, tying economic concerns with financial, was in crude oil.

Long-term U.S. crude oil markets flipped into contango this week for the first time in years, as the dizzying descent in prices unleashed a wave of hedging by oil producers fearing prices may not stay above $80 a barrel for long.

Contango, in which longer-dated futures are more expensive than near-term contracts, has yet to take hold at the prompt end of the oil futures curve, from the front month, November 2014, well into 2015.

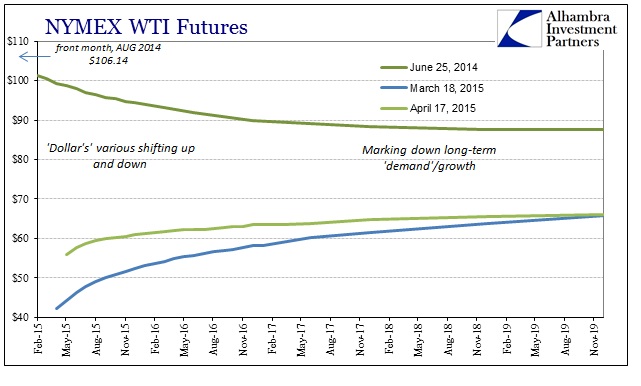

That was written into an article dated October 15, 2014, published at 9:08 pm after “it” was all over – or so everyone seems to want you to believe. The crude oil futures curve is most “naturally” in backwardation as it represents a real hedge for producers (as opposed to bond hedges and other financial elements that are removed expressions of something else; crude futures are actually tied to physically clearing quantities of a real substance). The break in the “dollar” that started back in late June had already pushed the curve flatter by October, but it was the drama of those first two weeks, culminating in the 15th, that radically altered the financial expression of clearing crude oil supply/demand.

To which most simply observe the supply end as if that were the fullest explanation for this radical alteration. There is some truth to that, as WTI curve mechanics began to diverge from Brent more than suggesting that WTI trading was taking on a more domestic shape somewhat divorced from the global market. In early June 2014, Bank of America/Merrill Lynch analysts were suggesting that supply increases would eventually overwhelm backwardation in WTI and send it into contango in the second half of last year:

For this reason, even a modest surplus at the Oklahoma pricing point in 2H14 could result in an abrupt shift in the term structure of the WTI market. Given this backdrop, we see a risk of the WTI market moving into contango and maintain our view that WTI crude oil prices will head down to $94/b in the second half of the year.

If we assume that the BofAML analysts were close to target on their observations of WTI curve mechanics, that might serve as a baseline suggestion of the “supply effects” upon oil prices. They were expecting that supply would build into inventory (again, this was never unexpected as most commentary on the subject tries to suggest), push the cash price down and depress the curve into slight contango sometime toward the end of 2014.

Those expectations, which were not unreasonable even if they were a sharp break from prior assumptions, were sorely undercounting the dramatic shifts that actually occurred. The first of which was the “dollar” and its dynamics that wrought havoc on the front end entirely. WTI was pushed way beyond $94 to settle (for now) into the $40’s in early 2015. The futures curve did go contango, but not gently and slightly but rather insanely and steeply. That was far beyond any supply effects.

So where the drama of the “dollar” is most visible in the front changes to the curve, we cannot discount the fact that the much smoother and less volatile (which is how it is “supposed” to be) back end has shifted so much in the intervening ten months.

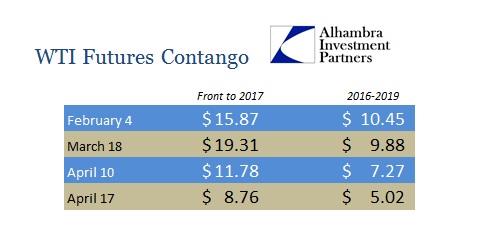

Oil producers under these conditions are going to be much more willing to sell crude for future delivery and store the physical commodity until then – that is what the steep contango curve “allows”, to easily absorb inflation and storage costs. Where the “dollar” continues to move the front end around based on more purely financial considerations, the back end is more and more about getting investors to take that future delivery. If the back end flattens out and moves down, that suggests an increasing difficulty on the part of producers to find willing buyers for future delivery at a consistently high price.

That means the whole of the WTI futures curve is a nice package of both financial and economic expectations and perceptions, both of which were radically altered before October 15, but with a defining break thereabouts.

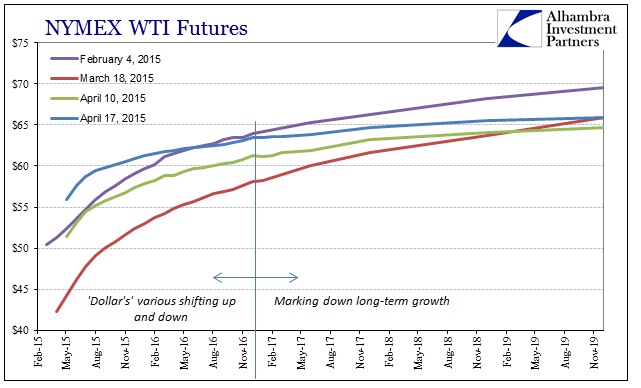

That fact has continued even in more recent trading, as the “dollar” shifted again on March 18 with that last FOMC retreat from ending ZIRP. As such, the front end of the WTI curve has been heavily “bid” but with very little change on the back end. The WTI curve “wants” to move into backwardation again, but the “dollar” and economic downgrades are making it difficult to do so at much higher prices – all of which suggests that what the “dollar” unleashed wasn’t limited to practical finance, instead was anticipation of these high difficulties.

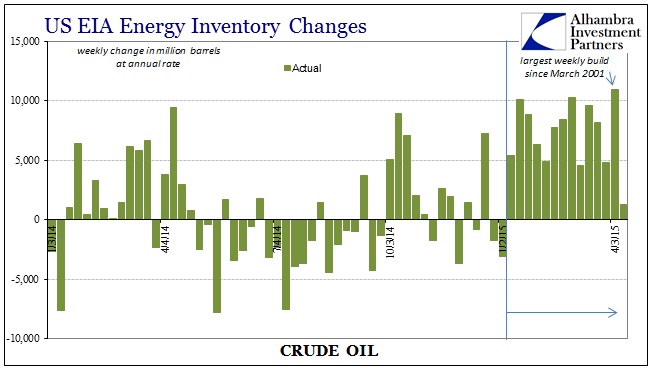

The inventory build in Cushing, OK, should have been fully expected from that moment the curve broke on October 15. In other words, these are “demand” side effects being carried out that are expressed in the form of the “dollar” and its central role on pivoting even the futures prices and structure of those prices for the most vital economic commodity of crude oil. Once backwardation was swept aside by the dramatic “dollar” illiquidity, the massive buildup in inventory was, without the “dollar’s” acquiescence, a foregone conclusion (the buildup itself was, as noted above, expected; the degree of it was not at all).

The next stage in oil price evolution, then, is also highly dependent on the “dollar’s” movements. If the curve attains more flattening at or around its current levels then the physical market might be more sorted out with a potential move upward. However, if the “dollar” begins to “act up” once more and steepens that front end, then that will exacerbate the inventory issue and further question the dynamics upon the longer end of the curve – meaning a translation into economic expectations. In other words, can buyers at the long end, trying to be assured of future growth by all those “transitory” encouragements of economists, withstand another run on the “dollar?”

Even to this point, with the front end rising as the “dollar” “falls”, does not suggest much for “normalcy.” The back end has continued to settle right around $65, which is highly uneconomical (as you may have heard) for a great deal of US production. With contango levels falling drastically of late without much effect on that longer end, does not represent that these new conditions are so “transitory.”

That is why October 15 is so deeply important to understanding the fractures that are already evident. It wasn’t an “event”, singular, as so much the final limitation holding back a shift from one outline of perceptions to the next; from more optimistic and “normal” to something entirely unfamiliar, uncertain and unsettling (literally, as in the case of crude oil). That interpretation would more than suggest as to why so many seem to want to demote that day’s significance into a limited and packaged tirade against computers as that would offer a far less malignant interpretation of perhaps even future circumstances.