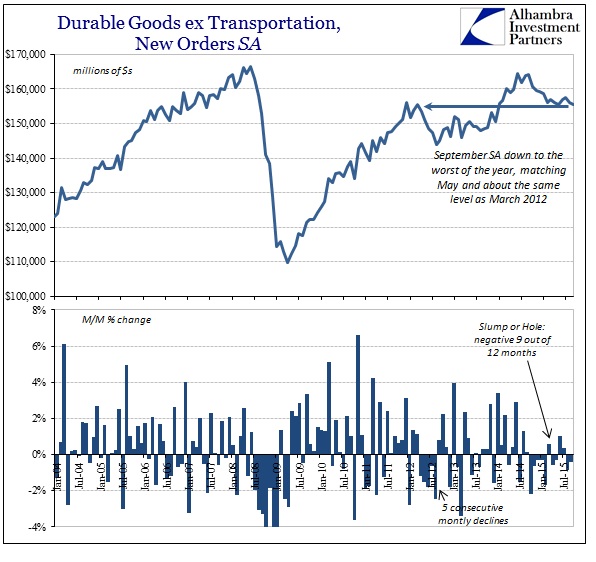

Anyone looking to buck the “dollar’s” direction in September has been sorely disappointed by almost every single data point so far. The latest is durable goods which was even more ugly across-the-board than August – and that includes the rather stark downward revisions for last month.

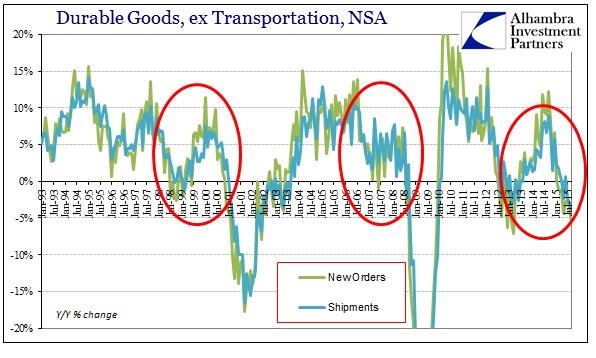

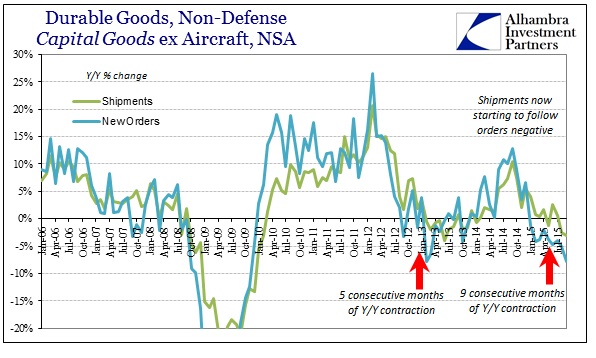

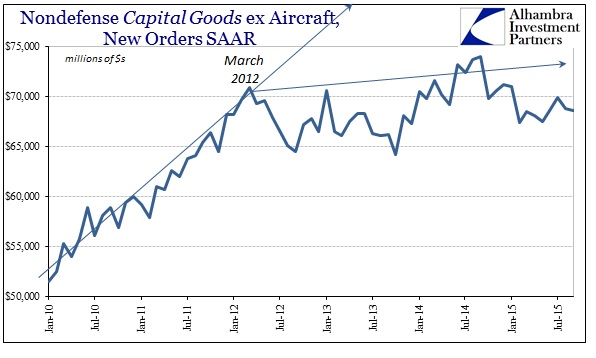

Year-over-year, new orders (ex transportation) fell almost 6% after declining a revised 3.74% in August; shipments have begun to track orders, as expected, falling 3.59% in September for the third consecutive month of contraction and four of the past five. Capital goods, a proxy for business capex, were even worse: new orders dropped just shy of 8% while shipments declined by more than 3%, forming what looks to be a steep downward slope.

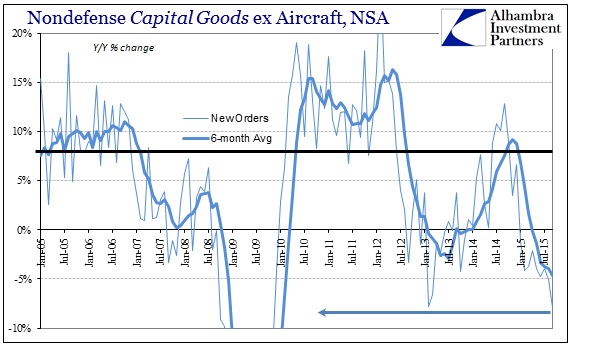

In terms of accumulating weakness, the 6-month averages in those series are either worse than the 2012 trough or matching it. It was that feebleness that surely convinced the Fed to engage in a third QE (and then another when the downside remained stubborn) at that time, a rather poignant comparison to the interest rate debate at the FOMC taking place today. Economists and policymakers have been at great pains to downplay the significance in manufacturing retrenchment as either unimportant or “transitory”, but the trajectory of the economy provided by this persistent downslope will not allow it.

Treasury prices are higher after the US durable goods orders report showed doubt about the economy’s performance during the third quarter. While September’s decline in orders wasn’t as steep as expected, prior months were revised much lower. This is leading investors to bring down their estimates of U.S. third-quarter economic growth, says Credit Agricole’s David Keeble, adding that Treasurys got a lift as a result.

When the dreariness of the end of “transitory” forces even economists to deploy anything other than glowing metaphors and descriptions of the economy you know it is quite serious:

Durable goods orders have been down in four of the past six months, a sign of the problems facing manufacturers as they struggle with economic weakness in key export markets like China. A stronger dollar has also been a drag, making American products less competitive overseas.

Economists said the new report provided further evidence of the headwinds. They were especially concerned by downward revisions in previous months showing weaker overall orders and a larger decline in the business investment category.

You will see in articles such as these that the “12%” figure has become the new staple of minimization, as in manufacturing “only” accounts for 12% of the economy or GDP. Even if that were true, which it is not, it still represents at least an early stage and severe economic issue with consumerism itself (which accounts for, these same people always proclaim, supposedly 70% of the economy – which is also a myth).

Underestimating what we see here of the economy (US as well as globally) misplaces the nature of this downturn. It isn’t so much that this data series is declining as a small part of the overall economic picture but rather the fact that both the trajectory has worsened and the contraction is lingering and accumulating. Given the inventory situation, that context places this gathering and dangerous dysfunction not as a process unto itself but rather as a warning marker that any potential downturn or recession is still only gathering. In other words, we are seeing some seriously troubling results already but still without the full measure of recessionary processes; including inventory.

It makes the mainstream narrative impossible to reconcile while at the same time confirming that early stage diagnosis – how can it be that consumers are so struggling yet jobs have been and continue to be great and at least good if slowing? Setting aside any trend-cycle interference along those lines, at the very least there has not been widespread layoffs and labor disengagement beyond the concerning labor force woes that seem now perpetual. If economists believe the Establishment Survey and unemployment rate, as surely they do even though they are in a world of their own, then they are quite wrong to dismiss any manufacturing recession as a sideshow since it is occurring while labor conditions are supposedly still very favorable. Typically confirming a cancer diagnosis does not lead to renewed focus on everywhere else a person might seem healthy.

In my view, that is where manufacturing is leading as a malignancy that may, on its own, be much less important and influential but when viewed as a part of an overall process confirms very severe malady yet to be fully manifested. Since the durable good series includes not just consumer spending but also business investment (productive, not financial) the interpretations apply to both sides of the economic ledger (demand and supply).