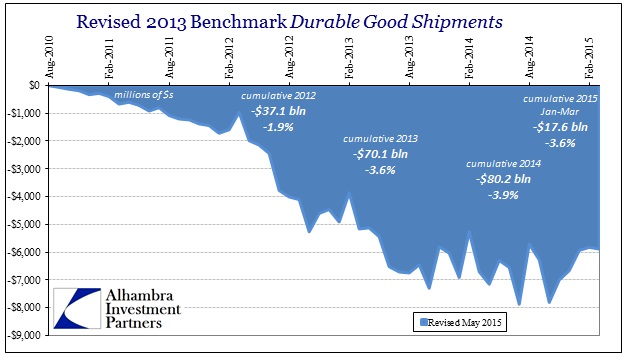

The benchmark revisions (trend-cycle) to durable goods left us with a smaller estimated economy but that wasn’t supposed to be a problem because all that matters supposedly is what comes next. In other words, the cycle was already deficient so the scale of that deficiency was not meant to suggest anything about the next phase, according to economic projections. If anything, however, this year is proving that benchmark revisions were significant and not just for an academic review of what has already transpired. The lack of sustained recovery, and its smaller presence, is most certainly a primary factor in why 2015 refuses, so far, to show any growth.

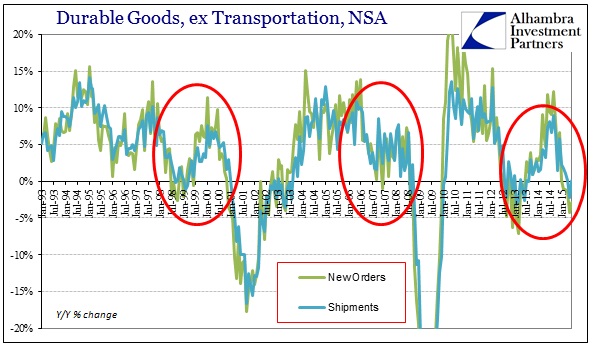

With data for June now being worse than the rest of 2015, there is no longer any doubt that we are well past the point of an “anomaly.” Durable good shipments continue to be flat but orders are now sinking quickly. Like retail sales, that is an ominous development as it suggests serious weakness being exhibited without yet the most pressing and recessionary processes. To my view, that is the attrition that is associated with the lack of recovery to this point, which makes those huge downward benchmark revisions quite relevant for extrapolating into the immediate future.

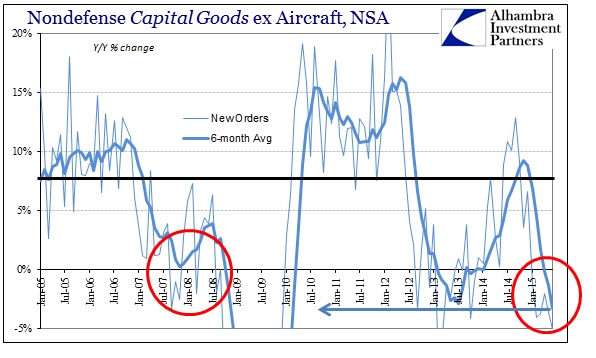

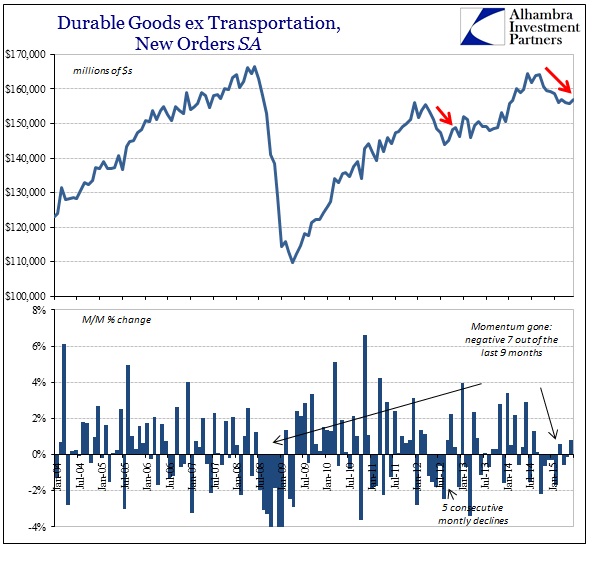

Durable goods shipments (ex transportation) were up just 0.11% year-over-year in June but new orders declined by nearly 3%. That follows a contraction in May of more than 4% (revised, more on that below), leaving the 6-month average at -1.8%. Capital goods (non-defense ex aircraft) shipments were also flat, at just 1.2%, while new orders fell more than 5%. The 6-month average for new orders for capital goods is -3.3%, the lowest since 2009. That would suggest that this contraction is far worse in absolute measures than the 2012 slowdown, which is already being weighed by its extension in 2015 to half a year without sign of abatement.

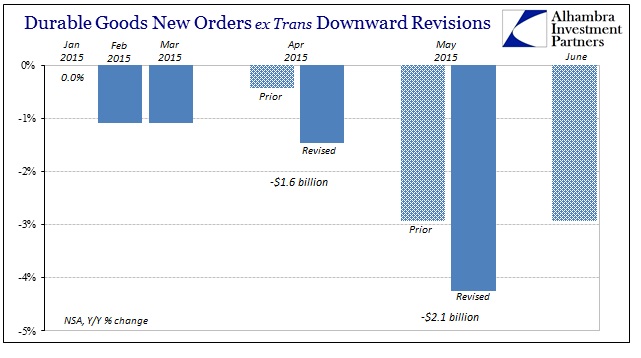

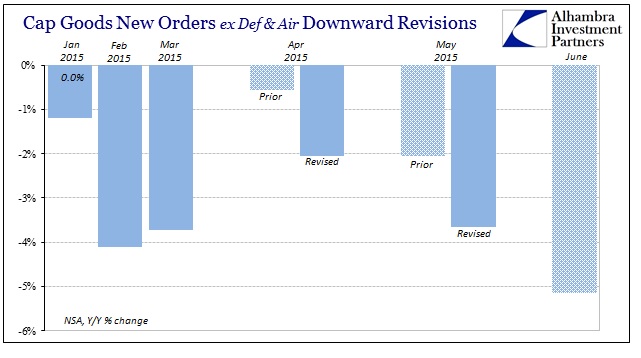

Not only are the incoming figures concerning, but the revisions to prior months are as well. Month-to-month variations in estimates are a part of the process, but they are not typically so wide. Since April, the monthly revisions (like GDP, durable goods figures are revised in an advanced, preliminary and final setup with the revisions to the final figures being usually quite small and trivial) have been large and downward. For April, the final estimate is $1.7 billion less than the advanced, while May’s first estimate has been revised down by $2.1 billion. That meant that May’s Y/Y calculation dropped from -2.94% to -4.26%. Capital goods orders were revised similarly.

In the seasonally-adjusted series, that meant what was a positive reading in May, +0.8% which was enough to compel, as usual, another widespread “the bottom is in” narrative, completely disappeared. That would at least call into question June’s seasonally-adjusted advance, but more importantly leaves the trend in durable goods as widening this year’s “hole” or “slump” into something that can no longer be dismissed out of hand.

Only two of the past nine months have shown any M/M growth, with June’s advance being the second. All of that adds up to nothing having changed about the contracting economic picture now completing a half year except that it may have been worse than first feared. That is certainly relevant to the second half which still has not found the full weight of recessionary pressures yet; meaning attrition so far to this point is nothing like what has been seen at any other time.