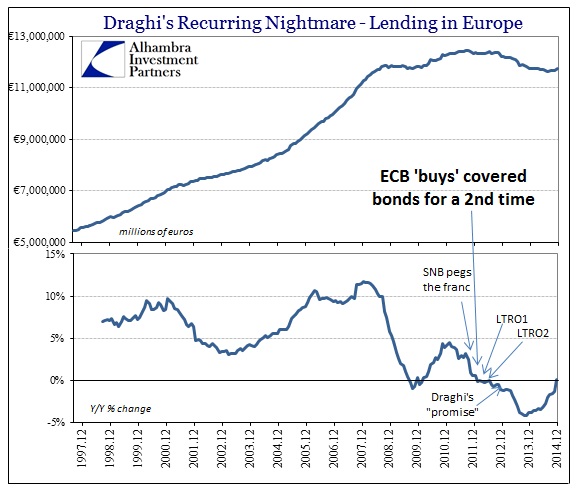

For the first time in thirty-five months, overall lending in Europe was higher year-over-year. Not since January 2012 had that been the case, as shrinking in lending was a de facto monetary limit on where the ECB wants the European economy to go. And while one month is not necessarily the start of a durable trend, indications had been for some time that total lending activity had at least been flattening out after the long decline.

While we don’t know for sure how much the T-LTRO’s had as an effect on any net increase in lending, however tiny, the disappointment over the takeups in September and December does not mean there was no effect at all. And that is precisely the problem, as the monetary pathway for all of this monetarism is intended to ease any restraints on lending as if restraint were everywhere and always a negative outcome. In other words, the ECB practically begged banks to lend, to the tune of hundreds of billions in indirect funding, including €212.44 billion in T-LTRO’s cumulative, interbank rates persistently below zero, yield curves collapsed everywhere and the result was December 2014 lending was just €5.1 billion above December 2013.

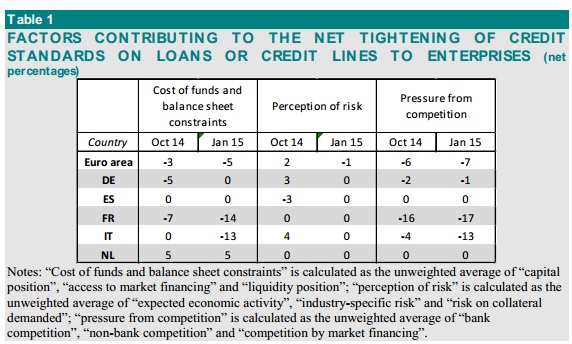

According to the fourth quarter Euro Area Bank Lending Survey, lending standards have continued to decline throughout Europe, including in the periphery. As shown above, a lot of that has been attributed to both the cost of funds and pressure from competition; almost none of it from perception of risk! Again, that raises the idea about what the ECB is actually trying to accomplish, namely as it looks at lending for the sake of lending rather than an actual intermediation process of resource allocation.

Those are challenging questions in any environment, pro-cyclical or not, but coming as the Eurozone teeters toward re-re-recession makes this all the more potentially problematic. Is now a good time to encourage banks to be more and more reckless?

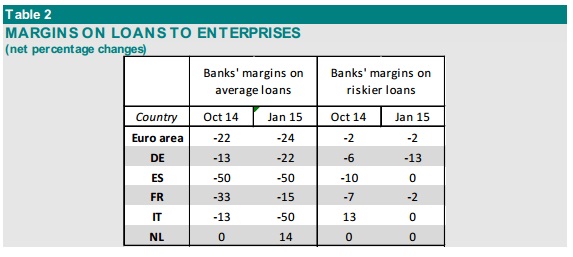

So far, however, the intentions are still thwarted as credit remains basically stalled in the riskier tiers. Part of the intent on “portfolio effects” of all that the ECB has done relates to reducing spreads on the outer reaches where central bankers clearly intend for credit to flow (including European mortgages, as if that were a great idea again). According to the survey, that hasn’t happened yet, as bank margins are still falling. Taken together with credit standards apparently devoid of any improvement in risk perceptions, and it very much appears as if credit has at least stopped shrinking but almost exclusively to those businesses that don’t necessarily need it the most (like Google issuing “cheap” bonds).

Maybe that will be good news (short-term, nothing good longer-term) for European stocks as that could provide a source of funds, like the US, for a surge in share repurchases, but it doesn’t argue for much in the macro economy otherwise. The fact that only now has lending stopped shrinking, despite improving credit conditions for more than a year and a half, despite all the monetary “headwinds” designed in that direction more than suggests that this will be, if it holds past any one-time T-LTRO boost, at best a long and slow bank recovery. That possibility only holds for the raw level of bank lending, saying nothing about the wisdom in actual economic terms about lending standards and absolute recessionary factors.

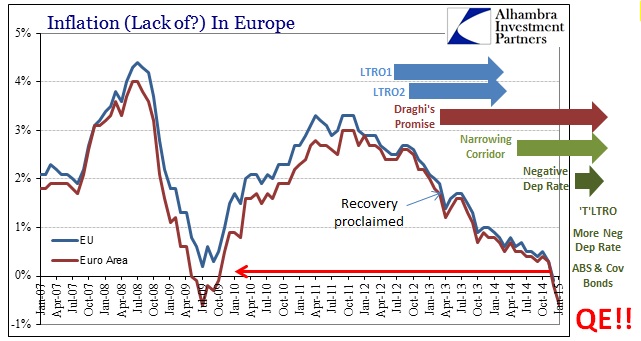

The problem is the asymmetry that is decidedly against the ECB’s designs in banking. If it takes such a massive and sustained effort to even gain the possibility of more credit, then it probably isn’t worth it to begin with – central bankers will ignore the accumulated side effects of such heavy intrusion, but the real economy and the distortion to “markets” are real, evident and most often deleterious. This might be a case, like Eonia, of winning the wrong battle while the war rages elsewhere.

I am not at all convinced that lending will begin some massive resurgence, but even if it does it is looking increasingly too late – which is the primary problem with redistribution even when it finds a favorable outcome. The timing differences are too large to have the intended effect. In other words, even if the ECB gets banks to lend as it wishes, it will still take more time to get to a level sufficient enough to have an effect and by then the economy is already deeper within the downward slide. And at that point the lending that occurs becomes a burden and not Europe’s salvation.

Taken as a whole, it seems more likely that European banks have simply come to a much-diminished equilibrium about lending. The ultimate impact of the T-LTRO’s and even now QE are highly contentious:

As part of its plan to prime the euro zone economy with cash, the ECB said in January that banks would be charged the refinancing rate for its targeted long-term loans, or TLTROs, from the March offering onwards.

But 16 of 20 euro zone money market traders polled said the lower cost would not draw more demand.

“Even from the get-go, regardless of what the rate is, the whole package is not attractive for banks and they’ll be reluctant to take up the loans,” said a trader.

Fixing banks and bank lending is not the same as fixing the economy. If you have to do it by destroying money everywhere it may not have been worth the trouble.