By Tyler Durden at ZeroHedge

When it comes to stock market, one thing never changes: price action determines the newsflow, and not the other way around and the recent 7% rebound off the 1812 lows two weeks ago which has pushed the S&P to nearly 1960 (or over 21x on a GAAP P/E basis as we showed this weekend) has been interpreted by many as an “all clear” to any imminent downward drop.

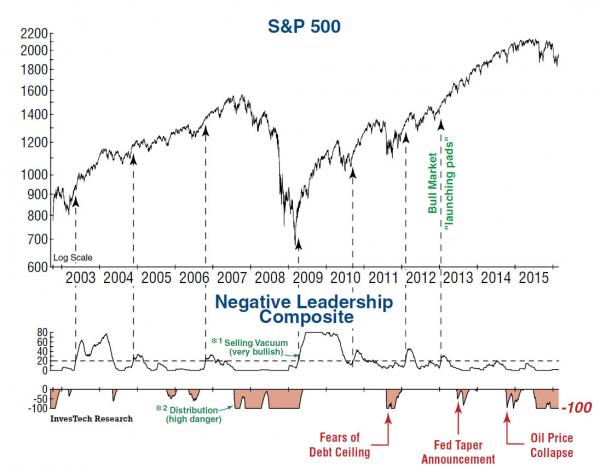

And yet, as Investech reports in their latest weekend note, there is nothing normal about this rebound, or rather, bear market short squeeze aka “rally”, for many reasons of which the most prominent one is that there has been absolutely no upside leadership through the entire bounce.

In fact, “extreme negative leadership readings of this duration generally only occur in bear markets”, which in addition to the PBOC’s panicked RRR cut overnight to halt the latest swoon in stocks, confirms that this is merely the latest bear market rally.

From Investech:

Over the past two weeks, equity markets have rebounded 6.7% off of their lows, yet downside leadership persists. Consequently, the “DISTRIBUTION” component of our Negative Leadership Composite remains locked at -100. Extreme negative leadership readings of this duration generally only occur in bear markets, which means our portfolio defenses will remain high until the technical picture changes.