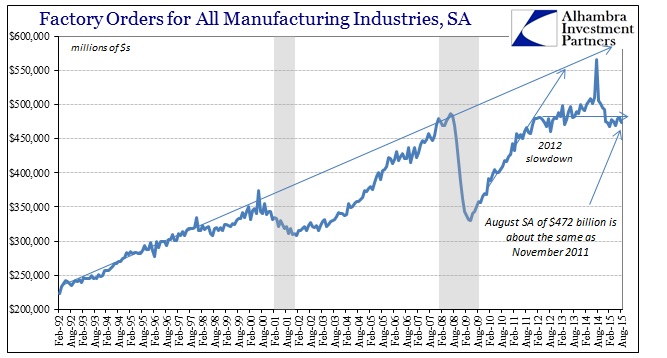

You get the same sense from factory orders that you get from payrolls – the economy is obviously and significantly slowing but there isn’t yet any crispness or urgency to any of it. I think that is the business environment reacting to both revenue reality (falling off) without being ready to commit to more serious negative adjustments just yet. In terms of factory orders, production is contracting but following along with an unbelievably constant , but extreme, inventory level. The fact that production needs to fall off just to maintain that suggests a huge downside if (once?) sentiment finally turns fully away from “transitory.”

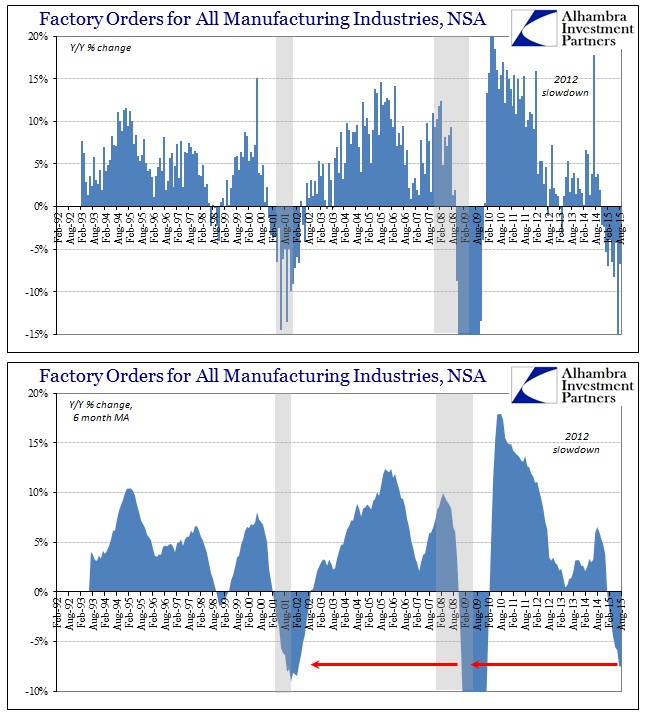

Last month’s factory orders contraction was skewed by a huge surge in July 2014 on Boeing orders. With August, we can combine the two months to smooth out that rough fluctuation – it didn’t help. Year-over-year, orders declined 15.1% in July and 6.8% in August; cumulatively, the two-month total change is -11.1% showing that factories are indeed in a serious slump. The 6-month average remains at -7.5%, which is already comparable to the full dot-com recession.

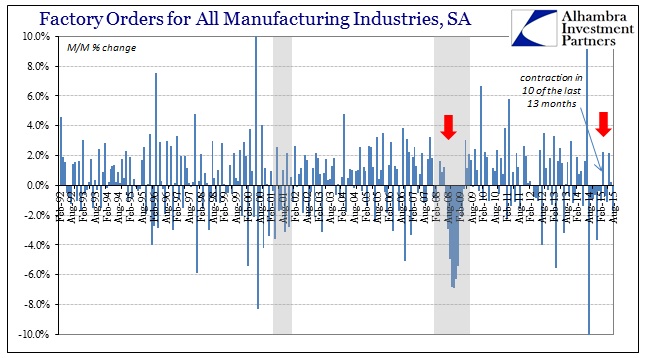

In the seasonally-adjusted series, ten of the past thirteen months have been negative which, again, suggests a determined but not excessive contraction that is usually associated with massive inventory level projections.

While this “slump” has certainly picked up of late, it actually traces back to early 2012. Where mainstream economic statistics (and extrapolations of them) have moved economists toward high optimism, it is clear at least from factory activity that “strong demand” never materialized; quite the contrary. The US manufacturing economy has struggled mightily over the past few years, which actually may account partially for the rather reduced downside variation so far this year (leaner operations tend to stay more stable until no longer possible).

As with each passing month, either demand has to truly surge to clear out inventory (just ahead of the Christmas season, no less) or production will find more and deeper cuts, eventually just letting go at some unknown critical point. With the “dollar” again, it seems far more likely the former has been ruled out; payrolls for September appear to agree.