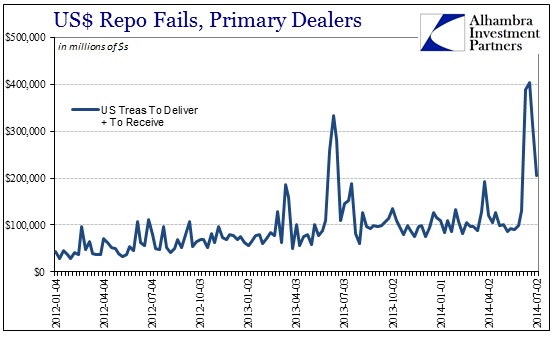

With the latest data from FRBNY in hand, the surge in repo fails authorities and certain credit market observers that were stressed over the affair, it is actually confirmation of regularity, and thus a high degree of systemic deficiency. Further, as a real world test, it ends any credibility the reverse repo program had as an institutional tool for maintaining interbank order; even beyond the inability to place a hard floor on interbank rates.

Ever since the fails penalty was put in place on UST repo, the incidence of failures (both to receive and to deliver) dramatically declined in both frequency and amplitude. There was not, however, an elimination of failures altogether as that would be impossible outside of total authoritarianism. What we have is something short of that, a hybrid whereby interbank rates are not always what they appear.

In repo, most visible trading is conducted at the general collateral rate (GCF), which gets published as if repo markets were monolithic. In other words, like LIBOR, the rate only applies to general circumstances. Individual repo issues often trade special, that is the rate charged to borrow cash is below the GCF rate because the particular security is in high demand (most of the time due to short positions). As a cash owner in need of a specific security, you will accept a lower interest return just to receive that security in the form of collateral.

In more extreme cases, the necessities of the security overwhelm any considerations for the cash. If you need a specific security bad enough (and do not want to, or cannot, make an outright purchase because of balance sheet considerations and accounting) you will even lend your cash at a negative rate. That, however, does not show up in the “official” figures about the repo market as there is nothing that incorporates a comprehensive assessment of what is really OTC and more often than not bespoke. That simply means we don’t really know what is taking place inside this market, only catching brief glimpses to hopefully enhance those published figures.

Since the fails penalty is set at 3%, any participant that fails in their repo obligation is charged 3%, meaning in essence that they are paying a -3% repo rate on cash lending. As I said above, most of the time the incidence of failure is relatively minor and only a small portion of the repo market is receiving special, let alone -3%. However, if fails spike as they have recently, that means that under the surface the proportion of troublingly low repo rates has also elevated – and done so in a manner whereby both negative rates abound and very little of this distress is actually visible.

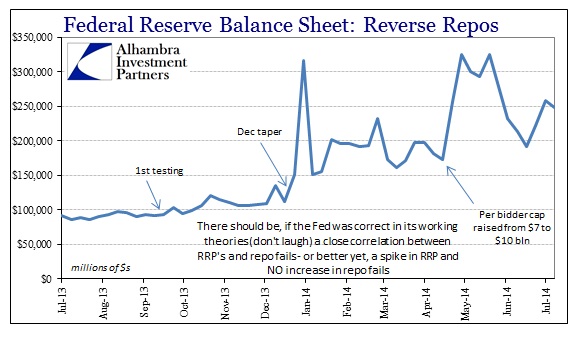

The Fed’s new policy, active since September 2013 when FRBNY started limited testing, is supposed to alleviate exactly this problem. If the repo market is short of collateral, market signals, the preponderance of special rates which favor collateral owners (or in this case, participants that can access the Fed’s SOMA portfolio) should bring in more collateral from “storage”, places where it is otherwise idle in the hands of its legal owner (which includes SOMA). Think of it this way, if the “market” is paying you to borrow cash with the condition only that you have available collateral, and you have a way of obtaining such collateral, you and anyone else like you would do so in quantity.

That’s the problem, though, in that there isn’t a direct relationship between the repo market that might be suffering and those collateral “middlemen” that have the ability to bridge the divide to either non-market sources or the Fed’s SOMA holdings. That is actually how the Fed has been marketing the reverse repo program, yet it doesn’t really match up to the complexities of reality.

And that is exactly what we saw in the most recent episode. If the RRP worked as advertised, there should have been a concurrent spike in RRP balances as the “market” obtained collateral from SOMA to take advantage of repo shortages and the hidden but no less pervasive negative rates on cash borrowing. It didn’t happen. In fact, if it worked fully, there would actually be no rush of fails at all, since SOMA would absorb, indirectly, all or nearly all of this demand for UST collateral.

Apart from this general failure in policy, maddeningly similar in so many ways to the Fed’s failure in using IOER as a rate floor (they can’t seem to get it right; a new slogan?), the end of the surge in repo failures is, again, a worrying sign. That would confirm what I thought originally, as fragility is a very real problem around window dressing.

That has a couple of very important implications that are probably going to be ignored (fingers crossed is very much a part of FOMC deliberations). If the increase in repo failures had persisted beyond the quarter’s end, it would indicate something else as proximate cause – meaning an individual problem limited to individual circumstances, and thus not systemic. The regularity with which repo fails have arisen is axiomatically an indication of artificiality in what should be a “resilient” marketplace.

As I said in my last post on repo, the fact that there is a fragility evident in the second week of June in both 2014 and 2013 (in addition to major liquidity events, related to repo, in the second week of September in 2007, 2008 and 2011, not to mention 1998) is a major warning about systemic bottlenecks. The very real fact of quarter end maneuvers is like the tide washing out and revealing a lot of naked swimmers. Unfortunately, the prevalence of nudity (extremes in risky positioning) is hidden the rest of the time which most participants take as simple “normalcy.”

The worst cracks in any system are those that are not visible. Here we see almost that, where the cracks are visible but only at certain times (of regularity). Furthermore, the fact that such distress did not produce any downstream negative function, such as another crash or bank failure, is mistakenly perceived as “resiliency” when it is in fact quite the opposite. Just because you didn’t have a heart attack today or yesterday is not evidence that you never will and can thus ignore high blood pressure and cholesterol. What this means is that there are risk factors evident and that if nothing is done as far as mitigation, there is an elevated chance of an “event.”

There the RRP is most relevant – in that it is now a tested failure toward such mitigation and any reliance on it toward that end is a dangerous mistake. But again, almost all of this “risk factor” is hidden in the dark recesses of the investment banking/shadow system that still survives the 2008 “event.” The problem with modeling liquidity is that what appears today, or even at this very moment, is not guaranteed to be there tomorrow or even the next minute. The repo warnings here are proof of that, unambiguous and systemic, marking not just the typical downside of liquidity but rather how small the door really is for when the crowd heading toward the exit suddenly expands with even a small amount of urgency.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com